Ah, Bitcoin, the precious digital coin that no one truly understands but everyone pretends to. Recently, its value took a tiny nosedive after the Fed played hard to get on rate cuts—like a bashful lover avoiding commitment. But don’t let that fool you! Behind the curtains, four mighty signals are winking bullishly; a sort of cosmic wink from the financial gods, or perhaps just a fancy way to say “buy now or cry later.” 🤑

From ancient cycles that seem to run on a mysterious calendar, to the global liquidity peaking like a drunken party guest—oh, and lest we forget, the panic in the altcoin camp and a famous chart heating up faster than a biddle stove—everything screams one thing: Bitcoin might just be gulping for its final, grandiose rally in this wild circus called the cycle. 🎪

And if those charts are anything to go by, brace yourself—$130,000 could be knocking on your door sooner than you think. Or perhaps Bitcoin’s just teasing us like a cat with a laser pointer; who can tell? 😏

The Oracle Says: October is Like a Bull in a China Shop

According to the wise Saint Pump—whoever that is—our dear crypto is sitting tight in a final “wait and see” mode, a sort of nervous squirrel before the storm. The four-year cycle prophecies that the top of this rollercoaster ride happens roughly 18–20 months after each halving—mark your calendars for October 20th, 2025! Seems like the universe wants us Fed up or just loves symmetry.

What’s more? October, that splendid month—has been a Bitcoin magnet, being bullish 10 out of 12 recent years, with an average gain of nearly 22%, enough to make even the grumpiest hodler chuckle into their coffee. ☕

Global Money Supply: The Countdowns and Peakings

Now, onto the money spigot. Global liquidity—or M2—has a schedule of sorts, peaking around September 23. Bitcoin, being the impatient creature it is, tends to reach its climax *before* the money supply peaks—like that friend who always arrives early for the party. This makes the upcoming days even more tantalizing for crypto enthusiasts. 🕰️

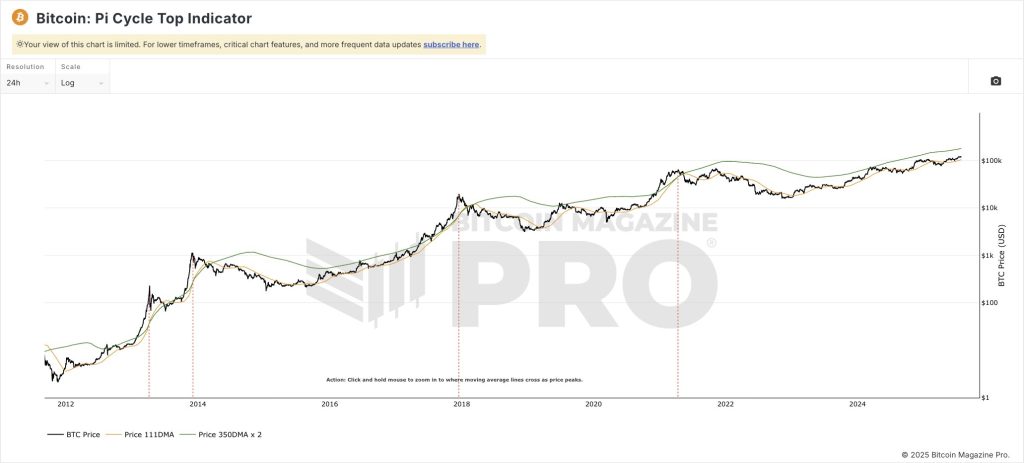

The Pi Cycle Wakes Up — And Looks Hungry

Next, the Pi Cycle Top indicator—no, not your favorite pie recipe—lays in wait. Based on magic moving averages, it’s shown us the top zones before, and it’s stretching its legs now, hinting at some serious momentum brewing. The gap between the two key averages grows, just like a balloon ready to burst or a lion in a cage—very exciting!

The Altcoin Graveyard and What It Tells Us

Meanwhile, the rest of the crypto carnival is turning gloomy—altcoins, those smaller, often more manic friends, are bleeding out and losing their shiny dominance. This frantic rotation hints at a Bitcoin last stand, where investors, like moths to a flame, rush into the bigger glow, leaving the smaller sparks behind. 🔥

Even sentiment analysis—those fancy word clouds of fear and greed—are screaming “flee!” from altcoins, a sign that the final Bitcoin surge might just be around the corner. Or maybe Elon Musk’s latest tweet. Who knows?

Final Destination: $130K or Bust!

Looking at the charts, Bitcoin’s cozying up around $118K, climbing like a caffeinated squirrel on a tree—healthy and eager. The signs point to a last, glorious consolidation before it goes ‘boom,’ with targets possibly soaring past $130,000. Well, hold onto your hats, folks—if history’s any guide, this final act could leave most of us slack-jawed. 😲

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-07-31 12:23