Stellar (XLM), the plucky little crypto that could, is currently wobbling near $0.47 after a 103% monthly joyride. 🌕 But now, its rally has stalled, leaving behind a trail of indecisive Doji candles that look like they’ve had one too many pints at the local pub. 🍻

Two ominous signs are now pointing south: a mountain of leveraged longs sitting under the price like a sleeping dragon, and momentum slipping faster than a banana peel on a rainy day. 🍌 Key support levels? They’re sweating. 😓

Leverage Pocket Below $0.40: The Cascade of Doom Awaits

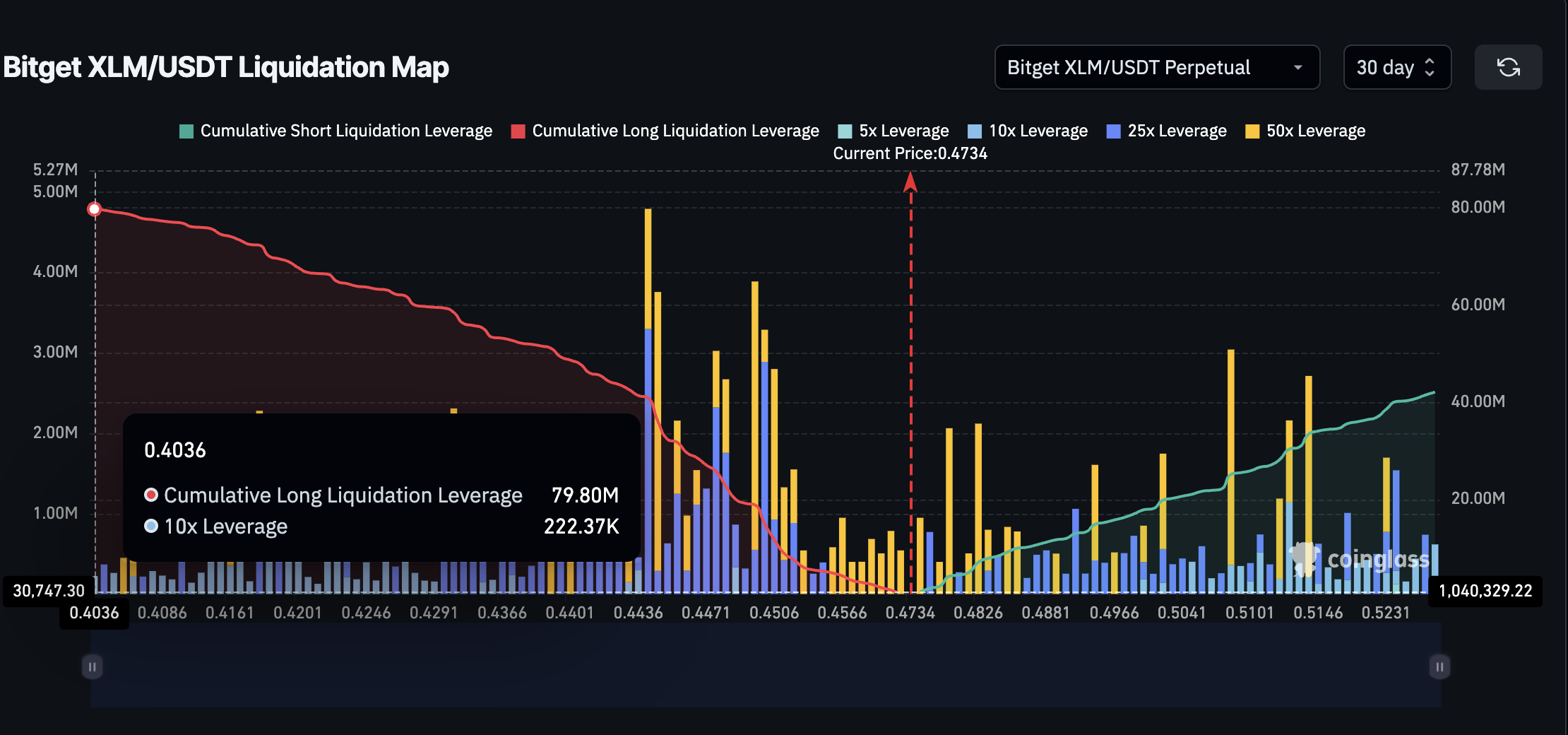

XLM is hovering above $0.45, but Bitget’s 30-day liquidation map reveals a whopping $79.8 million in long exposure compared to a mere $42.1 million in shorts. The cumulative cluster? It’s lurking under $0.40 like a troll under a bridge. 🌉

Every step down could trigger smaller pockets first, but once the dense area under $0.40 is hit, it’s like waking a grumpy dwarf with a hangover—selling will amplify as forced closures slam the order book. 💥

A liquidation map, you ask? It’s where leveraged positions go to die. When the biggest clusters sit below the spot price, even a modest drop can turn into a snowball… made of knives. ⚔️

Daily RSI Divergence: Déjà Vu from December’s Slide

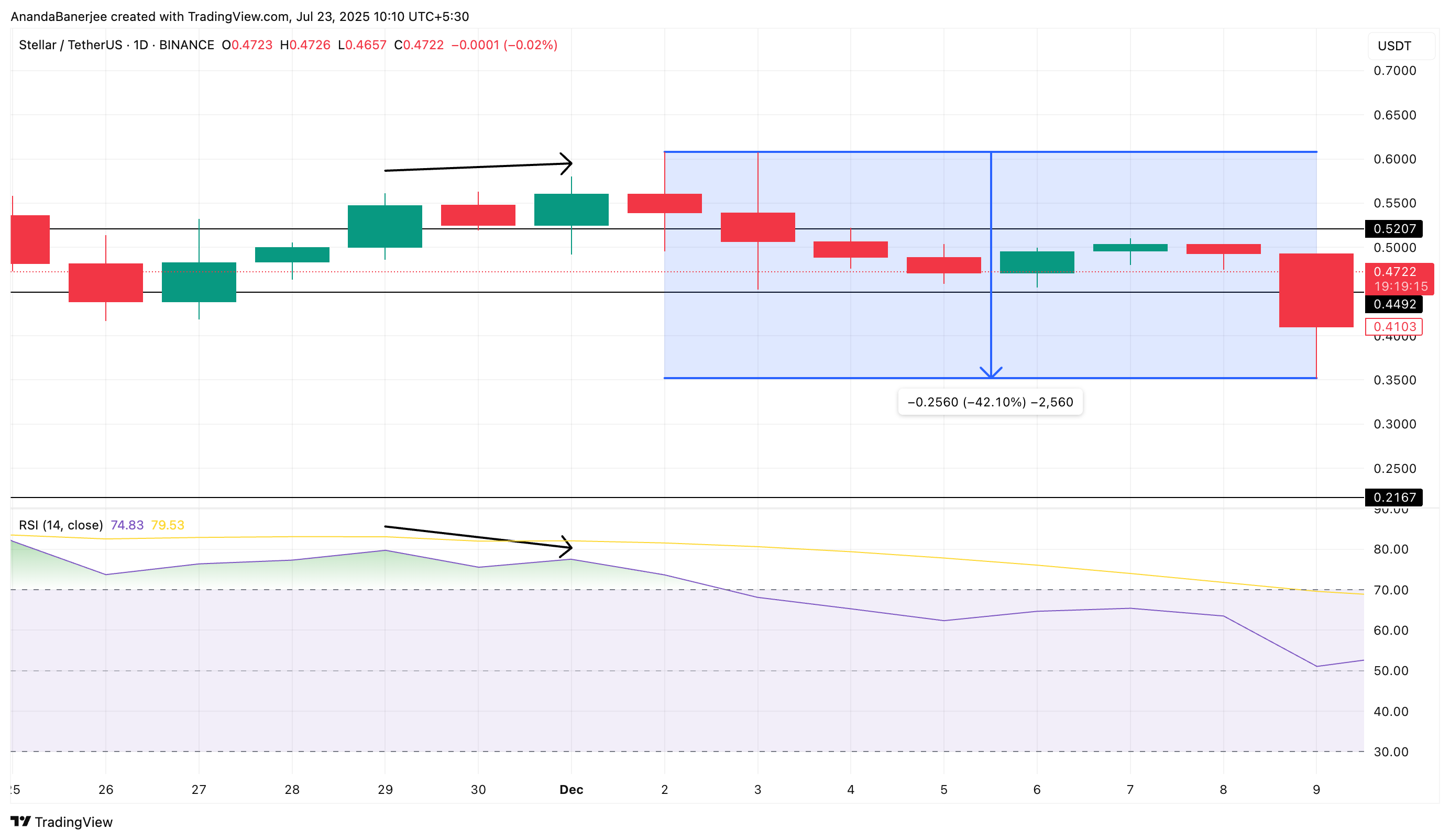

Since July 14, the price has been chilling near the highs, but the Relative Strength Index (RSI) on the daily chart has been making lower highs. It’s like the price is at a party, but the RSI is already calling a cab. 🚕

The last time XLM pulled this stunt, in late December, the price plummeted over 40%. History doesn’t repeat, but it does do the occasional awkward dance. 💃

RSI measures the strength of price movements on a 0–100 scale. When the price is steady or rising but RSI is easing, it’s like your date saying “I’m fine”—things are about to get messy. 🥴

With leverage and liquidation risks lurking below, this loss of momentum is about as welcome as a tax audit. 📉

Craving more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. 📧

XLM Price Eyes Support Levels: Fibonacci to the Rescue?

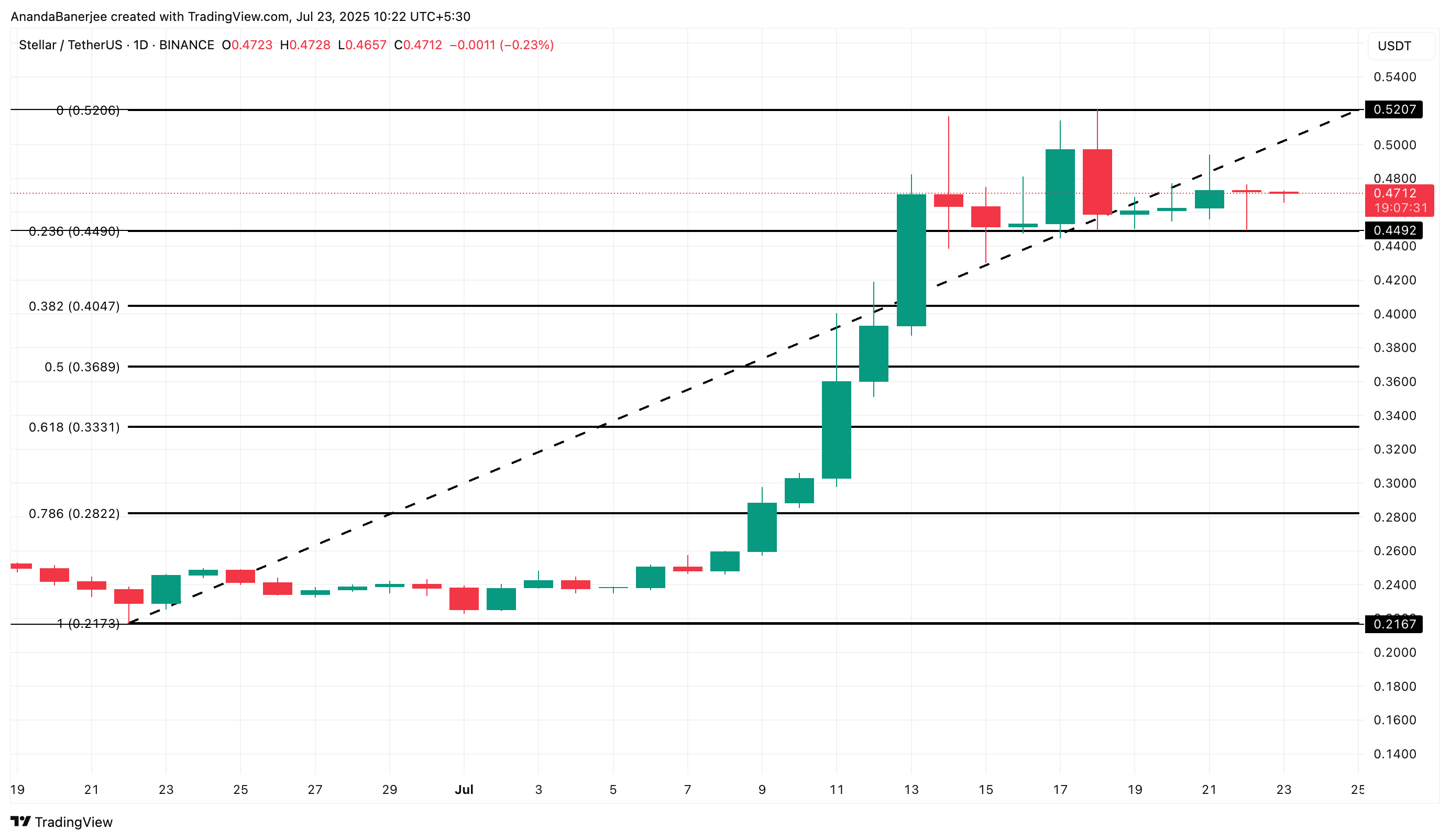

A Fibonacci retracement from the $0.21 low to the $0.52 high highlights potential support levels if selling kicks in: $0.44 (0.236) is the strongest, having been hit more times than a piñata at a kid’s party. 🎉

Fibonacci levels are like the crypto world’s favorite horoscope—they mark common pullback areas. When they overlap with liquidation clusters, reactions tend to be sharper than a witch’s wit. 🧙♀️

XLM is currently perched above $0.44. A daily close beneath that level would put $0.40 in the spotlight. Below $0.40, the liquidation hypothesis wins, and a break there could send XLM tumbling toward $0.33 faster than a wizard falling off a broomstick. 🧹

A 40% decline from the $0.52 high lands under $0.33, inspired by the December 2024 pattern. Below $0.28 (if $0.33 breaks), the entire XLM price structure could turn bearish faster than a Discworld troll turns to stone in sunlight. 🌞

Invalidation? Simple: a firm daily close back above $0.52, with RSI turning up and liquidation risk thinning out, would neutralize this bearish setup and restore the upside case. But until then, it’s anyone’s guess—just like the weather in Ankh-Morpork. ☔

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- Gold Rate Forecast

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- Gears of War: E-Day Returning Weapon Wish List

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- The Saddest Deaths In Demon Slayer

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Rocket League: Best Controller Bindings

2025-07-23 14:08