Right, so Ethereum‘s decided to have a little *moment*. Up 25% this week? Honestly, it’s trying too hard. It’s breezed through resistance levels like they were…well, nothing. Like my attempts at small talk at parties. Currently hovering around $3,800. Impressive. For a computer code.

Everyone’s terribly enthusiastic, naturally. But even I, a professional observer of chaos, can sense a slight wobble. It’s gone up a lot, okay? A lot. Like, suspiciously a lot. Needs a breather. Probably needs a spa day.

Technical Analysis

By Shayan – bless him for trying to make sense of all this.

The Daily Chart

Apparently, it’s smashed through $2,800 and $3,400. Very assertive. The moving averages are about to do a little dance – a bullish crossover, they call it. Sounds…intense. Acting as support near $2,500. Which is helpful, I suppose. If you’re into that sort of thing.

Now it’s staring down a “major supply zone” between $3,700 and $4,100. Ooh, drama. A cluster of “bearish order blocks”? Sounds like a particularly unpleasant book club. Next target: $4,107. The last high from early 2024. Honestly, just make a decision, Ethereum.

But be warned: people might take profits. Shocking, I know. Especially if it just…stops. Like a really awkward pause in a conversation.

The 4-Hour Chart

Still going up, apparently. But the RSI is giving it the side-eye. A “bearish divergence.” Oh dear. Basically, the price went up, but the RSI didn’t follow. It’s like when you *say* you’re fine, but your face says otherwise. 🙄

Could be a sign it’s about to stop being fun. A drop below $3,500 and we’re looking at $3,200. Structurally significant, apparently. Everything’s structurally significant these days. Still, it’s bullish…for now. Like me after my second coffee.

Watch the $3,800-$4,100 zone. Breakout? More upside. Rejection? Nap time. 😴

Sentiment Analysis

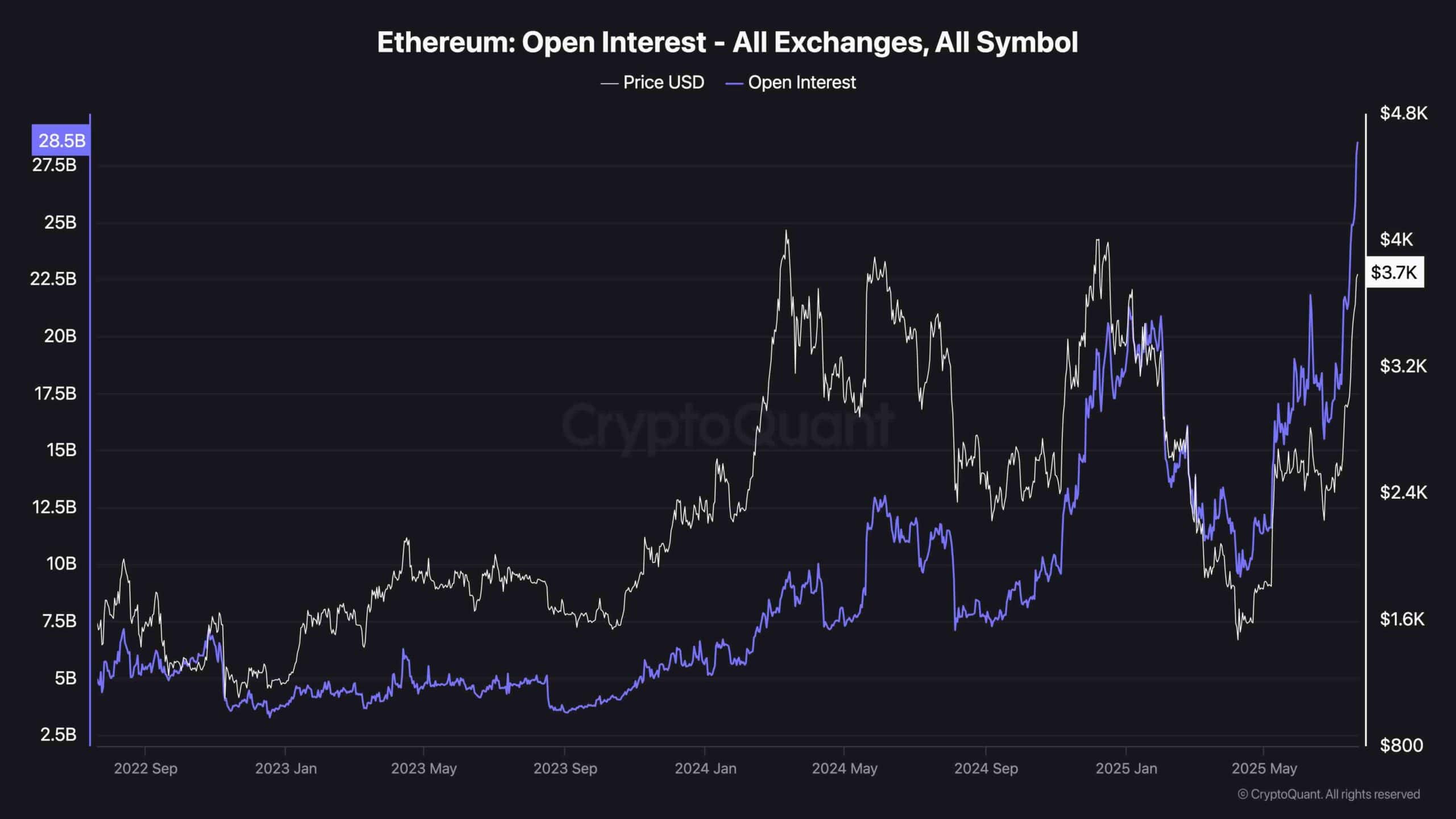

Ethereum Open Interest – because we need more numbers.

Open Interest is at a multi-year high, over $28B. Everyone’s getting involved. Great. More people to witness the potential collapse. 🙃 It’s being driven by leveraged positions. Which is…fine. Absolutely fine. (Don’t quote me on that.)

Basically, if it goes down, it could go *down*. Monitor for “long liquidations” and “sudden deleveraging.” Fun terms, aren’t they? If it stalls and the interest stays high, brace yourselves. But for now, everyone’s still enthusiastically throwing money at it. Which is…a choice.

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Jujutsu Kaisen Modulo Chapter 18 Preview: Rika And Tsurugi’s Full Power

- ALGS Championship 2026—Teams, Schedule, and Where to Watch

- Assassin’s Creed Black Flag Remake: What Happens in Mary Read’s Cut Content

- Upload Labs: Beginner Tips & Tricks

- Jujutsu: Zero Codes (December 2025)

- Mario’s Voice Actor Debunks ‘Weird Online Narrative’ About Nintendo Directs

- The Winter Floating Festival Event Puzzles In DDV

- Roblox 1 Step = $1 Codes

- Landman’s Controversial New Episode & Non-Binary Character Isn’t Landing With Fans

2025-07-21 16:06