In the vast and ever-shifting landscape of the financial world, where the winds of fortune blow capriciously, Chainlink (LINK) stands firm, a steadfast figure amidst the storm. Over the past week, LINK has ascended nearly 6%, and in the last month, it has soared by over 24%. While other cryptocurrencies falter and stumble, LINK marches forward, its steps growing stronger with each passing day.

Yet, every journey has its obstacles, and LINK is no exception. There lies a formidable barrier, a resistance zone that has, time and again, halted its progress. Should LINK manage to break through this barrier with conviction, the path ahead may well be paved with gold, leading to the coveted realms of $30 and beyond.

Exchange Reserves: The Silent Sentinels of Market Movements

The on-chain data, like the whispers of the market, reveals a steady decline in Chainlink’s exchange reserves since June 20, 2025. From a lofty 172.23 million LINK, the reserves have dwindled to 162.45 million LINK as of August 19, marking a 5.67% reduction. This decline is more than mere numbers; it is a harbinger of things to come, for in the past, such drops in exchange reserves have heralded significant price rallies:

- November 13, 2024: The reserves hit rock bottom, and LINK soared from $13.49 to $29 in a mere month.

- February 23, 2025: Another low was formed, and LINK leaped from $10 to $17 by April, much to the delight of its holders.

- June 19, 2025: The reserves bottomed out once more, and LINK surged from $11.65 to $25.79, a testament to the power of these silent sentinels.

Now, as the reserves approach the yearly low of 161.44 million LINK, the stage is set for a fourth consecutive local low on the yearly chart. History, it seems, is poised to repeat itself, for each time this pattern has emerged, it has been followed by a surge in price. Even at the current price of $24.65, the reserves remain tight, a clear sign that holders are reluctant to part with their precious LINK, thus keeping sell pressure at bay and the potential for gains intact.

For token TA and market updates: Craving more insights into the world of tokens? Don’t miss out on Editor Harsh Notariya’s Daily Crypto Newsletter here.

Heatmap and Chainlink Price Chart: A Tale of Two Forces

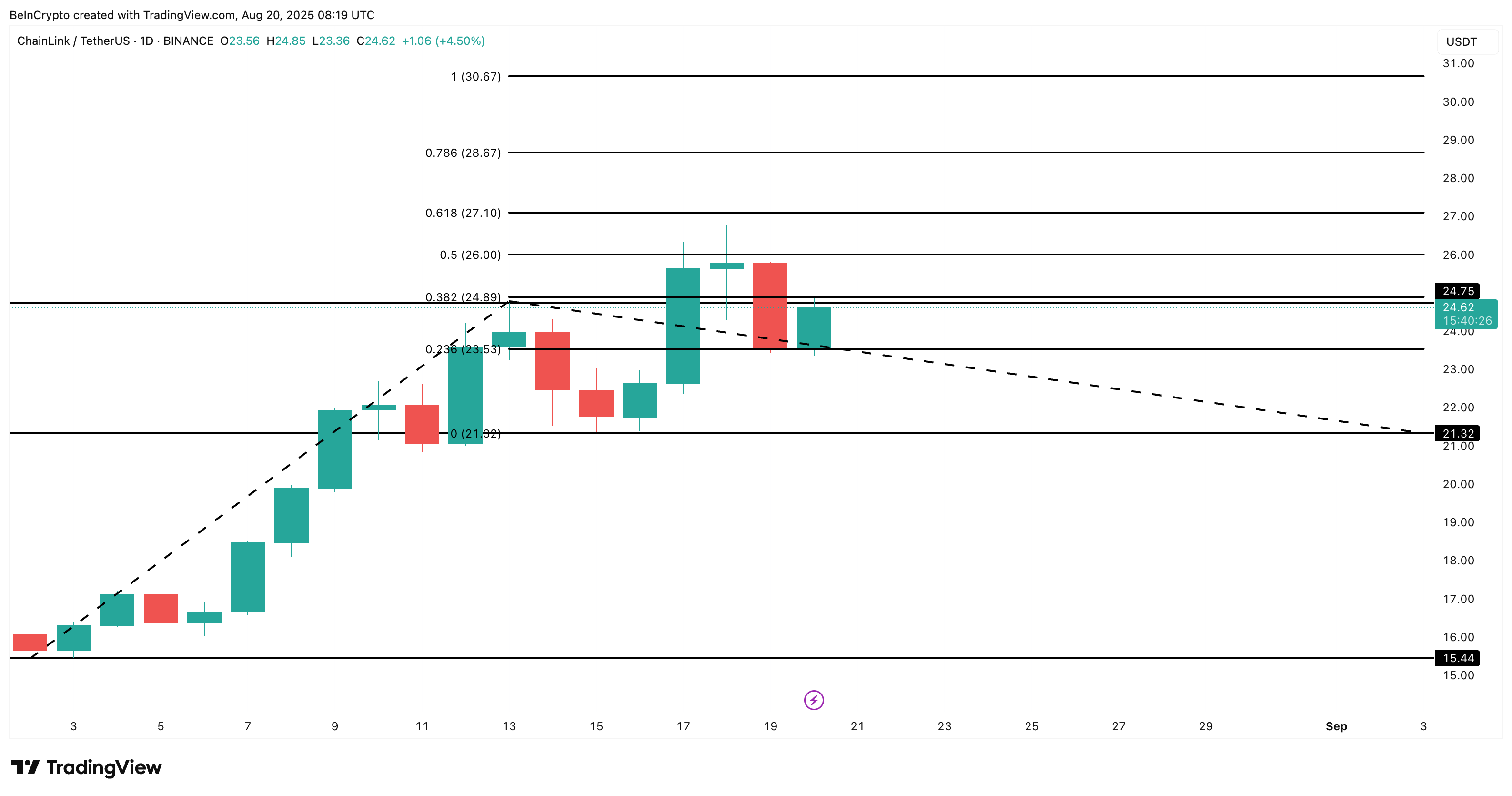

From a technical perspective, the use of a trend-based Fibonacci extension tool is particularly apt, given that LINK is still in an uptrend. The levels are drawn from the $15.44 low (August 2) to the $24.78 high, with a retracement to $21.32. Currently, the price is testing a formidable barrier between $24.89 and $26.00, a region that has often served as a sell wall. Yet, let us narrow our focus to a more precise point within this zone.

According to the cost-basis heatmap, the critical accumulation zone is at $25.24, where a staggering 9.74 million LINK are clustered. At the current price of $24.65, this wall is worth approximately $240 million. The heatmap, a map of sorts, reveals the territories where most traders have purchased their LINK, highlighting the price zones with the highest concentration of holder entry points. These zones often serve as resistance or support, acting as the gatekeepers of price movements.

For the rally to continue, LINK must breach the $25.24 barrier and close above it on the daily chart. This would confirm a breakout, paving the way for the next targets of $28.67 and even $30.67. However, should LINK dip below $21.32, the uptrend structure would be compromised, and a period of short-term weakness might ensue. Thus, the fate of LINK hangs in the balance, a delicate dance between hope and caution, as the market watches with bated breath. 🕰️🚀

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Gold Rate Forecast

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- The Saddest Deaths In Demon Slayer

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- Jujutsu: Zero Codes (December 2025)

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- Respawn Confirms Star Wars Jedi 3 is Still Alive!

2025-08-20 19:22