The crypto market cap hit a record high of $4 trillion in July, and Bitcoin Dominance dropped to 61.5%, the lowest since April. Analysts are now whispering, “Altcoin season, my good people, has officially begun!”

The real question, of course, is when to bail out. Because, as any seasoned trader will tell you, staying too long at the party can turn a good night into a hangover from hell. Here’s what the experts are saying.

Altcoin Investors Are Seeing Green in July

Most altcoin investors who started buying in June are probably feeling pretty smug right now. The altcoin market cap (TOTAL2) has soared by 44% since then, hitting a whopping $1.5 trillion. 🚀

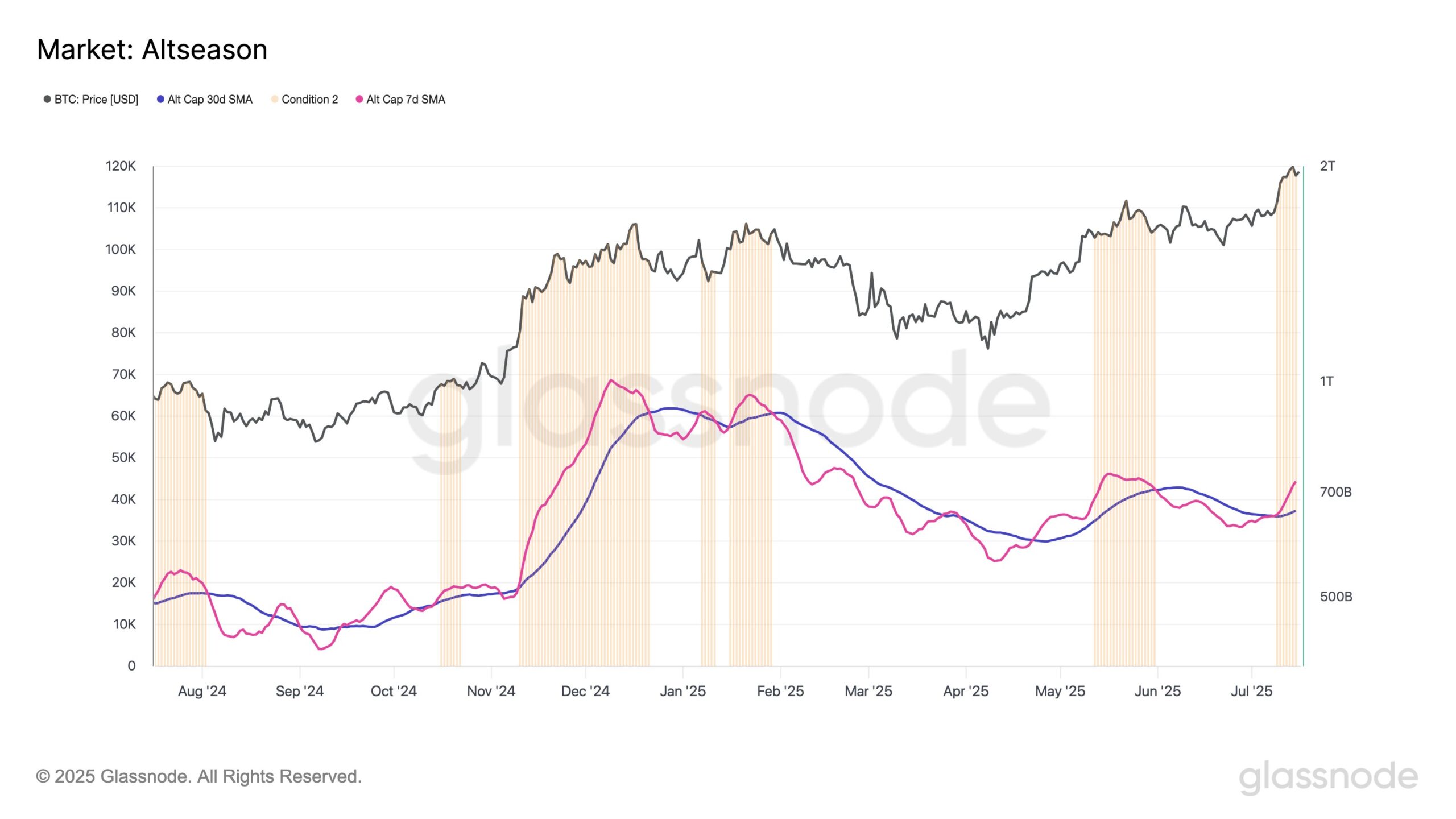

Glassnode’s secret sauce, the Altseason Indicator, confirms that capital has been flowing into altcoins since early July. 📈

“Glassnode’s proprietary Altseason Indicator fired on July 9. This means stablecoin supplies are expanding, capital is flowing into BTC and ETH, and, simultaneously, the altcoin market cap is rising — a structural environment conducive to capital rotation,” Glassnode reported.

Today, CryptoBubbles shows a market that’s as green as a leprechaun’s hat. Many altcoins are up between 10% and over 20%. 🍀

But let’s not forget the cautionary tale of late 2024, when the altcoin season ended with a bang and a whimper. Many altcoins plummeted by 50% to 90%, and investors who didn’t act quickly found themselves in a financial purgatory. 🌋

So, identifying when to take profits is as crucial as spotting the start of the altcoin season. Here are four factors analysts recommend to determine the best time to exit.

Analysts’ Four-Step Plan to Exit the Altcoin Season

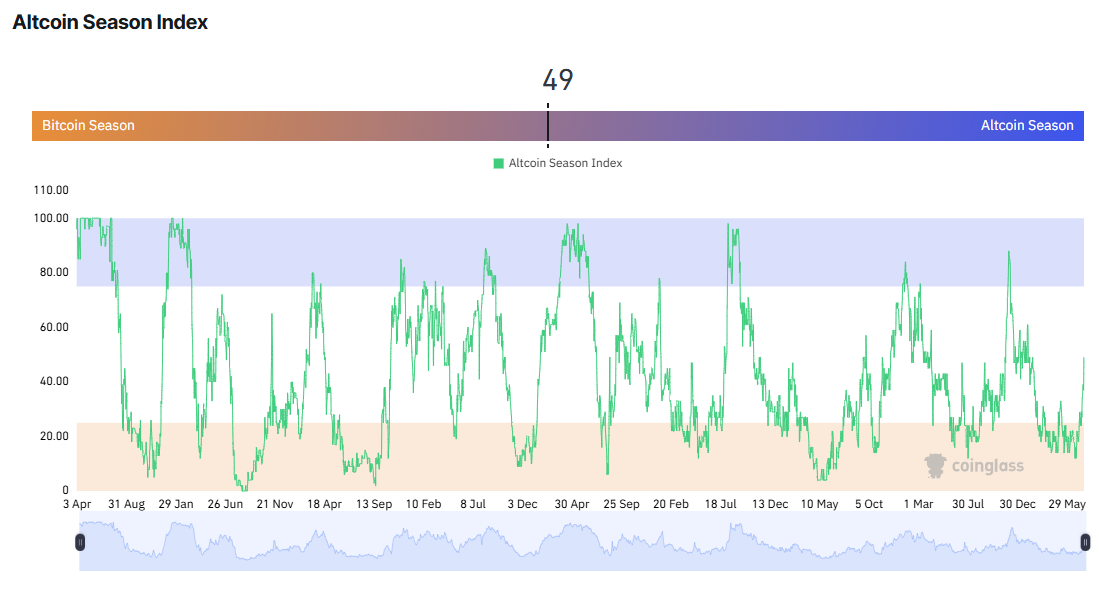

The simplest and most widely used signal is the Altcoin Season Index. This index is great for identifying entry points, but when it hits its upper limit, it’s also a warning to the broader market. 🚨

As of this writing, Coinglass reports that the index is at 49. When it reaches 70 to 100 points, it’s time to cash out, according to the experts.

“The Altcoin Season Index is rising, and the altcoin market cap has surged significantly in recent days. When the index reaches above 70, it’s time to sell your altcoins. Right?” — Coinglass reported.

For the more technically inclined, the altcoin market cap (TOTAL3) is forming a cup-and-handle pattern, according to analysts like Peter Brandt and Greeny. Using the measurement theory of that pattern, TOTAL3 could reach a target of $2 trillion. That might be the sweet spot for altcoin holders to consider exiting. 📏

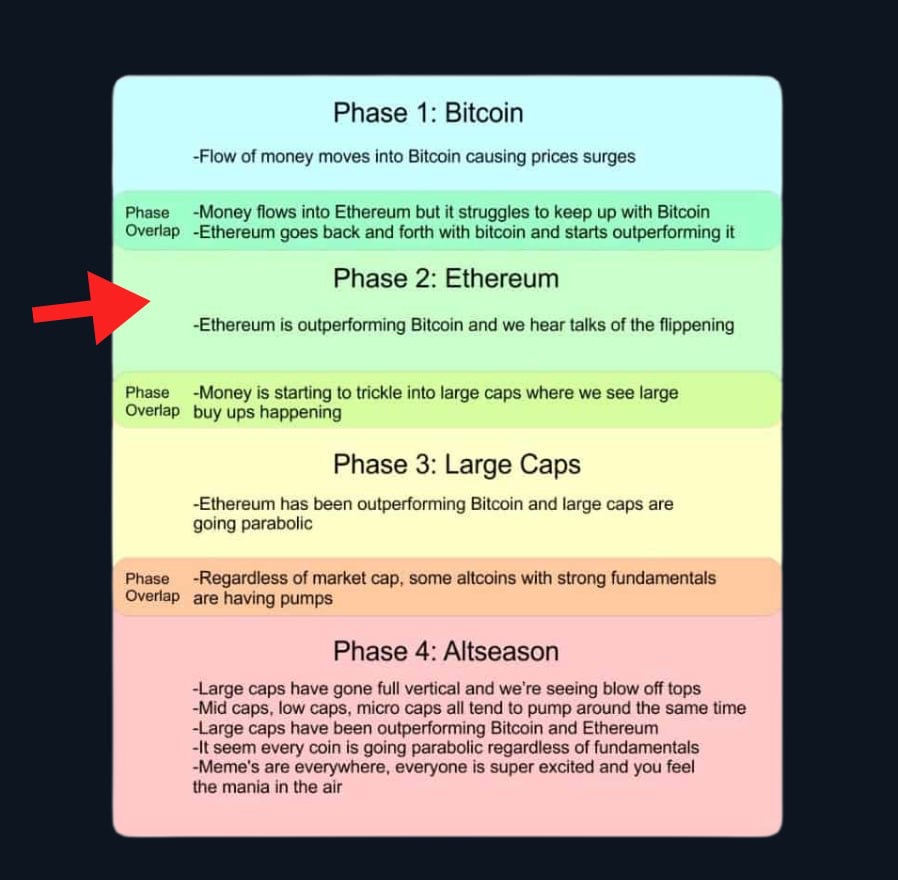

Some investors track the capital flow cycle to predict the end of the season. For example, investor NekoZ believes the market is now entering the second phase of a four-phase cycle.

“ETH has started to outperform BTC in terms of returns, which means we have moved into the second phase of the altcoin season,” NekoZ said.

In this framework:

- Phase 1 is Bitcoin outperforming.

- Phase 2 is Ethereum outperforming Bitcoin.

- Phase 3 sees large-cap altcoins rally.

- Phase 4 is when small-cap altcoins and meme coins pump, often signaling the final stage of the altcoin season.

Many observers are closely monitoring this progression, and it’s wise to keep an eye on it yourself. 🕵️♂️

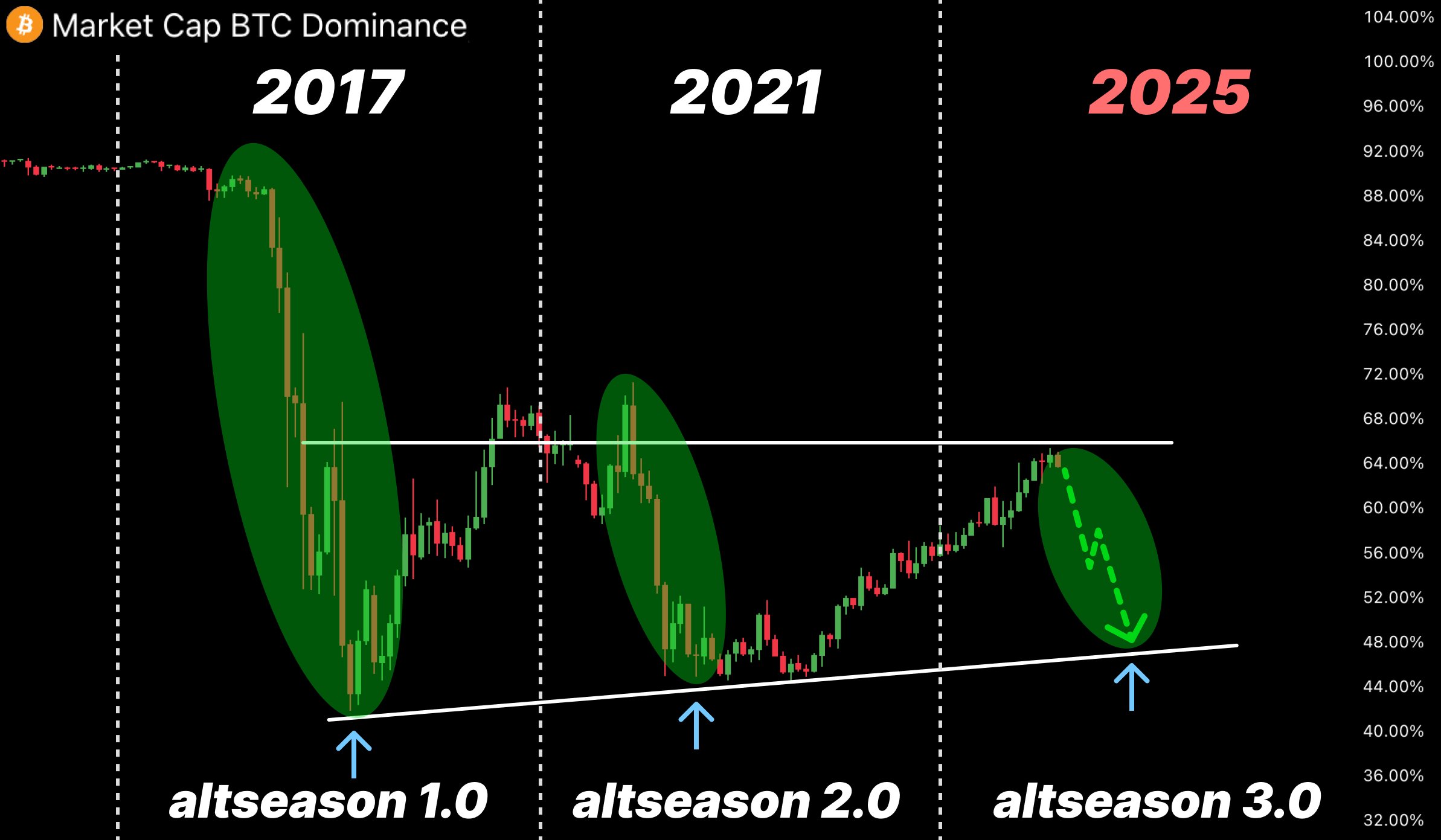

The last factor to consider is Bitcoin Dominance (BTC.D). In July, BTC.D decreased from 65.5% to 61%, marking the largest monthly drop since November 2024. Analysts, looking at trendlines from previous cycles, believe that the altcoin season may continue until BTC.D falls to 48% to 50%. 📉

Every investor has their own strategy, but history shows that holding altcoins for too long can be a risky business. Unlike Bitcoin, which tends to recover better, altcoins can leave you with a portfolio that looks like a deflated balloon. As the market overheats, the risks grow even higher. 🌡️

Read More

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- How to Unlock the Mines in Cookie Run: Kingdom

- YAPYAP Spell List

- Top 8 UFC 5 Perks Every Fighter Should Use

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- How to Build Muscle in Half Sword

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Gears of War: E-Day Returning Weapon Wish List

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

2025-07-18 12:51