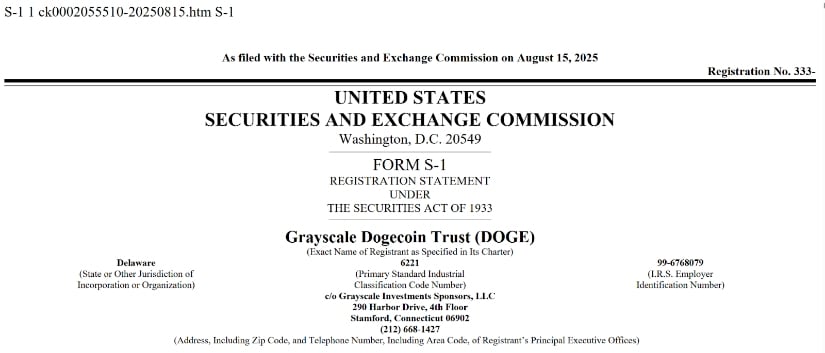

Ah, the peculiar dance of finance and folly continues! Grayscale Investments, that grand arbiter of crypto-curiosities, has filed its paperwork with the SEC-a bureaucratic waltz, if you will-to birth a Dogecoin exchange-traded fund. Yes, dear reader, under the ticker ‘GDOG’, no less. How delightfully canine! 🐕🦺

This filing, akin to a caterpillar donning a suit to become a butterfly, renames Grayscale’s existing Dogecoin Trust into a full-fledged ETF structure. Imagine, ordinary investors can now dabble in Dogecoin without wrestling with crypto exchanges or digital wallets-those Byzantine contraptions of modernity. And where shall the actual Dogecoins reside? Why, nestled safely in the vaults of Coinbase Custody Trust Company, of course. How quaintly reassuring. 🏦✨

The Great Dogecoin ETF Derby 🏇

But lo! Grayscale is not alone in this race. Oh no, several other financial thoroughbreds are galloping toward the finish line. Bitwise pranced in with its application in January 2025, while Rex Shares and Osprey Funds trotted along earlier this year. And let us not forget 21Shares, who sauntered in with an amended filing in May. Such a merry jamboree of ambition! 🎠

Each firm, like a child choosing between chocolate and vanilla, selected different regulatory paths. Bitwise opted for the Securities Act of 1933 (how delightfully vintage!), while Rex Shares and Osprey chose the sterner but more protective Investment Company Act of 1940. Ah, the poetry of bureaucracy! 📜🎭

And what a transformation we witness here! What began as a jest in 2013-an internet jest, no less-now boasts a market value exceeding $30 billion. Yes, Dogecoin trades more than $1 billion daily. One might say, it has gone from barking at the moon to howling in the boardroom. 🌕🤑

The SEC’s Clockwork Ballet ⏳

The SEC, ever the diligent timekeeper, formally acknowledged Grayscale’s initial filing in February 2025, setting off a review period that stretches up to 240 days. Multiple Dogecoin ETF applications now pirouette through this process. Ah, the suspense! 😌

Decision deadlines for most Dogecoin ETF applications cluster between October 2025 and January 2026. The SEC, like a cautious curator, extends review periods as it peers deeply into each proposal. Market prediction platform Polymarket gives a 67% chance of approval in 2025, while Bloomberg analysts, ever the optimists, place the odds at 75%. Such confidence! Or perhaps, mere wishful thinking? 🤔📈

The Winds of Regulatory Change 🌬️

Under the Trump administration, the regulatory climate for crypto ETFs has shifted like a chameleon on a kaleidoscope. Bitcoin and Ethereum ETFs now trade successfully, with Ethereum ETFs recently hitting $17 billion in weekly trading volume. A veritable feast for financiers! 🎉💰

The SEC now juggles over 75 crypto ETF applications beyond Dogecoin, including proposals for Solana, XRP, Cardano, and other luminaries of the crypto cosmos. This broad review suggests regulators are adopting a more systematic approach, as if tidying their desks before the cosmic reckoning. Paul Atkins, the new SEC chair, appears more crypto-friendly than his predecessor. Industry experts, those ever-optimistic soothsayers, believe this leadership change improves approval chances for alternative cryptocurrency ETFs. How positively thrilling! 🧙♂️🌟

The Market’s Yawn and Institutional Interest 😴

Despite all this fanfare, Dogecoin’s price remains as flat as a pancake left too long on the griddle, trading around $0.23. Such indifference! This muted response contrasts sharply with how other cryptocurrencies typically react to institutional adoption news. Grayscale’s existing Dogecoin Trust holds about $2.5 million in assets. An ETF structure, however, would likely attract far greater investment, as ETFs are as easy for traditional investors to buy and sell as a cup of coffee. ☕💸

This institutional interest reflects Dogecoin’s curious evolution from meme to legitimate payment network. Major companies like Tesla and AMC Theatres now accept Dogecoin payments. Even the Department of Government Efficiency, nicknamed D.O.G.E., has bestowed additional attention upon this quirky cryptocurrency. Grayscale believes Dogecoin has transcended its meme origins, positioning it as a faster, cheaper alternative to Bitcoin for everyday transactions. How pragmatic! Or perhaps, simply poetic. 🛒💡

The Final Act 🎭

The SEC’s decision timeline places final rulings in early 2026 at the latest. But approval could come sooner if regulators decide to quicken their pace, like a tortoise suddenly remembering it’s late for tea. Success for any Dogecoin ETF would likely boost all applications in this space, while rejection of early applications could delay the entire category. The SEC, ever the perfectionist, prefers consistent standards across similar products. How admirably pedantic! 📏📝

If approved, a Dogecoin ETF would mark another milestone in cryptocurrency’s march toward mainstream adoption. It would also test whether meme-based cryptocurrencies can attract serious institutional investment through regulated products. The current regulatory review process will determine whether Dogecoin joins Bitcoin and Ethereum as an SEC-approved ETF asset, potentially opening the door for broader cryptocurrency investment options in traditional portfolios. A tale of triumph or tragedy? Only time will tell. ⏳🎲

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- Gears of War: E-Day Returning Weapon Wish List

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Jujutsu: Zero Codes (December 2025)

- The Saddest Deaths In Demon Slayer

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- Top 8 UFC 5 Perks Every Fighter Should Use

- Where to Find Saltstone in No Rest for the Wicked

2025-08-17 03:18