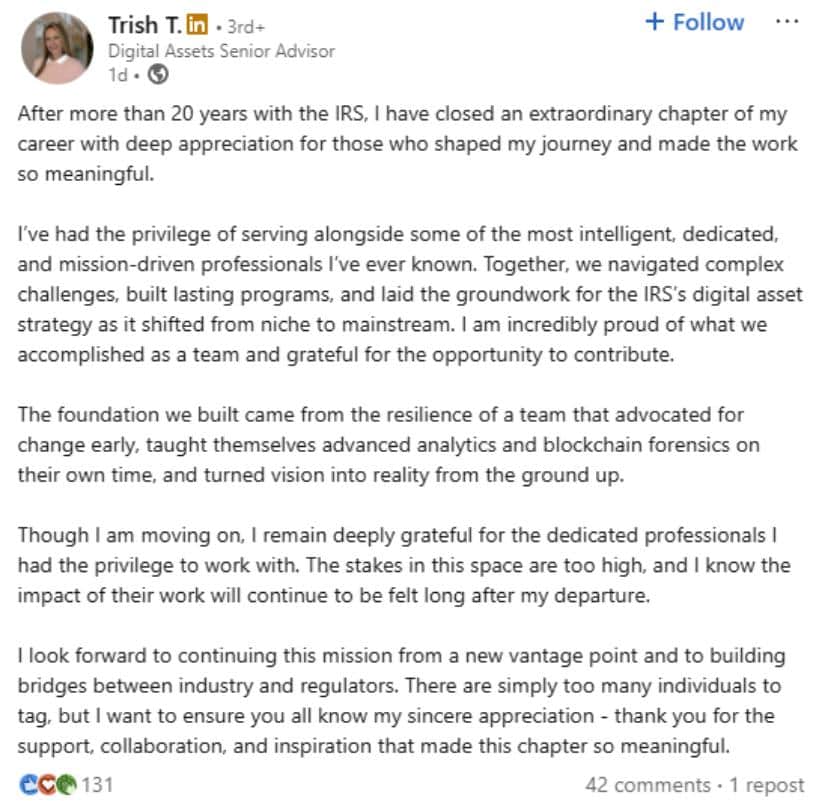

It is with no small degree of astonishment that we find ourselves learning of Ms. Trish Turner’s swift departure from her post as the head of the IRS digital assets division, barely three months into what appeared to be a promising tenure. This sudden change, alas, adds yet another chapter to the ever-turbulent saga of leadership at the IRS. Could there be a more fitting conclusion to such a saga than her own announcement via LinkedIn, where she bids adieu to her 20 years of service in government and embarks upon a new adventure in the private sector? But do not fret, for Ms. Turner shall not be idling; she has already secured a position with Crypto Tax Girl, a most curious name for a tax firm that specializes in the rather modern and enigmatic realm of cryptocurrency. Bravo to her for keeping the tax world on its toes!

Short-Lived Leadership Role

Having only recently taken the reins in May of 2025, Ms. Turner followed in the footsteps of her predecessors, Sulolit “Raj” Mukherjee and Seth Wilks, both of whom also departed after a rather brief stay at the helm of this department. Perhaps, in retrospect, the role of guiding the nation’s tax policies for digital assets might be best suited to someone with a stronger constitution-or at least a bit more patience! One cannot help but wonder whether the frequent turnover at the IRS might be a sign of the difficulties inherent in adapting to such a rapidly changing industry.

But fear not, dear readers, Ms. Turner’s resignation does not mark the end of her illustrious career. No, she has merely turned the page to an exciting new chapter where she will no doubt make her mark as tax director at Crypto Tax Girl, an organization that assists clients in navigating the murky waters of cryptocurrency taxation. This new venture seems rather fitting, given the continuing developments in the world of crypto, where the tax landscape seems to change almost as frequently as the market itself. How exciting! 😏

Moving to Private Sector

As we know all too well, the private sector beckons with promises of higher salaries and fewer bureaucratic entanglements. Ms. Turner, ever resourceful, has wisely seized this opportunity to leave behind the beleaguered IRS in favor of joining the ranks of Crypto Tax Girl. Her experience is expected to prove invaluable, particularly as tax laws related to cryptocurrency continue to evolve at breakneck speed. Who could resist such an invitation? Ms. Laura Walter, founder of Crypto Tax Girl, seems quite pleased with her new acquisition, for she has expressed great excitement about having Ms. Turner onboard to help advise clients. Indeed, who wouldn’t be thrilled to have a woman of such experience, especially in a world where tax regulations and digital currencies seem to be forever in flux?

Agency Faces Major Challenges

As if Ms. Turner’s departure were not enough, the IRS is also grappling with other rather serious challenges. Not only is it preparing for an onslaught of new cryptocurrency tax filings, but the agency is simultaneously dealing with significant budget cuts and staff reductions. One could almost say that the IRS has been tasked with the Herculean job of keeping up with a digital revolution on a shoestring budget. Alas, poor IRS! It seems that the task of regulating an ever-growing digital asset market may well be beyond its current capabilities. 👀

Regulatory Pressure Mounting

As if the IRS were not under enough pressure, recent events have added fuel to the fire. The Treasury Inspector General for Tax Administration, no stranger to controversy, has recommended a series of reforms to how the agency’s criminal division handles digital assets. Furthermore, with the government’s ongoing attempts to legislate on the complex issues surrounding decentralized finance (DeFi), one cannot help but wonder how the IRS will manage such a complicated regulatory environment without the experience of veterans like Ms. Turner. As we all know, the crypto world waits for no one-least of all, government agencies!

Industry Reaction

The crypto industry, ever quick to express its views, has already reacted to Ms. Turner’s departure. Economist Timothy Peterson, ever the wit, remarked that Ms. Turner had “left the Dark Side to become a Crypto Jedi Knight.” One can only imagine the cheers of approval from crypto enthusiasts everywhere. After all, if anyone can navigate the complicated web of tax regulations in the crypto world, it is surely someone with decades of experience in government service! 🙌

What Comes Next

As for what the future holds for the IRS, it seems that no clear successor has yet been announced to fill Ms. Turner’s rather large shoes. With new tax rules on the horizon and a rapidly expanding market to oversee, one can only hope that the agency will find someone capable of managing the complexities of cryptocurrency taxation. However, if the agency’s track record is anything to go by, it may take more than just a fresh face to steer the ship to calmer waters. 😅

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- How to Unlock & Upgrade Hobbies in Heartopia

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

2025-08-24 23:30