As the major U.S. stock indices teeter precariously near the precipice of record highs, the whispers of disquiet echo through the hallowed halls of finance, where uncertainty reigns, and the Fed Chair finds his position hotter than the sunlit stones of a summer’s day. One might chuckle at the absurdity of it all, yet the plight of the digital stock traders grows ever more poignant.

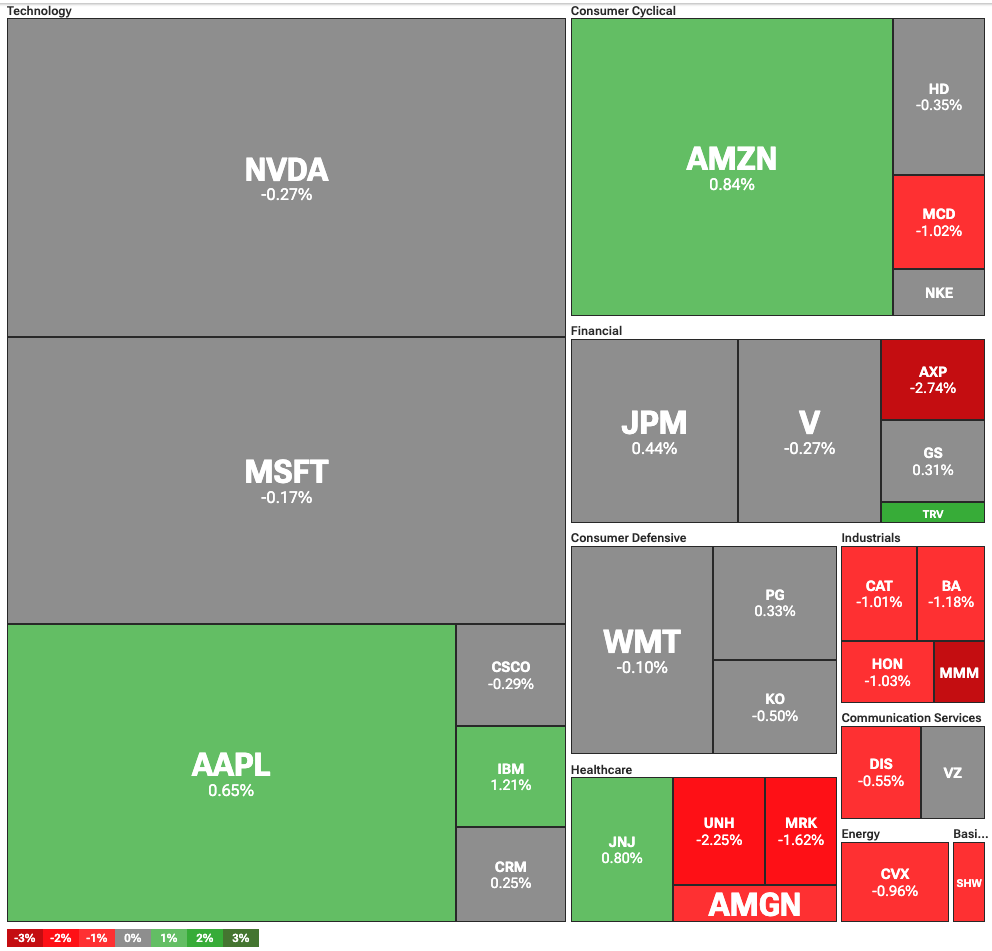

This past Friday, the Dow Jones succumbed to the whims of fate, stumbling downwards by 238 points, the equivalent of a full-bodied stumble at a grand ball, representing a 0.54% decline as if mocking our optimism. Simultaneously, the S&P 500 crept down by a mere 0.14%, and the tech-savvy Nasdaq Composite followed suit, drifting downwards by 0.09%. The number crunchers cheered at the plateau of values, blissfully ignorant of the storm brewing behind the shadows.

The long-awaited earnings from Netflix descended upon the market like a soggy blanket, failing to ignite the anticipation one might expect. Despite beating forecasts, the stock plummeted by 5%, a fitting tribute to the art of disappointment, particularly as the company chose to issue less-than-stellar guidance that might leave even the most optimistic trader with a frown. Meanwhile, American Express, that erstwhile golden card of commerce, suffered a 2.5% decline, its strong earnings washed away like grains of sand at the edge of the sea.

Amid this financial farce, traders turned their eyes towards the tumultuous drama unfolding over tariffs against the EU, fueled by the fiery rhetoric of none other than President Donald Trump. The President’s relentless demands have escalated the minimum tariff on imports from a meek 15% to a roaring 20%, a delightful increase one might joke makes about as much sense as a cat in a dog park.

Not content with merely shaking the waters, Trump dismissed the EU’s overtures to reduce tariffs on U.S. automobiles, suggesting instead that they might remain stubbornly at a rate of 25%. Such is the iron fist of negotiation in the economy’s merciless arena!

A Ruckus at the Fed: Trump’s Unyielding Assault

But alas! The shadows darken further as Trump wages war against Fed Chair Jerome Powell, labeling him a “numbskull” for his obstinacy in not lowering interest rates. Alas! Can one truly deem an affront to the youth seeking homes as trivial? Higher rates are presented as an insurmountable wall, preventing even the most determined from entering the sacred sanctum of homeownership.

“Truly one of my worst appointments,” he lamented, casting a glance of reproach not only at Powell but also at Joe Biden, the architect of this reappointment drama. Critics within Trump’s clique take aim at the $2.5 billion renovation of Fed edifices, keen to stage a coup, while those very same appointees yearned for opulent marble, surely a fitting decor for looming disaster but unnecessarily pricey just the same.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-07-18 22:40