Bitcoin, the digital darling, has taken a little tumble from its lofty perch near $123,200. Now, it’s cozily nestled below $120,000, with a potential pit stop near $115,500. But is this a buying opportunity or a sign to bail? Let’s dive in and find out.

- Our beloved Bitcoin has started a fresh decline from its new all-time high, flirting with the $123,200 mark.

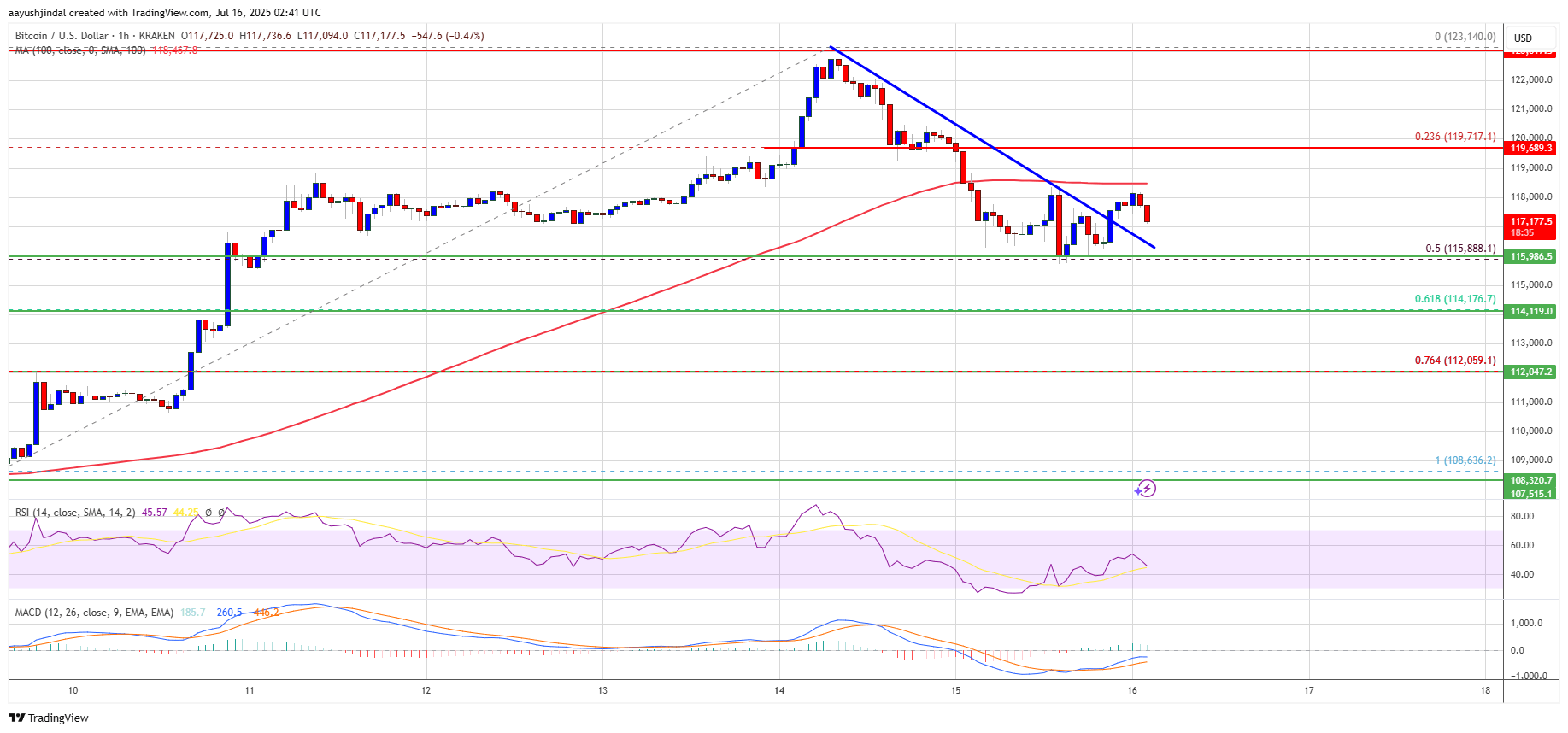

- It’s currently trading below $120,000 and the 100 hourly Simple Moving Average, which is like saying it’s having a bad hair day.

- There was a break above a bearish trend line with resistance at $117,300 on the hourly chart of the BTC/USD pair (data feed from Kraken, because who doesn’t love a good data feed?).

- If Bitcoin can clear the $120,000 resistance zone, it might just start another increase, proving once again that it’s the comeback kid of the crypto world.

Bitcoin price started a fresh increase after it cleared the $118,500 resistance zone, like a teenager finally outgrowing their awkward phase. BTC gained pace, moving above the $120,000 and $122,000 resistance levels, and the bulls even managed to pump the pair above the $123,000 zone. A new all-time high was formed at $123,140, and now, like a roller coaster, the price is correcting gains. It’s like Bitcoin is saying, “I’m just taking a breather, folks, no need to panic.”

There was a move below the 23.6% Fib retracement level of the upward move from the $108,636 swing low to the $123,140 high. Bitcoin is now trading below $120,500 and the 100 hourly Simple Moving Average, but it’s still holding the 50% Fib level of the upward move from the $108,636 swing low to the $123,140 high. It’s like it’s playing a game of “I’m not really falling, I’m just testing the waters.”

Besides, there was a break above a bearish trend line with resistance at $117,300 on the hourly chart of the BTC/USD pair. Immediate resistance on the upside is near the $118,500 level. The first key resistance is near the $120,000 level, and the next resistance could be $122,000. It’s like Bitcoin is setting up a series of hurdles, just to keep us on our toes.

A close above the $122,000 resistance might send the price further higher, like a kid on a sugar high. In this case, the price could rise and test the $123,200 resistance level. Any more gains might send the price toward the $125,000 level, with the main target being $130,000. It’s like Bitcoin is saying, “I’m not just here for the short term, I’m aiming for the moon.”

More Losses In BTC?

If Bitcoin fails to rise above the $120,000 resistance zone, it could continue to move down, like a deflating balloon. Immediate support is near the $115,850 level, with the first major support near the $115,500 level. The next support is now near the $114,150 zone, and any more losses might send the price toward the $112,500 support in the near term. The main support sits at $110,500, below which BTC might continue to move down, like a snowball rolling downhill.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone, which is like saying it’s taking a nap.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level, indicating that it’s feeling a bit under the weather.

Major Support Levels – $115,500, followed by $114,150.

Major Resistance Levels – $120,000 and $122,000.

Read More

- Jujutsu Kaisen Modulo Chapter 18 Preview: Rika And Tsurugi’s Full Power

- Upload Labs: Beginner Tips & Tricks

- How to Unlock the Mines in Cookie Run: Kingdom

- ALGS Championship 2026—Teams, Schedule, and Where to Watch

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- USD COP PREDICTION

- Roblox 1 Step = $1 Codes

- The Winter Floating Festival Event Puzzles In DDV

- Jujutsu: Zero Codes (December 2025)

2025-07-16 06:06