Ah, Ethereum. That little blockchain darling is bustling about, like a town drunk trying to find his way home, except now it’s strutting towards what analysts call the all-mighty $4,000 barrier. Everyone’s watching, paws twitching—retailers, institutions, even that guy who still believes “HODL” is a dance move. With bullish signs whispering sweet nothings and enough on-chain fundamentals to make a gold miner blush, ETH seems ready for its grand escape—if it can only break free from that pesky resistance. 🚀

Ethereum Price Today: Near $3,850 and Climbing

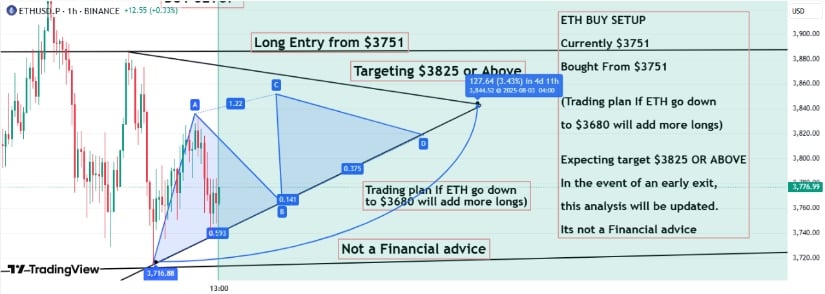

Currently trading around $3,827—just a tad above that cozy $3,800 mark, giving it a weekly hop of 3.61%. It’s like watching a puppy chase its tail—slow but with purpose. Thanks to big shots pumping cash through Ethereum ETFs, the market’s feeling somewhat bullish, as if all the good wine is just starting to flow. The volume? Over $36 billion in just a day—a number that might make your bank account cry or sing, depending on your position. Ethereum flirted with $3,884, eyeing the mystical $3,900 resistance, which it teases like a lover reluctant to commit. Break that barrier and a rapid ascent towards $4,000 could be on the menu—maybe even with some short positions getting wiped out in the process, adding fuel to the speculative fire. 🔥

ETH ETFs, Liquidity and the Great Money Surge

Meanwhile, the ETF circus rolls on. July 29 saw over $218 million pouring into Ethereum spot ETFs—more than Bitcoin’s paltry $80 million—like a thirsty camel at an oasis. BlackRock’s Ethereum ETF, the star of the show, snagged over $223 million, bumping its total to nearly $10 billion. Meanwhile, total assets under this ETF umbrella hit $21.61 billion, about 4.75% of ETH’s market cap. Bitcoin’s ETFs? Oh, they’ve got $152.71 billion—looking like the anchor holding down the entire crypto castle, but Ethereum’s catching up with its youthful swagger. 🏦

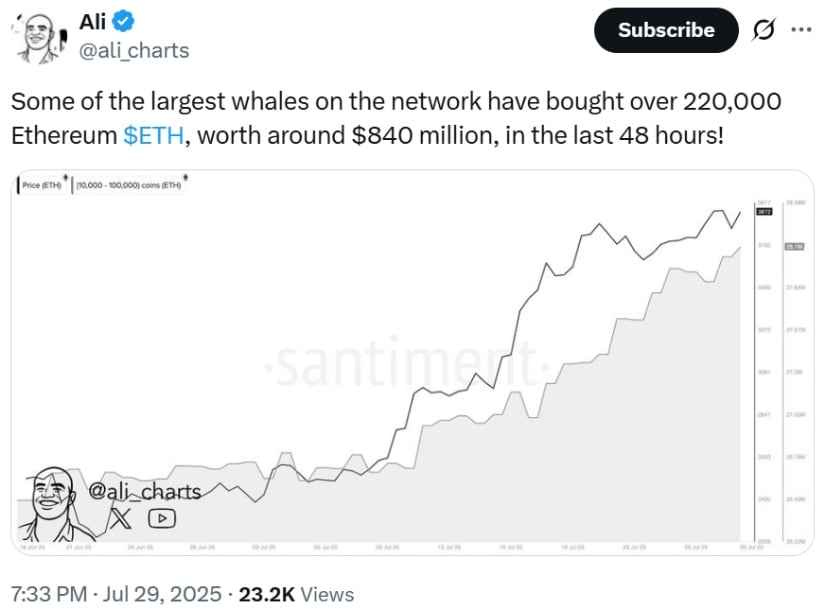

Whales and Giants: The Big Fish Are Watching

On the blockchain beast’s back, whales are munching like vampires at a blood bank. Over 220,000 ETH—nearly $840 million—flitted across large wallets in just 48 hours. There’s an 8% rise in whales holding over 10,000 ETH. It looks like the big fish are stockpiling, whispering, “Come at me, resistance!” Meanwhile, Bitcoin whales are taking a tiny breather—about 1.61% fewer of them—perhaps tired of the old guy in the corner and eyeing Ethereum with a hopeful glance. This shift screams institutional confidence—like rich folks swapping their yachts for private islands—long-term faith, not just trading heightening. 😂

Technical Musings: RSI, Resistance, and the Path Ahead

Ethereum’s RSI dances around 56.55—an equilibrium that’s neither bullish nor bearish but reads like someone sipping tea, thinking about lunch. It’s close to the top Bollinger Band at about $3,901, which has previously held back bullish ambitions—kind of like a strict headmaster. Support sits firm at roughly $3,565—doing its best to keep the peace during this little price flirtation. Break above $4,096 and ETH could dream about touching $4,500—a pivotal area that historians would call “the big climb.” Based on on-chain chatter, ETH might just squeeze past all resistance if the stars align or if the bulls get especially sassy. 🌟

Conclusion: Is $4K the Big Break or Just a Blip?

With enough institutional juice, whale armies, and bullish charts—plus a little bit of luck—Ethereum stands on the brink of something big. Cross that magical $4,000 and short-sellers may find their portfolios looking more like empty wallets, while ETH marches towards $4,500 with the swagger of a rock star. Keep your eyes peeled or risk missing the fireworks. Because if all goes well—and sometimes it does—Ethereum might just slip into its new role as the crown jewel of this brave, buzzing digital realm. 🍾

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

2025-07-30 23:21