TL;DR

- Some metrics are shouting that the BTC is looking a bit warm and might just need a cool-off period.

- Bearish signals? Oh, just a casual 3,000 BTC dumped by miners in less than a week. No big deal.

Will the Bears Reclaim the Ice Cream? 🍦🐻

So here we are, on July 14, with Bitcoin (BTC) trying out for the title of “Most Dramatic Price Rise,” hitting an eye-popping peak of over $123,000. I mean, at this rate, it’s about to donate a kidney just to outshine Amazon and stand proudly as the fifth-largest asset on the planet. Who needs a good credit score, right?

The rally has sent shockwaves through the crypto community, with bullish optimism soaring as high as your uncle’s expectations for his retirement portfolio (spoiler: they’re both in for a wild ride). But hold your crypto horses! There are some bits and bytes suggesting that maybe, just maybe, BTC could be gearing up for a nosedive.

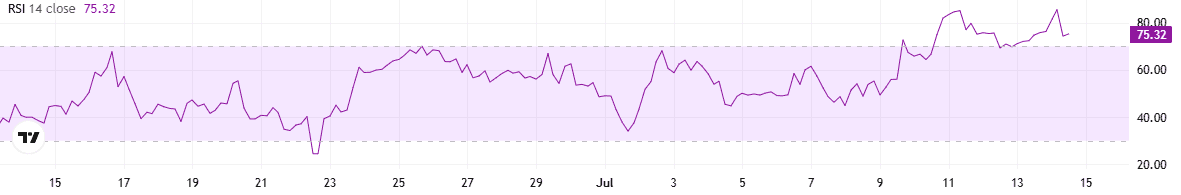

Take a gander at the Relative Strength Index (RSI) – it’s waltzed right into bearish territory at around 75. So, unless your intentions are to fast-track your way to a financial heart attack, you might want to consider that BTC’s rocket ride could hit some turbulence.

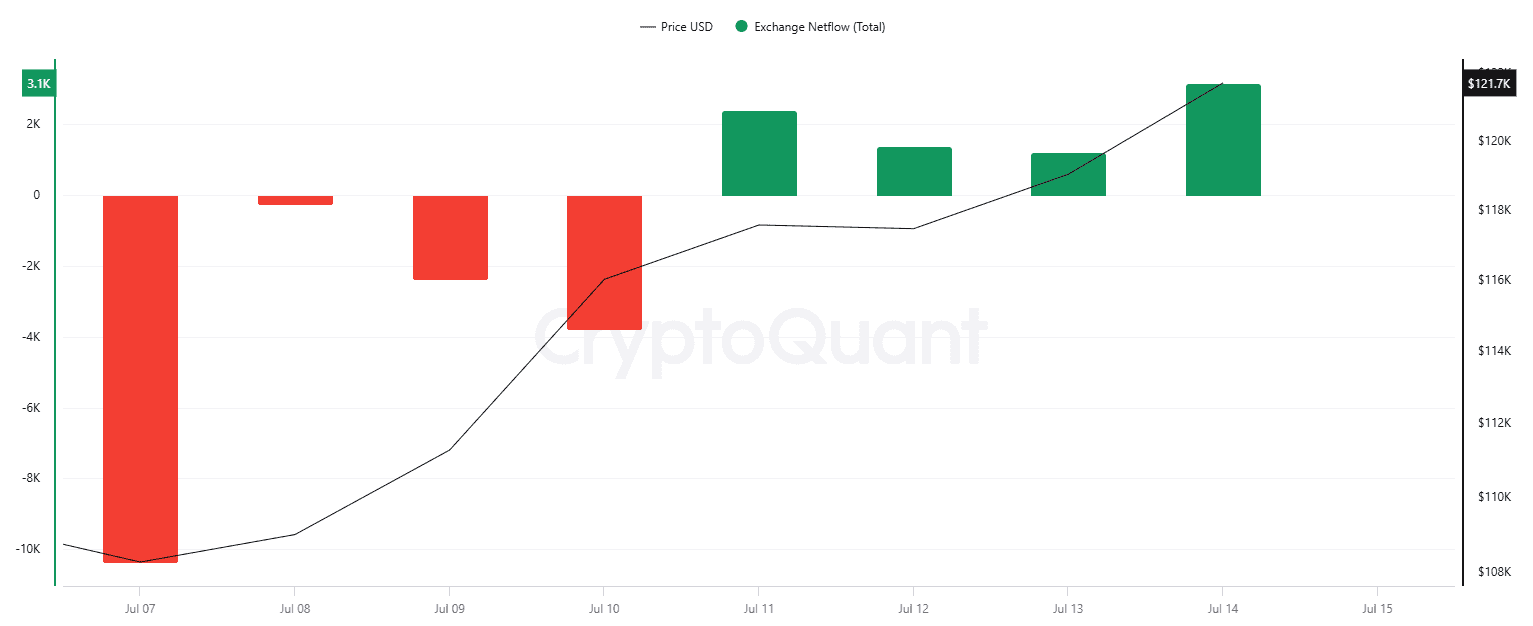

Then we have BTC’s exchange netflow. The graph – aka the “real drama queen” of our analysis – shows inflows doing a cha-cha above outflows for the last four days. A recipe for increased selling pressure, culminating in that glorious moment when your crypto hopes plummet.

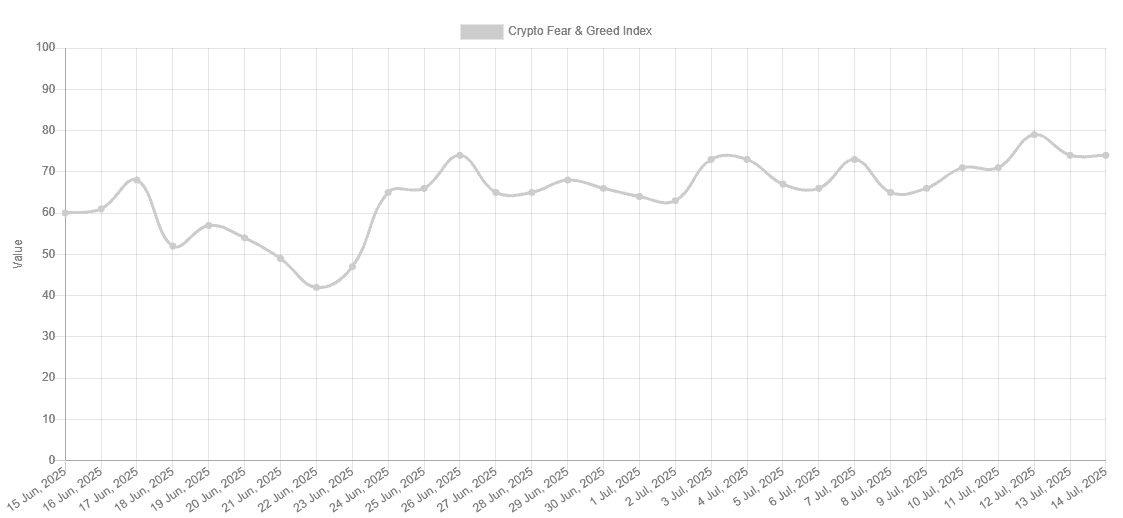

Shall we turn our attention to BTC’s Fear and Greed Index? Well, it’s still hanging out in that “Greed” or “Extreme Greed” zone since late June. Talk about living on the edge! But who could blame it? With all this excitement, it’s easy to forget that the crypto market might flip your expectations on their head faster than you can say “HODL.”

Speaking of unexpected flips, let’s chat about the miners. Another bear-claw mark on our sunny day is their recent sell-off. According to some savvy Twitter netizen (thanks, Ali!), over 3,000 BTC have been sold in under a week. 🐻💔

Miners have sold over 3,000 Bitcoin $BTC since Thursday!

— Ali (@ali_charts) July 14, 2025

Now, whether the miners are cashing in for fear of missing their profit party or just realizing they’ve got more Bitcoin than they know what to do with is anyone’s guess. Either way, with increased supply hitting the market, don’t be too shocked if demand decides to play hard to get.

But let’s end on a bright note – the little investors, affectionately dubbed “shrimps,” “crabs,” and “fish,” have been swimming around, accumulating more BTC than what miners can churn out monthly. It’s like watching the little guy take on the big corporations – heartwarming, really. Now, if only they could figure out how to make their voices heard in this raucous crypto universe.

Read More

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- How to Unlock the Mines in Cookie Run: Kingdom

- YAPYAP Spell List

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- How to Build Muscle in Half Sword

- Top 8 UFC 5 Perks Every Fighter Should Use

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- Gears of War: E-Day Returning Weapon Wish List

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

2025-07-14 18:57