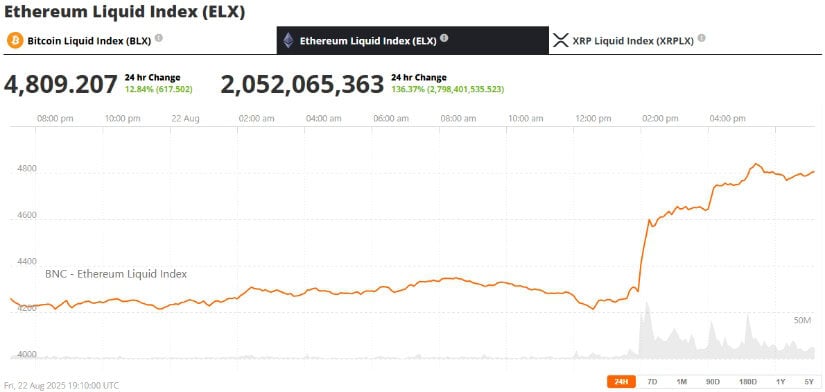

So, I was sitting there, minding my own business, when I heard about Ethereum hitting almost $4,800. 🤔 Like, what is this, a new episode of Seinfeld? “The One Where Ethereum Almost Hits $5,000.” But seriously, folks, this surge came after some guy from the Fed said something about maybe, possibly, not entirely ruling out a rate cut. 🙄

“Shifting balance of risks may warrant adjusting policy stance,” said the Fed Chair, Jerome Powell, at some fancy symposium. It’s like he’s reading from a script written by Jerry Seinfeld himself. 🎭 Investors, of course, went wild, and Ethereum surged nearly 12% in just a few hours. Can you believe it? I mean, I’ve had better luck getting a parking spot in West Hollywood.

Market Overview: ETH Technical Analysis Signals Resistance Near ATH

Ethereum is now less than 1% away from its all-time high of $4,868, which it hit back in 2021. According to TradingView, ETH is facing immediate resistance between $4,800 and $4,340, while the $4,000 zone is still a strong demand base. 📈

Technical analysts are having a field day. “Ethereum is right at the threshold of a breakout,” wrote analyst BullTheoryio on X. But let’s be real, historical resistance at the ATH could either cap gains or trigger a parabolic move. 🚀 With the RSI still below extreme levels, ETH might have more room to run before it starts to overheat. Or, you know, crash. Either way, it’s a rollercoaster ride, and I’m not even sure I want to get on.

Fundamental Catalysts: Fed Policy and Global Events

The Ethereum rally isn’t just about the Fed’s dovish stance. It’s also about the shifting macroeconomic winds. Powell’s comments contrast sharply with the FOMC’s July minutes, which were more hawkish. Now, market expectations for a September rate cut are near 90%, according to CME’s FedWatch tool. 📊 This is fueling investor interest in high-growth assets like Ethereum.

And then there’s the global context. The April 2025 announcement of “Trump’s tariffs of opportunity” caused a 4% dip in the crypto market. But, as DLNews reported, these policies ultimately boosted liquidity in digital assets. 🌍 Analysts say Ethereum’s resilience in the face of macro shocks strengthens its long-term outlook. Or, you know, it could just be a fluke. Who really knows?

Expert Views on Ethereum’s Next Move

Despite the bullish momentum, caution is advised as Ethereum approaches its all-time high. The $4,868 mark is a psychological barrier, and breaking it convincingly could push ETH to $5,000. But if it fails, we might see a pullback to the $4,000 demand zone. 🤞

Investor optimism remains high, with Ethereum’s staking yields, Layer 2 expansion, and the potential for an ETF approval seen as key drivers. Some even think ETH could outpace Bitcoin in the next growth cycle, thanks to its more diverse ecosystem. 🏆

Looking Ahead: Ethereum Prediction and Long-Term Outlook

Ethereum is at a crossroads. Fed policy shifts, strong Layer 2 adoption, and near-record price levels create both opportunities and risks. Short-term volatility around resistance levels is likely, but the medium-term outlook remains bullish if macro conditions stay supportive. 📈

Whether Ethereum breaks through $5,000 in the coming weeks may depend as much on the Fed’s September decision as on ETH’s technical resilience. For investors, the next chapter in Ethereum’s story could define its role in the evolving balance between traditional finance and decentralized networks. 🤔

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Best JRPGs With Great Replay Value

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Sword Slasher Loot Codes for Roblox

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- USD COP PREDICTION

- Dungeons and Dragons Level 12 Class Tier List

2025-08-22 23:17