Oh, Ethereum, you saucy minx! You’re just 2% shy of your all-time high of $4,878, but Santiment’s latest analysis is waving a big, red, clown-sized flag 🚩-on-chain metrics are screaming, “Danger, Will Robinson!” 🤖 But hey, who listens to metrics when you’re this close to the moon, right? 🌕

- Ethereum’s 2.2% below ATH, but Santiment’s like, “Uh-oh, high MVRV ratios!” 🤡

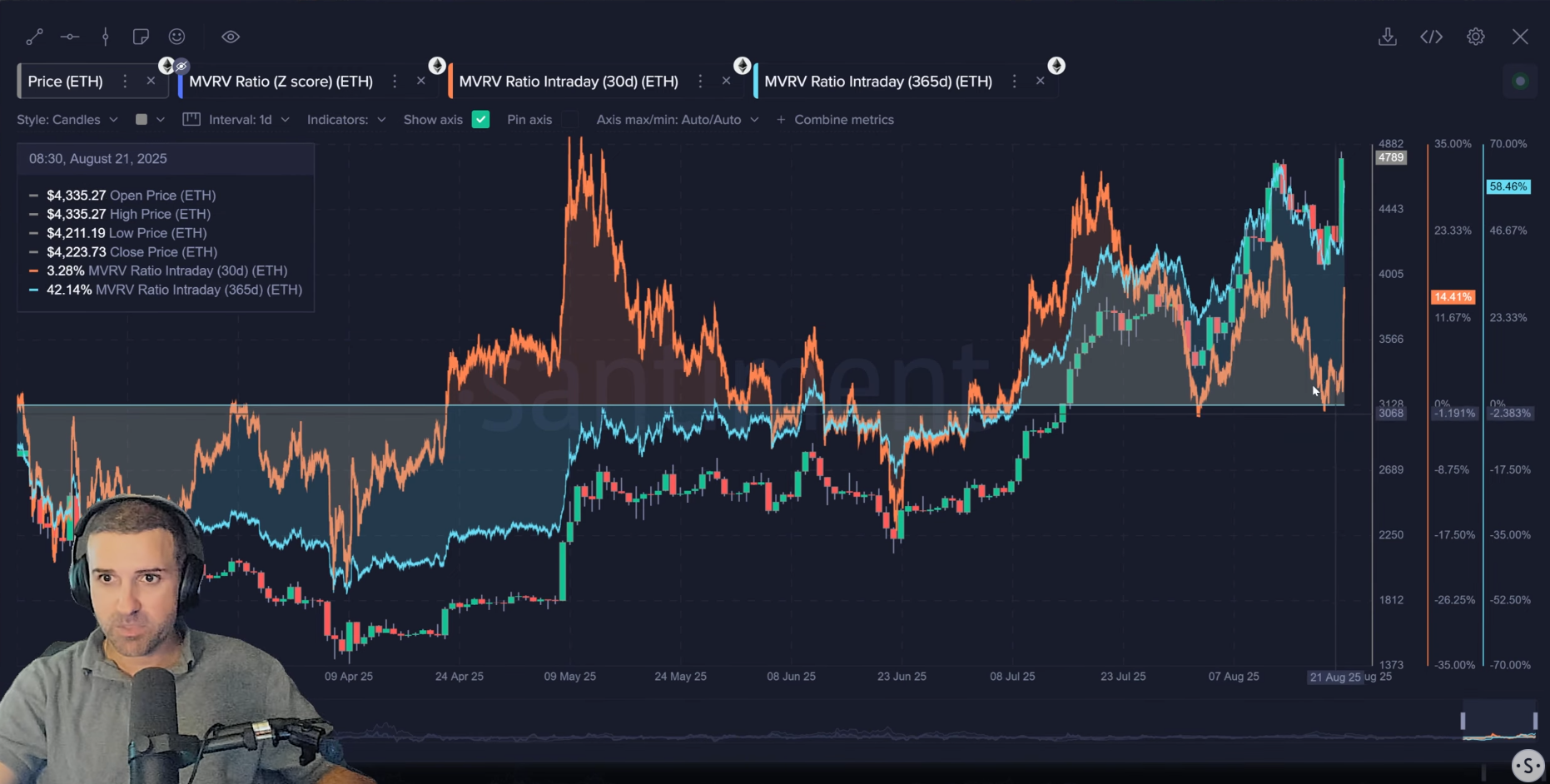

- 30-day MVRV at 15% and long-term at 58.5%-profit-taking party anyone? 🎈

- Bullish vibes: exchange supply’s dropping faster than my New Year’s resolutions, and network activity’s through the roof! 🚀

The crypto world’s second-favorite child (sorry, Bitcoin 😘) has jumped 32% in 30 days and 5% in the last week. Ethereum (ETH) hit $4,834 recently, and the crowd went wild! 🎉 But Santiment’s like the grumpy neighbor yelling, “Turn down the music!” 🎶

Blockchain analytics firm Santiment is all, “Whoa, Nelly! Valuation metrics are entering the ‘Oh, no, you didn’t!’ zone, which could trigger profit-taking shenanigans.” 🤪

Why Ethereum’s Price is Higher Than My Expectations at a Family Reunion

Ethereum’s up 40% in 2025, outpacing Bitcoin like it’s in a crypto sprint! 🏃💨 After reclaiming $4,000 in August and breezing past $4,500, it’s like, “Catch me if you can!” 🏎️

The rally’s fueled by spot Ethereum ETFs (thanks, SEC! 🙌) approved in July 2024, now holding over $20 billion. BlackRock’s ETHA is leading the pack like the cool kid in school. 😎 Plus, digital asset treasuries (DATs) are all about ether these days.

ETFs saw renewed inflows, adding $287 million on Thursday and more on Friday, hitting $30.54 billion. Meanwhile, the Ethereum ecosystem’s buzzing like a beehive 🍯-stablecoin supply’s up 10% to $147 billion, and transactions hit $880 billion. Cha-ching! 💸

Ethereum’s price is also riding high on hopes the Fed might cut rates in September. Weak jobs data and higher unemployment? Bring it on! 🤑 A dovish Fed means crypto’s the new black. 🖤

Ethereum Hits the ‘Danger Zone’-Bulls Are Still Dancing Like No One’s Watching 💃

Santiment’s all, “Check out Ethereum’s MVRV ratio-it’s in the ‘danger zone,’ where altcoins usually face pullbacks.” 🚨 But bulls are like, “We’re just getting started!” 🐂

The long-term MVRV’s at 58.5%, meaning holders are sitting on profits like they’re on a throne. 👑 But if ETH breaks resistance, selling pressure might hit like a ton of bricks. 🧱

MVRV ratios? More like “Maybe Valuation Really Volatile” ratios. When they hit extremes, price corrections often follow. Investors love taking profits-it’s their favorite hobby! 🎣

The 15% threshold’s been Ethereum’s turning point, with past declines ranging from 10% to 25%. But hey, who doesn’t love a good rollercoaster? 🎢

Bullish Signals Say, “Party’s Not Over Yet!” 🎊

Other metrics are like, “Chill, Santiment, Ethereum’s got this!” The mean dollar invested age is dropping, meaning dormant coins are waking up like it’s springtime. 🌸

Network realized profits are spiking, showing trading activity’s hotter than a summer barbecue. 🍔 And the supply of ETH on exchanges? Declining faster than my motivation on Mondays. 📉

Investors are moving ETH to cold storage like it’s the crypto apocalypse. 🧊 This usually means price appreciation, because less supply = more demand. Basic economics, people! 📚

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-08-24 18:36