Oh, dear reader, the tale of Ethereum (ETH) has taken a turn most unexpected. After basking in the warm glow of bullish volatility earlier this week, the price of this illustrious altcoin has cooled faster than one’s enthusiasm at a ball where neither cake nor conversation is forthcoming. In the past 24 hours, ETH has suffered a decline of over 3 percent, now trading at approximately $4.4k as of Friday, August 15, during the mid-North American session. One can only imagine the whispers among traders and investors alike-surely, the tonnage of their disappointment rivals that of an ill-fated soufflé. 🍰📉

A Glimmer of Hope for the Bullish Sentiment 🐂

Yet, lo and behold, the macro bullish sentiment for Ethereum persists, much like the stubborn cousin who insists on recounting their exploits at every family gathering. This optimism is fueled by the remarkable surge in Ethereum futures Open Interest (OI), which has leapt from a modest $18 billion in April to a staggering $62 billion in August. On-chain data, ever the faithful companion, reveals renewed institutional demand for Ether, led by the U.S. spot ETH ETFs. Indeed, one might say these investors have taken a page out of the SharpLink Gaming playbook, for they recently announced holdings of 728k ETH, valued at over $3.3 billion. And let us not forget BitMine, who, in a display of financial exuberance, acquired additional Ether worth $130 million, swelling their coffers to $5.26 billion. Bravo, dear whales, bravo! 🎉💰

But wait, gentle reader, for there is more to this tale. The implementation of Ether treasury strategies by corporations further bolsters Ethereum’s bullish narrative. It seems that even the most staid of institutions cannot resist the siren call of digital riches. How very modern! 🚀

A Midterm Bearish Tone Emerges 🐻

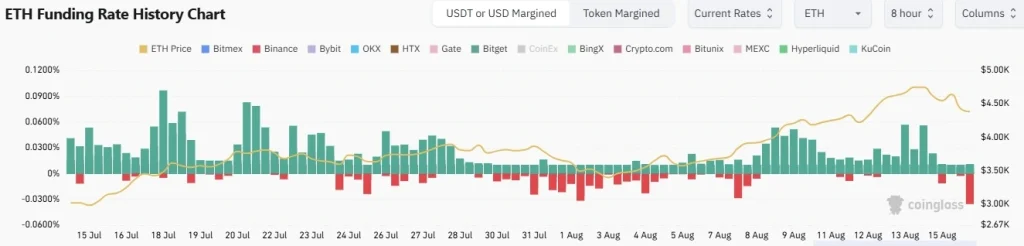

However, as with any good drama, the plot thickens. For all its bullish bravado, Ethereum finds itself teetering on the precipice of overbought levels, nearing its all-time high. Alas, the Funding Rate, according to CoinGlass, has turned negative-a harbinger of midterm bearish sentiment among futures contracts traders. Could it be that the market’s enthusiasm is but a fleeting fancy? 😕

To add insult to injury, the number of validators exiting the staking market has swelled like an ill-fitting waistcoat after supper. Data from everstake reveals that over 767,000 ETH, valued at $3.490 billion, are queued to leave the network. One might jest that these validators are fleeing as though pursued by a particularly persistent suitor. 😅

The Fate of ETH: To Rise or Retreat? 🤔

In the past two days, Ethereum has experienced a mid-term correction, retesting a crucial support level around $4.4k. On the four-hour timeframe, ETHUSD has flirted with the 50 Moving Average Simple (SMA) and a rising logarithmic trend established since the beginning of August. Will it hold firm, or shall it falter like a debutante’s first curtsy? Only time-and perhaps a few more dramatic exits-shall tell. Until then, we watch and wait, armed with charts, tea, and a healthy dose of skepticism. ☕📈

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Gears of War: E-Day Returning Weapon Wish List

- The Saddest Deaths In Demon Slayer

- FromSoftware’s Duskbloods: The Bloodborne Sequel We Never Knew We Needed

- All Pistols in Battlefield 6

- Jujutsu: Zero Codes (December 2025)

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

2025-08-16 00:48