As an experienced financial analyst, I believe the recent surge in institutional investment in Bitcoin through Spot ETFs is a bullish sign for the future of the leading cryptocurrency. The involvement of heavyweights like BlackRock and Grayscale, as well as other notable players, indicates a clear institutional appetite for Bitcoin and legitimizes it in the eyes of mainstream investors.

The digital gold rush is in full swing now, with Wall Street’s elites taking the helm. A notable increase in Bitcoin ETF holdings by institutions such as Spot Bitcoin suggests a growing trend of institutional investment in the foremost cryptocurrency. This massive influx of capital could potentially push Bitcoin prices to unprecedented levels, albeit not without encountering some challenges along the way.

BlackRock, Grayscale Lead The Institutional Charge

As a crypto investor, I can tell you that the emergence of Spot Bitcoin ETFs is largely due to the support of financial heavyweights like BlackRock, Grayscale, and Fidelity Investments. These asset management giants have played a pivotal role in making this trend a reality.

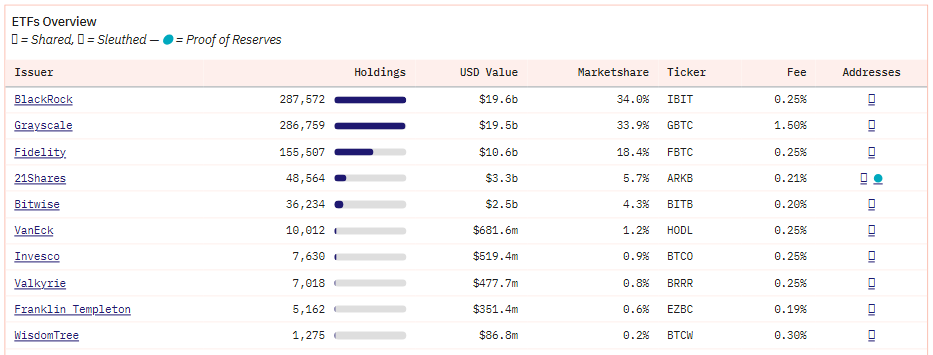

As a data analyst at Arkham Investments, I’ve examined the current landscape of the global Spot Bitcoin Exchange-Traded Fund (ETF) market. Based on my findings, Grayscale and BlackRock are uncontested leaders in this sector. The Grayscale Bitcoin Trust (GBTC) holds a significant advantage with approximately 288,000 BTC under its management. BlackRock’s iShares Bitcoin Trust (IBIT), on the other hand, closely follows with over 284,000 BTC in holdings.

As a researcher studying the expanding world of Bitcoin Exchange-Traded Funds (ETFs), I’ve come across some notable players worth mentioning. Fidelity, with their offering named Wise Origin Bitcoin BTC (FBTC), is making waves in the industry. Additionally, established names such as Bitwise and Active Managers are contributing to the growing ecosystem of Bitcoin ETFs.

Institutions Dive Into The Bitcoin Pool

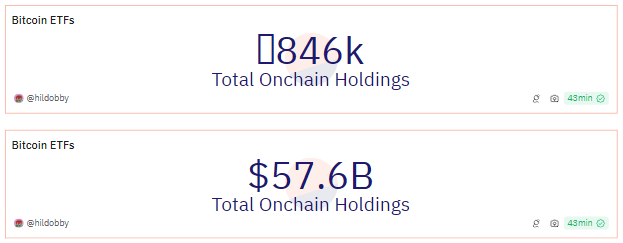

As a crypto investor, I’m always keeping an eye on the latest trends and developments in the market. Recently, data from blockchain analytics firm Dune has caught my attention. According to their findings, Bitcoin Spot ETFs based in the US hold a significant amount of Bitcoin – approximately 846,000 coins to be precise. This equates to roughly $58 billion in assets under management by these ETF issuers. This clear evidence suggests that institutional investors have a strong appetite for Bitcoin.

Stepping back to observe the bigger picture, the narrative becomes all the more intriguing. According to industry reports, the collective holding of Spot Bitcoin Exchange-Traded Funds (ETFs) worldwide has surpassed the 1 million Bitcoin mark – an important achievement.

32 #Bitcoin Spot ETFs now hold ~1 Nakamoto of $BTC

— Michael Saylor (@saylor) May 27, 2024

Bullish Signs For Bitcoin’s Future

As an analyst, I’ve observed an increase in institutional interest towards Bitcoin through Spot Exchange-Traded Funds (ETFs). This trend resonates with the optimistic market sentiment we experienced earlier in the year. Following the historic approval of these funds in January, Bitcoin’s price reached unprecedented heights, surpassing $73,000 in March. The growth in Bitcoin’s value was not only accompanied by broader acceptance but also boosted by the convenience provided by Spot ETFs, which made investing easier for institutional investors.

Institutional investment in bitcoin is increasing, signaling development within the industry. Positive trends and technical signals suggest Bitcoin could have a prosperous future ahead. However, it’s essential to exercise caution.

The arrival of financial giants such as BlackRock and Fidelity, each managing vast sums of money via Spot Bitcoin ETFs, represents a substantial shift for Bitcoin. This move lends credibility to Bitcoin among traditional investors and introduces large inflows of new capital into the marketplace.

The extensive participation of institutions in Bitcoin could potentially lead to another price spike similar to the one experienced earlier in 2021, significantly influencing the direction of the bitcoin market as a whole.

Read More

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- GLM PREDICTION. GLM cryptocurrency

- USD COP PREDICTION

- BCH PREDICTION. BCH cryptocurrency

- USD MYR PREDICTION

- CKB PREDICTION. CKB cryptocurrency

2024-05-30 13:11