As a long-term crypto investor with a keen interest in Dogecoin, I find the current market sentiment towards this meme coin intriguing. The recent price surge of over 26% has outperformed other blue-chip cryptocurrencies like Bitcoin, yet investors remain bearish.

In the crypto market over the past month, Dogecoin stood out as a top-performing asset, surpassing the gains of established cryptocurrencies such as Bitcoin. Based on information from CoinGecko, Dogecoin’s price soared by over 26%, whereas Bitcoin experienced an increase in value amounting to roughly 19% during May.

Despite the recent improvement in Dogecoin’s price, current on-chain indicators suggest that investors remain hesitant to adopt a bullish stance towards the cryptocurrency. The key question at hand is – what could be the potential repercussions of this persistent bearish sentiment on Dogecoin’s future price trend?

How Will The Bearish Sentiment Benefit Dogecoin Price?

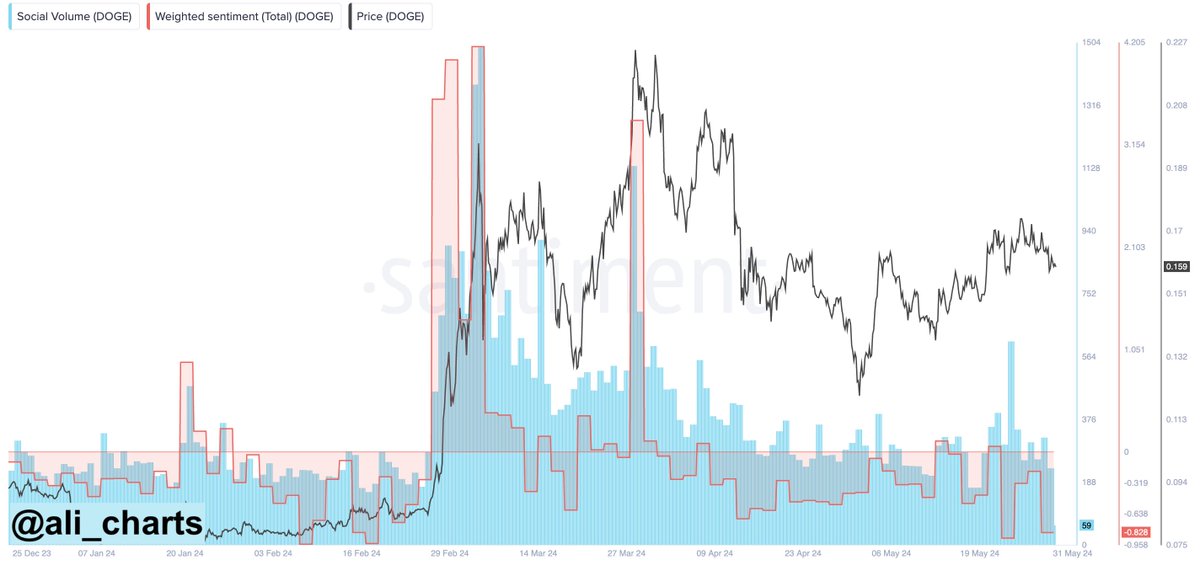

As an analyst, I’ve recently come across an insightful post from crypto influencer Ali Martinez on the X platform. He disclosed that the market outlook for Dogecoin is presently bearish based on his in-depth analysis of the weighted sentiment metric. This metric, which I utilize frequently to gauge the overall positive and negative emotions towards a digital currency, indicates a predominantly negative sentiment towards Dogecoin at this time.

As a sentiment analyst, I construct the weighted sentiment indicator using two essential components: sentiment balance and social volume. Sentiment balance represents my gauge to assess the gap between favorable and unfavorable opinions among investors during specific periods. The more positive sentiment outweighs negative, the higher the sentiment balance score.

the balance of positive and negative emotions expressed in these posts or messages, and the social volume itself.

Based on Martinez’s analysis, the last instance of such pessimistic attitude towards Dogecoin in the market was observed in early February. Subsequently, Dogecoin experienced a significant price increase of approximately 200%. The value of the meme token rose from under $0.1 to above $0.2 within a month’s time frame.

Historically, fear has often triggered significant price increases in financial markets, as prices tend to go against the prevailing sentiment. Consequently, given historical trends, the value of Dogecoin could potentially surge and even exceed the $0.3 mark if this pattern repeats itself.

Whales Acquire 700 Million DOGE In Three Days

One intriguing on-chain development that bodes well for Dogecoin’s price is the recent accumulation by major investors, or “whales,” as revealed by Martinez in a different post on X. In just the past three days, these whales have scooped up approximately 700 million Dogecoin tokens (valued at around $112 million).

As an analyst, I’ve observed that significant purchases of a token by large investors often indicate a positive outlook for its price. Furthermore, keeping an eye on the activities of Dogecoin’s major holders, or “whales,” is essential due to their substantial influence over market trends.

It is worth noting, though, that the recent buying spree hasn’t had any significant effect on the value of DOGE. As of this writing, the Dogecoin price stands around $0.159, reflecting a 0.5% decline in the past day.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- AVAX PREDICTION. AVAX cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- BEN PREDICTION. BEN cryptocurrency

- EUR KRW PREDICTION

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- PHB PREDICTION. PHB cryptocurrency

- ARKM PREDICTION. ARKM cryptocurrency

2024-06-01 14:11