Imagine, if you will, a world where the titans of industry suddenly discover the speed of lightning and the charm of a charming scoundrel-XRP. Yes, dear reader, since mid-2024, a merry band of corporations-some as grand as Japan’s SBI Holdings, others mere tech pretenders-have taken to stuffing their coffers with XRP, the asset formerly known only to crypto nerds, now the chic secret of big business. While Ethereum and Bitcoin once danced like peacocks on headlines, now XRP flutters its wings, promising swift cross-border payments with a wink and a nudge. Who knew speeds could be so seductive? 🚀

Across the globe-United States, Asia-Pacific, Canada-companies big and small have begun disclosing their secret loves: XRP holdings, or at least, they speak of plans to hoard this digital treasure. This report by CoinPedia pulls back the curtain to reveal institutional amorousness for XRP, and, oh yes, the allure of swift, borderless transfers. Cue the dramatic music: these corporations are betting their future on the quick settlement, and some probably on their morning coffee, too. ☕️

Top Public Companies Holding XRP – The Elite Circle of Speedsters

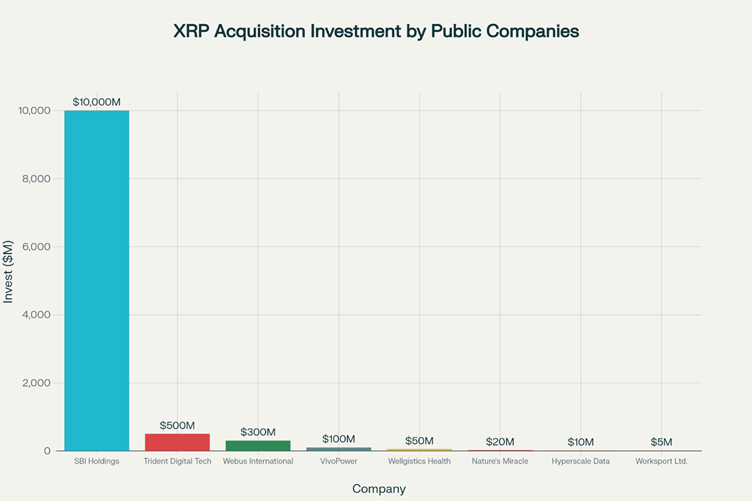

1. SBI Holdings

XRP Allocation: About ¥1.6 trillion (roughly USD $10 billion-don’t blink!)

A Ripple old-timer, SBI is the grand warrior wielding XRP in treasury routines and Japan’s crypto ETF dreams. Rumor has it, SBI’s XRP stash is worth more than its entire market cap-a tragicomic twist in this grand saga. Some compare SBI’s bold XRP crusade to MicroStrategy’s Bitcoin binge, prompting whispers of corporate crypto seduction. Meanwhile, the GAM fund is nudging SBI to formalize what’s already happening: XRP as a strategic asset, like a secret handshake that’s about to go public. As of now, the investment remains hidden on balance sheets-the fiscal equivalent of hiding a hidden love affair. 😉

2. Trident Digital Tech Holdings (NASDAQ: TDTH)

XRP Allocation: Up to $500 million

Singapore’s Web 3.0 mavericks, Trident Digital, plan to raise half a billion to build a colossal XRP treasury. Staking, reserves, ecosystem deep-diving-this company is aiming for the crypto hall of fame. Announced in June 2025, their ambition is to make Wall Street’s head spin with this audacious plan; the regulators better bring snacks for this rollercoaster ride. If approved, expect a tsunami of crypto innovation by late 2025, and perhaps a few confused board members scratching their heads.

3. Webus International (NASDAQ: WETO)

XRP Allocation: Cap of $300 million

A chauffeur service with a tech twist-yes, AI-powered luxury rides-Webus is gearing up to pour a cool 300 million into XRP treasury plans, posthaste. The deal with Ripple Strategy Holdings is like a pre-nup-conditional, guarded, and a little mysterious-pending approvals, of course. No assets yet, just a promise on a digital handshake, but oh the plans they have-if only law could keep up with ambition. 🚗💨

4. VivoPower International PLC (NASDAQ: VVPR)

XRP Allocation: Already raked in $100 million

Once a darling of private Saudi investors, VivoPower jumped into the digital money pool with both feet, grabbing XRP like a miser clutching gold. Partnering with Flare Network to generate yields, they’re turning XRP into a yield machine-because nothing says “smart money” like stablecoins and crypto yields, right? 💰

5. Wellgistics Health Inc. (NASDAQ: WGRX)

XRP Allocation: $50 million via credit line

First U.S. healthcare firm to dive into XRP, Wellgistics plans to use XRP for payments across pharmacies and as collateral. Imagine-medications paid instantly in XRP, without fuss or delay. All life’s emergencies, now faster-who needs ambulances when you’ve got instant settlements? 🏥

6. Nature’s Miracle Holding Inc. (OTCQB: NMHI)

XRP Allocation: Up to $20 million

This green thumb is investing in XRP as a long-term reserve. Fancy enough, a non-financial firm eyes XRP’s efficiency in global payments-because even in the cleanest farming, speed is everything. According to CEO James Li, XRP’s magic is undeniable, much like a good miracle. 🌱

7. Hyperscale Data Inc. (NYSE American: GPUS)

XRP Allocation: $10 million, initially

Starting modestly but thinking big, Hyperscale plans to keep XRP on its balance sheet, with updates flowing weekly. Lockup, lock-in, and maybe more-these tech giants see XRP as the future of cross-border transactions. Patience is a virtue, and perhaps by December 2025, they’ll be crypto royalty. 👑

8. Worksport Ltd. (NASDAQ: WKSP)

XRP Allocation: Up to $5 million

A clean energy pioneer, making its first crypto foray-XRP-to fund green dreams and e-commerce ambitions. Also contemplating accepting XRP as payment-because if you can’t beat ’em with speed, buy ’em. Who says cars and crypto don’t mix? 🚗💚

XRP Holdings: A Company-by-Company Look at the movers and shakers

Companies that’ve actually, really invested

| Company | Investment Date | Amount | Status | Performance | Details |

| VivoPower International | June 2, 2025 | $100M | Done & Dusted | 25.5% | Partnered with Flare, big plans |

| Worksport Ltd. | Jan 29, 2025 | Undisclosed | Done | 20.4% | Early XRP play, plans for payments |

| Hyperscale Data | July 28, 2025 | $10M | Ongoing | 25.5% | Weekly updates, lockup underway |

Upcoming plans-The “Coming Soon” list

| Company | Announcement Date | Planned Amount | Status | Potential Impact | Notes |

| Trident Digital Tech | June 12, 2025 | $500M | Planned | Risky but ambitious | |

| Wellgistics Health | May 8, 2025 | $50M | Approved | Long-term reserve | |

| Webus International | July 1, 2025 | $100M | Secured | Funding in place | |

| Nature’s Miracle | July 23, 2025 | $20M | Raised | Timing’s everything |

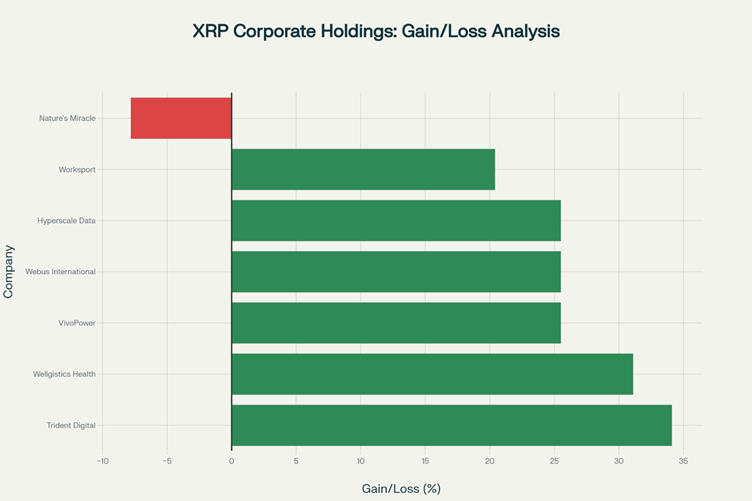

Profits or Pitfalls? The hypothetical gains/losses if these firms went all-in on XRP on day one

Let’s play with some number magic. If these companies had bought XRP the exact moment they announced their plans, how much would their profits look today? Turns out-most would be smiling with nice double-digit returns. Only Nature’s Miracle took a bath-probably bought high and sold low, a classic in the annals of crypto comedy. The lesson? Timing isn’t everything, but it helps. 🤑

| Company | Initial Investment | Current Value | Unrealized Gains/Losses | Percentage |

| TDTH | $50M | $67M | $17M | 34.1% |

| WGRX | $5M | $6.55M | $1.55M | 31.1% |

| VVPR | $10M | $12.55M | $2.55M | 25.5% |

| WETO | $30M | $37.65M | $7.65M | 25.5% |

| GPUS | $1M | $1.25M | $0.25M | 25.5% |

| WKSP | $0.5M | $0.6M | $0.1M | 20.4% |

| NMHI | $2M | $1.84M | -$0.16M | -7.8% |

Most companies gained, some lost, and a few went full dramatic-think of it as a crypto soap opera. 🎭

If Ripple Treated XRP Like a Treasury Darling

Ripple itself owns a mountain of XRP-about 41% of the supply, or roughly 40.7 billion tokens. Imagine Ripple declaring XRP as a treasury reserve-like the CEO finally admitting they’ve been hoarding cookies for a rainy day. This move could tighten supply, boost prices, and send the crypto markets into a tizzy. Plus, it might inspire other corporations to follow suit-further turning XRP into the corporate equivalent of a million-dollar poker hand.

Why Are Companies Embracing XRP? Because Speed and Utility Are the New Black

The rush is on-corporate treasuries exploded from $200 million to over $11 billion in mere months! What’s fueling this frenzy? Speed? Low fees? Utility? Yes, yes, and yes again. Companies see XRP as the magic bullet for borderless payments, liquidity, and even yield strategies-something gold and fiat can only dream of! Digital assets now have a seat at the corporate table, and XRP’s invitations to the party are still being sent out. 🎉

If you thought Ethereum was the only smart choice, think again. XRP’s ecosystem, despite lacking proof-of-stake, offers off-chain earning-lending, liquidity, and DeFi platforms turning XRP into a passive-income machine. The corporate world is waking up, and XRP is the new hot thing-being fast, cheap, and useful makes it practically irresistible.

The Big Picture: Clarity, the Secret Ingredient

The impending Digital Asset Market CLARITY Act is like a legal VIP pass for XRP-defining it as a commodity, reducing regulatory headaches, and making it a cozy fit for corporate treasuries. Suddenly, XRP isn’t a legal wild card but a standard player in the financial game. If only all laws moved so swiftly!

From farming tech to energy giants and biotech adventurers, these companies are trailblazers-early adopters in a world where speed means survival. Perhaps soon, everyone will be rushing to join the XRP club, sipping digital cocktails and toasting to faster, cheaper, and smarter money. 🍸

Never Miss a Beat in Crypto Land!

Stay in the loop-headline news, expert analysis, and the latest trends in Bitcoin, DeFi, NFTs, and more, all served with a side of sarcasm.

FAQs (Because You Have Questions, Don’t You?)

Why are companies adding XRP to their treasury stacks? Because it’s faster, cheaper, and just more fun-plus you get yield and utility served on a silver platter.

How has XRP performed in these bold new corporate roles? Mostly up, with many companies showing nice double-digit gains-except for one unfortunate soul, who bought at the peak and now pouts. 🎯

Can you earn passive income from XRP? Oh yes, through lending, staking (via third parties like Flare), and liquidity pools-passive income that even the laziest finance nerd would envy.

Who’s the biggest XRP hoarder? SBI Holdings-more XRP than some small countries. Think MicroStrategy, but with yen.

How does the CLARITY Act change the game? It turns XRP into a legitimate, legal commodity, making life easier for companies and regulators alike.

Is XRP worth it in 2025? Absolutely-its fundamentals, utility, and regulatory clarity hint at a promising future, even if some choose to remain skeptics.

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- Gold Rate Forecast

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- The Saddest Deaths In Demon Slayer

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Upload Labs: Beginner Tips & Tricks

- Rocket League: Best Controller Bindings

2025-08-07 09:31