Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Prepare your finest tea, for the influx of capital into crypto ETFs (exchange-traded funds) in July has set a new benchmark of bullishness. While the world is abuzz with tales of regulatory upheaval and macroeconomic turbulence, the real story is written in the language of finance: inflows. Ah, the sweet sound of money flowing like a river into the crypto realm!

Crypto News of the Day: Crypto ETFs Outshine VOO and Legacy Funds in July

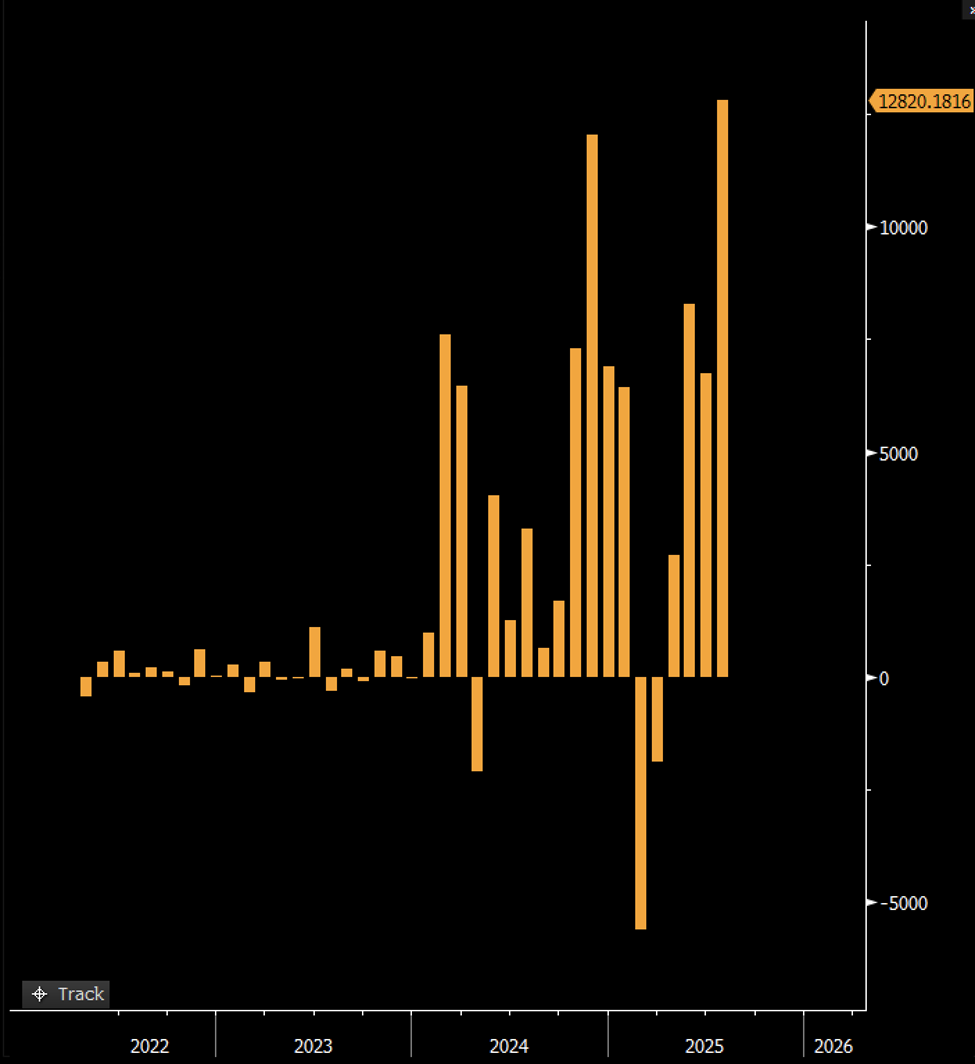

US crypto ETFs saw a staggering $12.8 billion in inflows during July, marking the most prosperous month for this category. The average daily intake soared to approximately $600 million, a figure that doubles the usual pace. One might say, it’s as if the gods of finance have finally turned their gaze upon the crypto world. 🌟

“US Crypto ETFs took in $12.8 billion in July, the best month ever, a $600m/day pace, about double avg. As a group that’s more than any single ETF did, including the Mighty VOO,” Bloomberg ETF analyst Eric Balchunas wrote in a post, with a hint of awe and perhaps a touch of envy.

To put this in perspective, VOO, the Vanguard S&P 500 ETF, is a titan among legacy funds. For crypto ETFs to surpass it, even if only for a fleeting moment, is a sign that the tides of investor behavior are indeed changing. It’s as if the crypto world has suddenly become the belle of the ball, and all the traditional funds are left standing on the sidelines, wondering what they’ve missed. 🕺💃

And the inflows were not limited to a select few. Balchunas noted that every ETF in the crypto category, save for the converted trusts, experienced net inflows. Bitcoin and Ethereum ETFs led the charge with equal contributions, a rare display of parity in a space where Bitcoin often steals the show. It’s almost as if Ethereum decided to throw a grand gala and invited Bitcoin to dance. 🎵🕺

“This is the most all-around dominant performance since the Eagles ended the Chiefs in the Super Bowl. Will be hard to top,” Balchunas quipped, perhaps with a wink and a nod to the future.

But the good news doesn’t stop there. The broader market’s appetite for risk has also returned with a vengeance. ARK Invest, under the guidance of the indomitable Cathie Wood, had a day to remember. The firm’s flagship fund, ARKK, saw an influx of $800 million in a single session, its largest one-day inflow ever. Balchunas couldn’t help but marvel at the feat:

“…$ARKK just took in $800 million in one day—It’s biggest one day inflow ever… $ARKW also saw $150m (huge for it), so the whole family did about a billion.”

The return of capital to risk-on assets like Bitcoin ETFs and other crypto products paints a vivid picture of current market sentiment. It suggests a renewed sense of optimism and confidence, as if the market has decided to throw caution to the wind and embrace the future with open arms. 🌈💪

This aligns with a recent prediction by Bitwise CIO Matt Hougan, who foresees an explosive second half of the year for Ethereum ETFs.

Flows into Ethereum ETFs are going to accelerate significantly in H2. The combination of stablecoins & stocks moving over Ethereum is an easy-to-grasp narrative for traditional investors.

ETH ETFs did $1.17 billion in flows in June. They could do $10b in H2.

— Matt Hougan (@Matt_Hougan) July 2, 2025

After a cautious spring, traders and institutions are now leaning back into the market with gusto. Some analysts may caution that this level of enthusiasm could undermine crypto’s decentralized ethos, but others see it as the dawn of a new era. After all, as ETFs continue to normalize crypto exposure for traditional portfolios, the line between old and new begins to blur. 🌍💫

Chart of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of July 31 | Pre-Market Overview |

| MicroStrategy (MSTR) | $401.86 | $393.59 (-2.06%) |

| Coinbase Global (COIN) | $377.76 | $337.90 (-10.55%) |

| Galaxy Digital Holdings (GLXY) | $28.42 | $26.65 (-6.21%) |

| MARA Holdings (MARA) | $16.08 | $15.21 (-5.41%) |

| Riot Platforms (RIOT) | $13.41 | $12.28 (-8.43%) |

| Core Scientific (CORZ) | $13.54 | $13.16 (-2.81%) |

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- INR RUB PREDICTION

2025-08-01 18:19