Bitcoin is taking aim at $116,000, with ETF interest making things hotter than a summer in the Sahara. Are we heading into a wild volatility storm? 🌀

Bitcoin’s price action is sizzling like a hot potato right now as it sets its sights on $116,000. After bouncing back from the weekend’s price lows, the world’s largest cryptocurrency is flexing its muscles like a bodybuilder at a beach party. 🏋️♂️

However, there’s some resistance standing in the way like an overenthusiastic bouncer at a club. Plus, those pesky ETF outflows are making traders’ heads spin like a DJ remix. 🎧

But fear not, Bitcoin enthusiasts, the crowd is watching closely as Bitcoin eyes the golden $116K prize. 🌟

Traders Watch Bitcoin Price at $116K 🧐

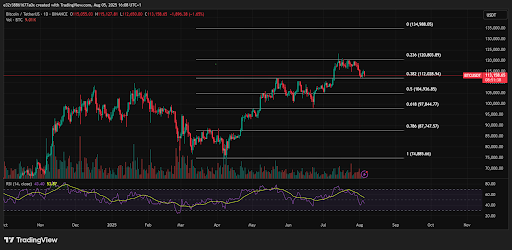

Bitcoin (BTC) started the week with a lazy stroll at $112,000, then decided to sprint up toward the $116,000 zone. According to the wise sages at TradingView, the bulls are testing some serious resistance around $115,800-imagine the fort Knox of price levels. 💰

That level is also like the top of a newly filled CME Futures price gap, which acts like a magnet for crypto traders. Even analysts like Rekt Capital are paying attention, thinking a clean move past this zone could send Bitcoin shooting for the stars like a rocket that just found its second wind. 🚀

After filling the Daily CME Gap, Bitcoin now has its sights set on breaking free, aiming to reclaim higher levels.

It all starts with breaking through $116K-it’s like the VIP access to the next level of crypto glory. 🎟️

– Rekt Capital (@rektcapital)

But let’s not get too carried away. It’s not all sunshine and rainbows. Some market watchers are pointing to large bid zones between $112,000 and $110,000, suggesting a dip before the party truly begins. 🎉

“$BTC is going lower before it goes higher,” said crypto trading group Material Indicators on X. Yes, folks, it’s a rollercoaster! 🎢

Which Zones Are Worth Watching On Bitcoin’s Charts? 📉

Bitcoin has some safety nets in place, in case things take a nosedive. These include $113,800, which is an initial bid wall, and the $112,000 zone, which is a recent local low. Think of them like the inflatable mattress that cushions a fall. 🛏️

The $110,500 level is a historical bounce zone, along with $109,000, which used to be Bitcoin’s all-time high. 🏆

According to Trader Cipher X, “If downside happens first, expect a bounce near $110.5K.” It’s like crypto’s version of ‘weeble wobble but don’t fall down.’ 💪

Bitcoin ETFs and Market Sentiment 🎭

Beyond the technical mumbo jumbo, the big institutional players are making their presence felt. Bitcoin spot ETFs are under the microscope, and the pressure is on. 😬

Last Friday, U.S. Bitcoin ETFs saw outflows of $812 million-no, that’s not a typo. It’s the second-largest on record! But don’t break out the gloom and doom just yet. QCP Capital suggests this might be part of the ‘shakeout’ before the inevitable rally. It’s like the market shaking the last crumbs out of its pockets before hitting the jackpot. 💸

“Historically, post-rally shakeouts that flush out excess leverage often lead to renewed accumulation,” says QCP. Sounds like a magic trick, right? ✨

The numbers seem to back this up. Over the weekend, open interest on Bitcoin futures dropped to its lowest since July 10, showing that leveraged players were flushed out like bad credit. 📉

And that kind of cleanup? Well, it often sets the stage for a smoother, steadier rise. QCP believes that Monday’s ETF netflows could signal whether the bulls are back or if they’re still napping. 🐂

In the grand scheme of things, while some analysts are leaning toward a short-term bearish outlook, others see this price action as the setup for a surprise twist in the Bitcoin story. 📚

While a dip to $110K or even $109K might make some traders twitch, many believe that Bitcoin still has enough juice to power higher before year’s end. It’s like that final scene in a movie where the hero gets a second wind and comes out on top. 🎬

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- Gold Rate Forecast

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- Gears of War: E-Day Returning Weapon Wish List

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- The Saddest Deaths In Demon Slayer

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Rocket League: Best Controller Bindings

2025-08-06 00:54