By framing crypto ownership as a path to better-informed regulation, Bowman has suggested a more practical, hands-on approach to policymaking. It’s like letting a chef taste the salt before they cook the whole meal. The stance comes as the Fed weighs in on how tokenization and blockchain could reduce frictions in financial markets, cutting costs and widening access-because nothing says “efficiency” like a blockchain-powered bureaucracy!

And while Bowman was talking policy, the timing couldn’t be better for traders. Meme coins like Maxi Doge ($MAXI) are already gaining a lot of attention, and even just a hint of regulatory easing can throw extra fuel on the fire. Because nothing says “cautious optimism” like a Fed official accidentally causing a meme coin bull run 🤡💸.

Bowman’s Call for ‘Practical Exposure’ to Crypto

At the Wyoming Blockchain Symposium, Bowman laid out her case for loosening internal Fed rules to let staff hold ‘de minimis [insignificant] amounts of crypto.’

@CryptosR_Us on X

Her argument was simple: regulators can’t fully grasp the asset class if they’ve never used it. By gaining ‘practical exposure,’ staff would better understand how crypto works in practice, not just on paper. It’s like telling a cop to drive a getaway car before they write a ticket. Genius!

Bowman also pointed to tokenization’s potential to cut costs and remove friction in capital markets, streamlining ownership transfers and expanding access. Because nothing says “streamlining” like a Fed staff member holding 0.0000001 ETH while drafting a report.

‘We stand at a crossroads: we can either seize the opportunity to shape the future or risk being left behind.’

-Michelle Bowman, Federal Reserve Vice Chair for Supervision

Bowman framed the moment as a fork in the road, saying the US stands at a tipping point where updated legal frameworks could allow a broader range of blockchain-based activities. Because nothing says “tipping point” like a Fed official using the phrase “fork in the road” in a speech about crypto.

Why It Matters for Regulation and Markets

Analysts say Bowman’s remarks shouldn’t be dismissed as industry talk. They hint at a potential inflection point in U.S. policy.

Vincent Liu, CIO at Kronos Research, called it a sign the Fed is moving from caution to curiosity. Attorney Andrew Rossow went further, arguing the speech represents an inflection point in US supervision that challenges the very logic of how financial oversight is carried out. Because nothing says “logic” like a regulator who owns crypto.

But not all reactions were upbeat. Critics warned that allowing regulators to directly hold crypto could erode impartiality and public trust, drawing comparisons to past financial debacles from Enron to FTX. Oh, sure, let’s give regulators a taste of crypto. Nothing says impartiality like letting them moonwalk on their own tokens!

For markets, though, even cautious optimism from the Fed can lift sentiment. History shows that softer regulatory tones have sparked retail belief, most visibly in meme coin rallies like $DOGE and $SHIB. When institutions acknowledge crypto, it validates the narrative, and that tends to ripple outward into meme coin hype cycles. Because nothing says “narrative” like a 10,000% pump in a token named after a dog.

Meme coins, after all, thrive on cultural timing as much as fundamentals. With Bowman’s comments fueling conversation about a more open regulatory stance, appetite for high-risk, high-reward tokens is climbing again. Because nothing says “high-risk” like a token that’s just a cartoon dog doing squats.

That’s where Maxi Doge ($MAXI) is finding its moment, riding both market speculation and the meme-fueled energy that has always defined the sector. Because nothing says “speculation” like a token that’s 90% vibes and 10% code.

Maxi Doge ($MAXI): Meme Coin Muscle in 2025

If $DOGE is the friendly neighborhood Shiba, Maxi Doge ($MAXI) is his over-the-top, gym-rat cousin.

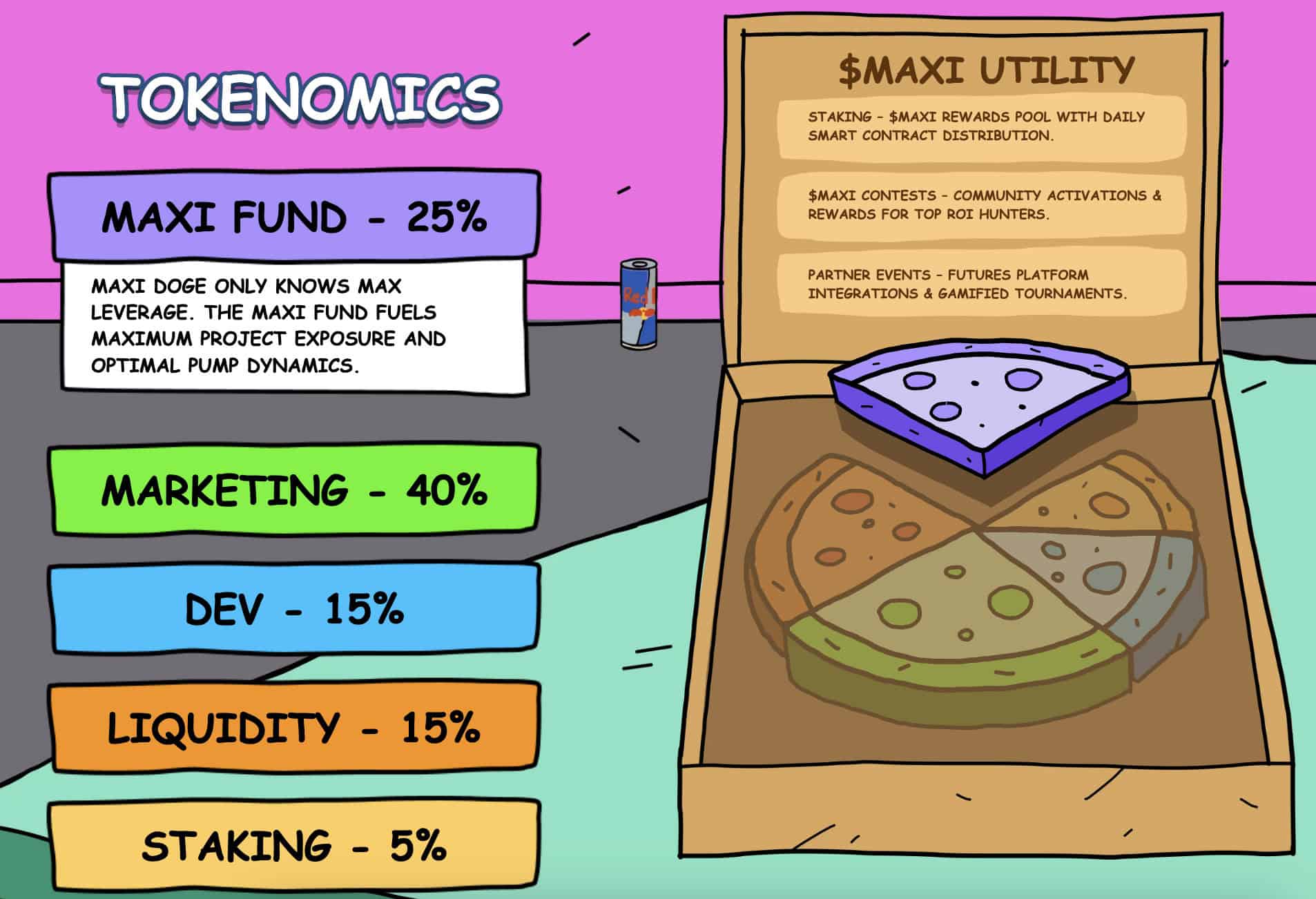

The numbers suggest the gag is landing. Maxi Doge has already raised more than $1.28M+ in its presale, with tokens priced at just $0.000253. A hefty 226% staking APY adds another draw for anyone looking to earn while they await launch. Because nothing says “earn” like staking a token that’s 99% vaporware.

Like $DOGE and $SHIB in their early days, $MAXI is light on utility for now. But the roadmap teases potential futures and leverage-trading tie-ins that align neatly with the project’s high-octane aesthetic. Because nothing says “utility” like a token that’s basically a crypto-themed action figure.

With regulatory conversations shifting and retail sentiment heating up, the timing of Maxi Doge’s presale feels anything but accidental. It’s like the universe is whispering, “Buy this token, and then cry when it crashes.”

Final Thoughts – From Fed Signals to Meme Coin Cycles

The Fed’s softer tone on crypto marks more than just a policy shift. It shows building momentum outside of institutional corridors. Because nothing says “momentum” like a Fed official accidentally fueling a meme coin bull run.

When regulators hint at openness, retail traders tend to follow, and meme coins often ride that wave hardest. Maxi Doge ($MAXI) is a good example: part satire, part speculation, part cultural phenomenon built for this moment. Because nothing says “cultural phenomenon” like a token that’s basically a crypto-themed action figure.

Remember, though, this is not financial advice. Always do your own research before investing. Because nothing says “research” like Googling “Maxi Doge Reddit” at 2 a.m. while eating a bag of Cheetos.

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Best JRPGs With Great Replay Value

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Sword Slasher Loot Codes for Roblox

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- Non-RPG Open-World Games That Feel Like RPGs

- Dungeons and Dragons Level 12 Class Tier List

2025-08-20 14:25