On July 14, an ambitious trader named Falllling, who probably thought he was on the verge of creating a new financial instrument called “the fall,” experienced a truly spectacular wipeout, with $334 million in short bets vanishing into thin air within the span of a mere three hours. Talk about a crash course in humility.

The $334 Million Misstep: From High-Risk to High-Drama

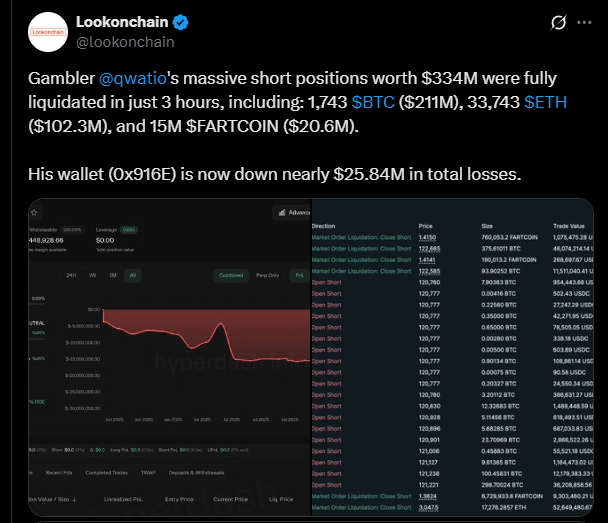

A trader so aptly named Falllling (perhaps a subtle hint of what was coming?) had the misfortune of seeing his $334 million worth of short positions wiped out faster than you can say “Bitcoin‘s going to the moon.” According to the ever-watchful crypto sleuths at Lookonchain, this included 1,743 Bitcoin valued at $211 million, 33,743 Ether worth $102.3 million, and a whopping 15 million FARTCOIN (yes, you read that right) valued at $20.6 million. I’m not sure what FARTCOIN is, but it sounds like something that belongs in the “What was I thinking?” files.

The aftermath of this catastrophic event left Falllling with a hole in his wallet amounting to $25.84 million. The figure has sparked endless memes and discussions on social media, with some questioning why anyone would bet against BTC when the market is clearly on a bull run. I mean, did someone forget to check the weather forecast? Spoiler alert: It’s bull season.

And if you thought that was bad, hold on to your hats, because Falllling’s saga is drawing comparisons to another trading legend, James Wynn, who similarly went from “big bet” to “big regret” earlier this year. Wynn famously lost over $100 million in May 2025 when his $100 million long BTC position was liquidated faster than you could say “Oops, wrong call.” And yes, Wynn also thought 40x leverage was a good idea. Apparently, he’s on a mission to prove that financial Darwinism is alive and well.

After his losses, Wynn did what any self-respecting trader would do: he deactivated his X account and went into hiding. Because if you can’t handle the heat, might as well turn off the oven, right?

Bitcoin’s Explosive Surge: Making Traders Wish They’d Stayed in Bed

Meanwhile, in a plot twist that no one saw coming (except, well, everyone who knew how volatile crypto is), Bitcoin’s rally on July 14 hit a new high, sending all those who were betting against it into a state of complete disbelief. The digital asset blasted through the psychological barrier of $120,000 and climbed to a new all-time high of $122,604. Some say it was like watching an unstoppable force plow through a bunch of over-leveraged traders. This, of course, led to an epic wave of liquidations.

For weeks, BTC had been playing coy, testing the $110,000 level like a cat testing a puddle of water. But on July 10, it finally gave in, blasting upwards by more than 10% in just four days. And just like that, market indecision went out the window, replaced by a full-on stampede. It’s like someone told the bulls, “Go wild,” and they did—wildly.

In fact, the rally triggered a staggering $702.56 million worth of liquidations in just 24 hours, with 124,000 traders losing their shirts (and probably their socks, too). Of that colossal amount, $590.72 million came from short positions, and just $111.84 million from long positions. So, if you were betting against Bitcoin, well, let’s just say you were probably better off flipping a coin.

Read More

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- How to Unlock the Mines in Cookie Run: Kingdom

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- YAPYAP Spell List

- Top 8 UFC 5 Perks Every Fighter Should Use

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- Gold Rate Forecast

- Gears of War: E-Day Returning Weapon Wish List

- How to Build Muscle in Half Sword

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

2025-07-14 13:02