Ah, the markets hold their collective breath again, a familiar ritual of hope and dread. All await the pronouncements of the great oracle, Jerome Powell, from his mountain retreat in Wyoming. This, comrades, is likely his final performance upon that gilded stage.

For years, this man’s words have echoed through the canyons of global finance, a capricious wind that either fills the sails of speculators or dashes their ships upon the rocks. And now, the final act approaches. The gamblers of crypto and stocks, a ragged and nervous lot, scour his every syllable for a sign, a crumb of hope for cheaper money, a glimpse of the legacy this modern-day tsar wishes to etch into the economic stone.

The Swan Song of the Money Printer

This Jackson Hole, you see, is not just a meeting. It is a theatre where the high priests of capital signal their divine will-a performance they grandly call the “Oscars of Monetary Policy.” How they love their grand titles! 😏

“…a single mumbled phrase from the Chair can send the vast, trembling machinery of global wealth into a frenzy,” pontificated one analyst, a man who likely has never felt the callus of a real day’s work.

We have seen this power before! In ’21, a cooing, dove-like sound from Powell set the machines humming with joy. Then, in ’22, a sudden, hawkish shriek sent everyone scurrying for cover like cockroaches when the light is turned on. What comedy! What farce!

This year, the circus is amplified, for the ringmaster may be taking his final bow. The economists whisper that he might try to change the very rules of the game itself, to leave a mark that will outlast his reign.

“Jerome Powell will give his last Jackson Hole speech this Friday. While the gamblers listen for the jingle of a rate cut, the man may be rewriting the entire rulebook,” chirped the financial newswires, forever stating the obvious with profound gravity.

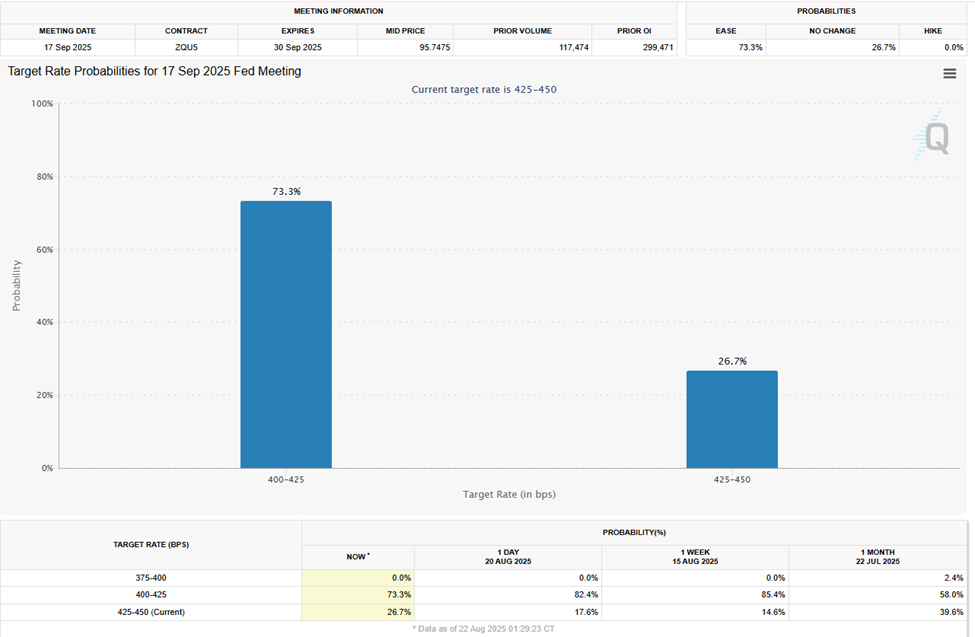

And of course, his court is divided! One Fed president says “No cut today!”, clinging to the stubborn ghost of inflation. Another echoes the caution. Yet others murmur softer, gentler nothings. The market, that great and stupid beast, still bets on a cut, its optimism as fragile as a champagne glass. 🥂

They say he will retire the old policy of “average inflation targeting.” A fine phrase! It meant they could overshoot their own arbitrary number to make up for past mistakes. A brilliant invention-like deciding the train is on time if you average its speed over the entire year, including when it was sitting broken down in a field!

For years, these wizards have tried to keep their little fire of inflation at exactly 2%, no more, no less, while the government pours gasoline on the debt bonfire next to it. A truly magnificent balancing act!

Love this take. 4% is the new normal. That’s the likely exit for govt’s. Watch closely in Feb/March for this.

– Jeremy Allaire – jda.eth / jdallaire.sol (@jerallaire) October 10, 2022

A Carnival of Risk and Hedged Bets

So the big players, sensing the coming storm, hide their gold. They make complex, side-ways bets in the markets, a tangled web of insurance against the whims of the oracle.

Someone sold over $210 million dollars worth of $TSLA puts at close today going into the Jackson Hole event tomorrow…

– flowtopia.co (@flowtopia_co) August 21, 2025

And what of Bitcoin, that digital rebel born from distrust? Powell’s breath once blew life into what they called a “Supercycle.” Now, the prophets of crypto say the conditions are even riper! Three cuts already in the pocket! The capital is ready to flood in! Hooray! 🎉

“Bitcoin will receive another growth impulse and consolidate at new levels,” declares one such prophet, with the certainty of a man who has never been wrong (in his own tweets).

He promises the riches will trickle down to the thousand other bizarre digital tokens, creating explosive gains. Explosive! Of course, others, the ever-cautious mortals, warn of a world on edge-of weak jobs, of wars, of political pressure. They point out that Bitcoin, in its glorious volatility, has already stumbled below a key line, trading at a mere $113,144 as the vultures took their profits. A mere pittance!

So here we stand. For Powell, this is a chance to cement his legacy, to build a sturdier cage for the economic tiger after years of poking it with a sharp stick.

For the rest of us, watching the carnival from the cheap seats, the question remains: Will his final act offer a soothing lullaby, or will it be the starting pistol for another glorious, chaotic, and utterly ridiculous stampede for easy money? Place your bets!

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Best JRPGs With Great Replay Value

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Sword Slasher Loot Codes for Roblox

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- USD COP PREDICTION

- Dungeons and Dragons Level 12 Class Tier List

2025-08-22 11:13