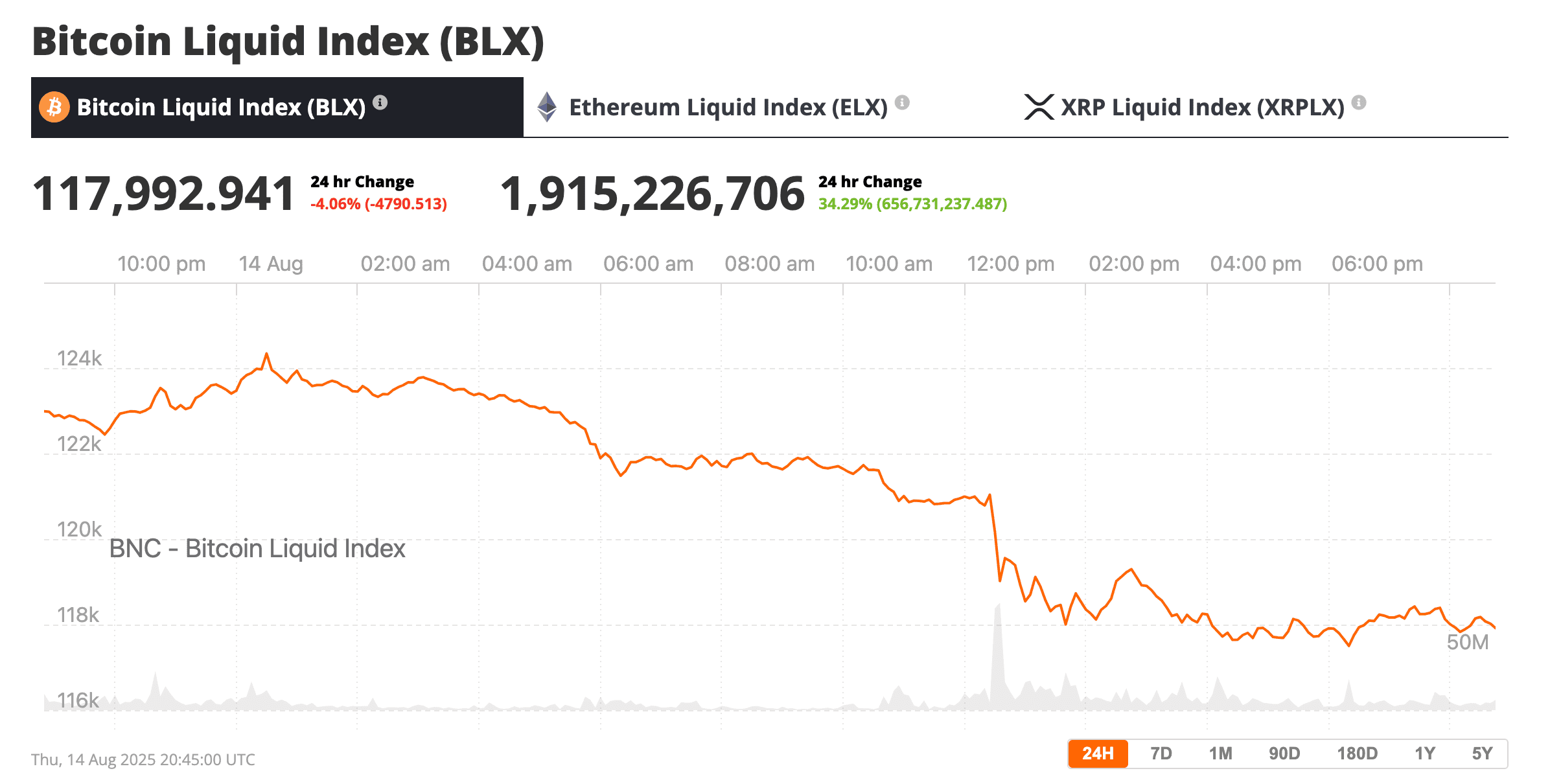

Ah, the capricious nature of Bitcoin! Just yesterday, it soared to dizzying heights, a veritable titan at over $124,000, only to plummet like a tragic hero in a Dostoevskian tale, now languishing at a mere $118,000-a decline of 2.3% in the span of a mere 24 hours. Such is the fate of those who dare to dance with the fickle mistress of cryptocurrency! 🥴

Bitcoin’s descent to just under $118,000, source: Bitcoin Liquid Index

And what, pray tell, has caused this sudden descent into the abyss? A rather alarming report from the U.S. Producer Price Index (PPI) for July, revealing a 3.3% annual rise in wholesale prices. The implications? A dampening of the once-hopeful expectations for Federal Reserve interest-rate cuts, reducing the probability of a Fed funds rate at or below 3.75% by January 2026 to a mere 61%, down from 67% just a week prior. Oh, the irony! 📉

But wait! The plot thickens! The sell-off was exacerbated by the liquidation of over $1 billion in leveraged positions-mostly from those optimistic souls betting on higher prices. It is the largest long-side wipeout since that fateful decline in late July, when Bitcoin briefly dipped below $112,000 before staging a dramatic comeback. Truly, a tale worthy of the grandest of novels! 📖

Some traders, in their infinite wisdom, reacted to the remarks of U.S. Treasury Secretary Scott Bessent, who, in a moment of candor, declared that the government had no intentions of expanding Bitcoin purchases for the Strategic Bitcoin Reserve. Such comments, like a cold shower on a hot summer day, dampened the spirits of many who had clung to the hope of a March executive order from President Trump, which had encouraged “budget-neutral” Bitcoin acquisitions. Alas, the dreams of many were dashed! 😱

Yet, in a twist befitting a farcical comedy, by late afternoon, the secretary had a change of heart! In a post on X, he proclaimed that the Treasury is “committed to exploring budget-neutral pathways to acquire more Bitcoin to expand the reserve.” How delightful! The government, it seems, is open to finding cost-offsetting mechanisms to add to its holdings, while still clinging to the “foundation” of seized assets. A true balancing act! 🎭

Options Market Signals Stability

Despite the chaos, the derivatives data suggest that traders are not pricing in significant downside risk. The 30-day BTC options delta skew-a measure of relative demand for puts versus calls-stands at a mere 3%, below the 6% threshold often associated with bearish positioning. This implies a balanced risk outlook, with little expectation of a retest of the $110,000 support level. How reassuring! 😌

Macro Risks Remain

While analysts maintain a cautiously optimistic medium-term view, they warn of stretched valuations, shifting Fed rate expectations, and the ever-growing U.S. government debt-now surpassing $37 trillion! Such burdens could introduce fresh headwinds. Yet, institutional demand, ETF inflows, and global central bank liquidity expansion continue to underpin the bullish case for Bitcoin in 2025. A paradox, indeed! 🤔

For now, the consensus is that Thursday’s slide was merely a healthy shakeout-a market taking a breath after its frantic sprint to record highs. A moment of reflection in this grand theater of finance! 🎭

Read More

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- How to Unlock the Mines in Cookie Run: Kingdom

- Gold Rate Forecast

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- The Saddest Deaths In Demon Slayer

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

2025-08-15 04:55