Bitcoin, that most temperamental of assets, has once again defied the grim specter of economic uncertainty, proving it’s either a hedge or a hallucination-jury’s out! 📈 Institutions and day-traders alike are swooning, as if it’s 1929 and the champagne’s free.

Market Overview: Bitcoin Technical Analysis Highlights

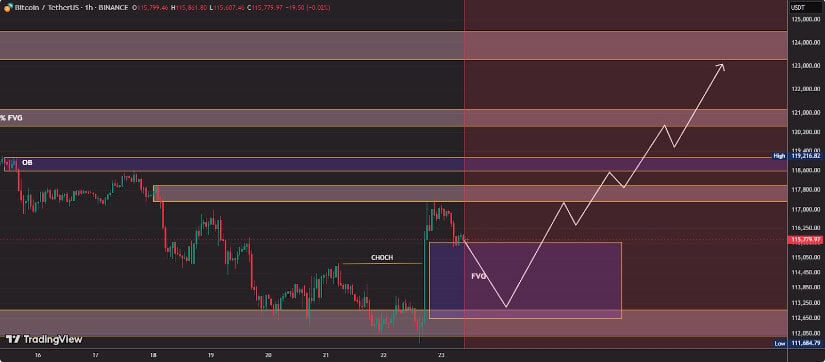

Bitcoin (BTC) currently lingers near $115,700, a 2.5% spike that’s thrilling investors who’ve forgotten the meaning of “sleep.” Ethereum, XRP, and Solana aren’t about to be left at the station either, galloping ahead like caffeinated ponies. 🐎

From the vantage point of those who believe charts are oracles:

-

Resistance: BTC faces the dread specter of sellers between $116,500-$118,000. Breach $118,500? Cue a champagne waterfall toward $123,000. $130K? Why not! 🍾

-

Support: $112,000 clings to relevance like a bad perm. Slip below? Say hello to a “correction” (read: panic sale) toward $108,000. 🚨

-

Indicators:

-

50-day SMA: Pointing skyward like a tipsy optimist. 📈

-

RSI: At 54, it’s “meh” about urgency. Room to run? Maybe. 🤷♂️

-

MACD: Bearish pressure’s waning, but volume’s a no-show. Breakout? Only if the stars align. 🌌

-

Analysts, those ever-reliable soothsayers, spy a symmetrical triangle pattern-a surefire sign of trend continuation! (Unless it isn’t. Have we learned nothing?) Holding $112K? That’s the plot twist for a sprint to $120,900. 🎬

Trend and News Factors: Jackson Hole, Whales, and Bitcoin Halving 2025

The High Priest of Finance, Jerome Powell, delivered his annual sermon at Jackson Hole, declaring inflation “tamed” but warning against “reckless” rate cuts. Investors, ever the obedient flock, nodded solemnly while crypto traders muttered, “Same as it ever was.” 🎩💼

Whales, those mythical creatures of the crypto deep, have been quietly hoarding BTC. Glassnode, the crypto paparazzi, reports this aligns with “institutional adoption.” Translation: Rich folks are playing hot potato with digital gold. 🐋💥

The 2025 halving looms like a holiday sale. Historically, these events precede rallies-so traders are buying popcorn and pitchforks. 🌽

Expert Insights: Bitcoin as an Inflation Hedge and Long-Term Outlook

Leah Wald, CEO of SOL Strategies, predicts $175,000 by 2025-because why let reality spoil a good story? Mike Novogratz, a man who’s seen the abyss, insists macroeconomic conditions are key. Thanks, Captain Obvious. 🚀

Liquidity’s the real star here. Bitcoin doesn’t care about rate cuts-it wants liquidity, like a vampire craves drama. A dovish Fed? Cue the “Hallelujah” chorus from crypto-choirs. Layer 2 solutions? Just a sideshow for low-fee transactions. 🎭

Final Thoughts

Bitcoin’s fate hinges on $112K. Lose it? Panic ensues. Break $118,500? Champagne flows. Long-term? Whales, ETFs, and halving hype are the new gospel. The Fed’s next move? Just another plot twist in the crypto opera. 🎭

Will BTC hit $130K? Why not! It’s 2025, and reality’s optional. 🧨📈

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Gears of War: E-Day Returning Weapon Wish List

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- The Saddest Deaths In Demon Slayer

- Jujutsu: Zero Codes (December 2025)

- Respawn Confirms Star Wars Jedi 3 is Still Alive!

- FromSoftware’s Duskbloods: The Bloodborne Sequel We Never Knew We Needed

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

2025-08-23 16:48