Oh, what a tale we have here! After three weeks of relentless green candles, the altcoin market cap (TOTAL3) has decided to don its red cloak in the final week of August. A week so crucial, it could shape the market’s destiny for the rest of the year, or perhaps just ruin your weekend plans. 🤔

Amidst this cosmic drama, certain altcoins have seen a peculiar surge in open interest, a phenomenon that might as well be called “The Great Bet” among traders. 🎲

1. Ethereum (ETH)

Ethereum, that grand stage of digital finance, has recently set a record in open interest, surpassing the staggering sum of $70 billion on August 23. An all-time high, you say? Yes, indeed, according to Coinglass, a source as reliable as a weather forecast in a Russian winter. 🌨️

And yet, this figure hovers around $69.8 billion, a testament to the intense derivatives market where traders bet their fortunes on the whims of the market gods. High open interest, however, is like a signpost pointing towards a cliff. 🚧

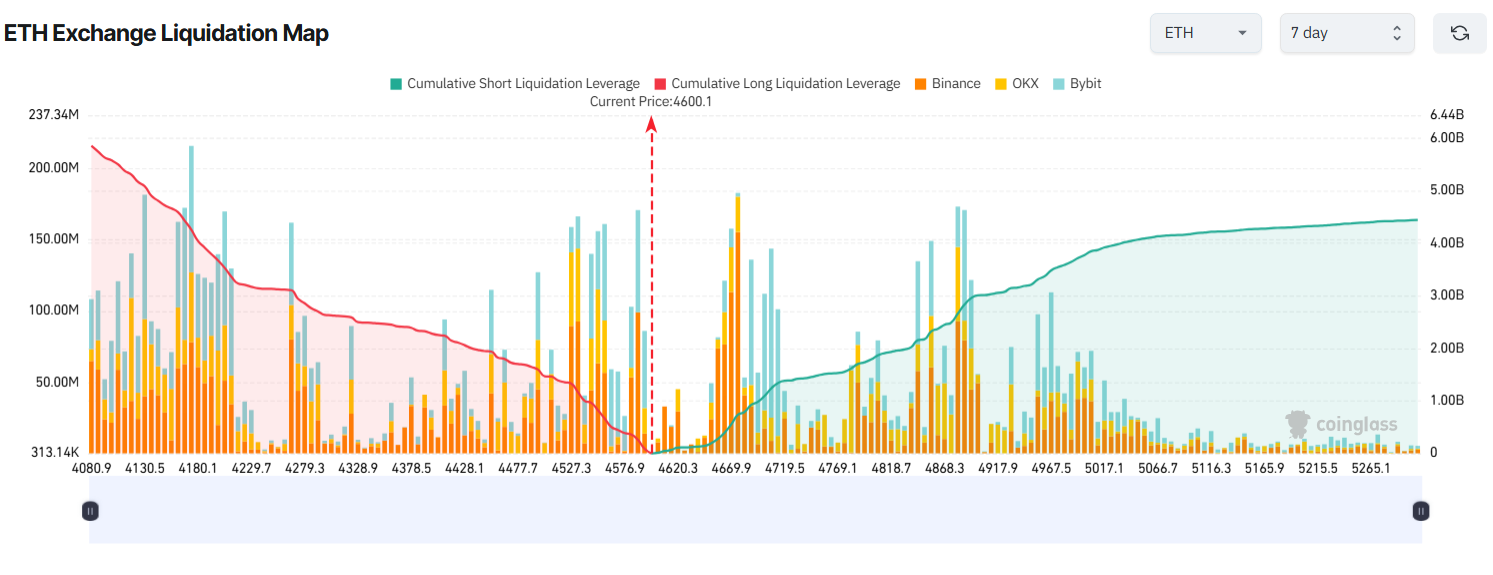

The seven-day liquidation map of ETH reveals a curious imbalance: long positions (red on the left) slightly outnumber short positions (blue on the right). This, my friends, is akin to a chess game where one side has a few more pawns, but the real battle is yet to unfold. 🏟️

Should ETH defy the odds and soar above $5,100 this week, the shorts might find themselves in a liquidation bonanza, totaling up to $4.1 billion. But alas, if the market decides to play a cruel joke and ETH plunges below $4,100, the longs could face liquidations worth $6 billion. A gamble, indeed! 🎩✨

Adding to the intrigue, older ETH holdings are being moved, a sign that the big players are cashing in their chips. Validator Queue data shows a whopping 846,000 ETH waiting to be unstaked, ready to flood the market. These factors could spell doom for the long positions this week. 😱

2. Dogecoin (DOGE)

Dogecoin, the beloved meme coin, is forming a large symmetrical triangle pattern, a shape as ominous as a storm cloud on the horizon. As we enter the final week of August, the price is nearing the triangle’s apex, a moment that will reveal the next trend. 📊

Crypto analyst KALEO, a seer of sorts, predicts an upward breakout for DOGE this week.

“A quick move back to the $0.40 – $0.50 range is imminent. It’s time,” KALEO declared, as if summoning the spirits of the market. 🧙♂️

This prediction aligns with the hopes of many investors who foresee an altcoin season ahead. If DOGE breaches the $0.25 mark this week, short liquidations could reach $200 million. Conversely, a drop below $0.20 could liquidate long positions worth $170 million. 🌊

Currently, the total short liquidation volume outstrips the longs. A 6% pullback on August 25 seems to have dampened the earlier bullish spirit. 🌦️

3. Hyperliquid (HYPE)

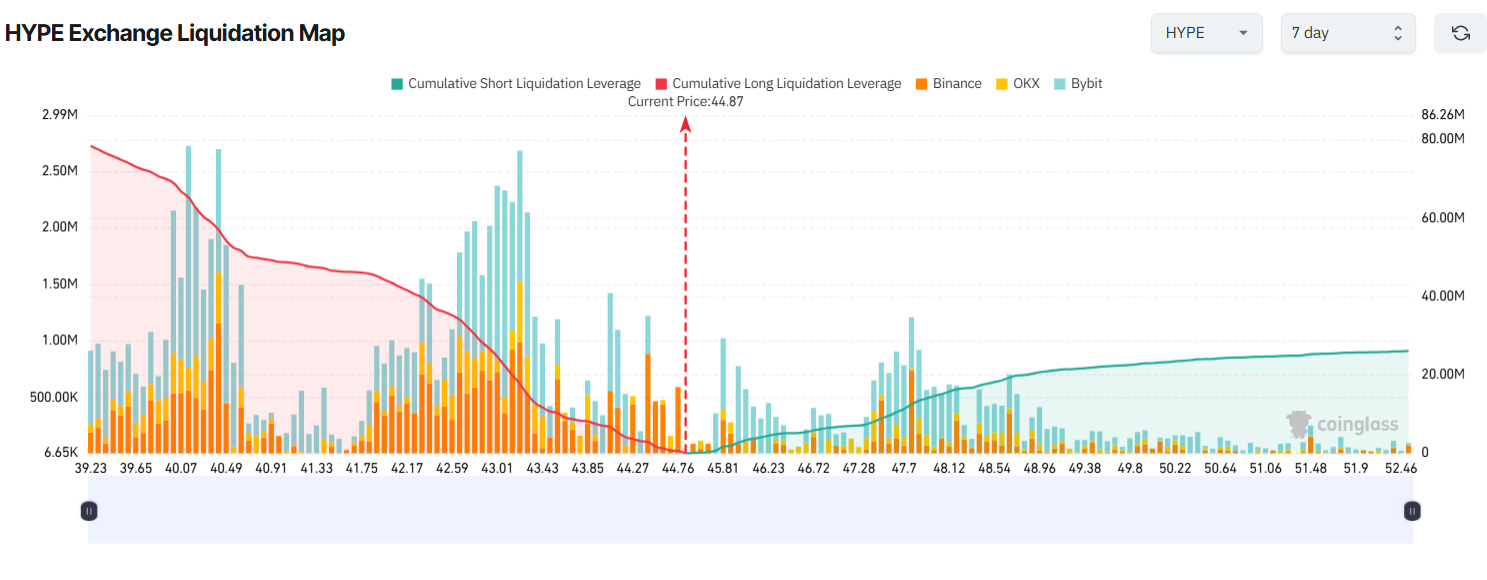

Hyperliquid (HYPE), the new kid on the block, has a liquidation map that looks like a battlefield. Long liquidations heavily outweigh shorts, a situation that could turn ugly if HYPE drops to $39 this week, potentially liquidating nearly $80 million in long positions. On the flip side, a breakout above $50 could liquidate about $24 million in shorts. 🚀🔥

Many traders are betting on a continued rise for HYPE, a sentiment echoed by BitMEX founder Arthur Hayes, who forecast a 126x price increase. Meanwhile, a report from Syncracy highlights a surge in Bitcoin spot trading on Hyperliquid, surpassing volumes on leading exchanges.

“Just now, BTC spot on Hyperliquid did more 24H volume than Coinbase and Bybit combined,” Syncracy Capital co-founder Ryan Watkins announced, as if he had just discovered a hidden treasure. 🗝️

These factors explain the bullish tilt in HYPE’s liquidation map, a map that could lead to either fortune or ruin. 🗺️

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-08-25 20:12