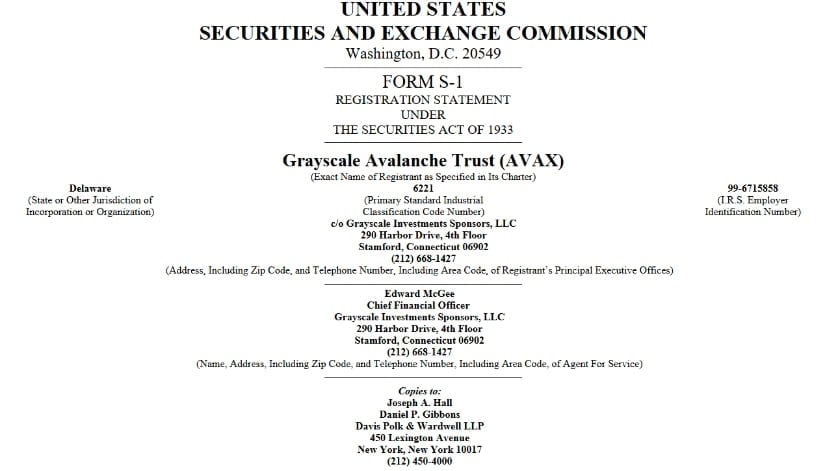

In a move that can only be described as both audacious and slightly bonkers, the digital asset manager known as Grayscale has decided to file its S-1 registration statement with the Securities and Exchange Commission (SEC) on the 22nd of August, 2025. This is not just any filing, mind you; it’s an attempt to transform its existing Avalanche Trust into a publicly traded ETF on Nasdaq. Because, why not? Who doesn’t want to throw their money into the swirling vortex of cryptocurrency? 🤔

The proposed fund, which will trade under the delightfully catchy ticker symbol “AVAX,” aims to provide direct exposure to Avalanche’s native cryptocurrency through your regular brokerage accounts. Yes, folks, you can now experience the thrill of cryptocurrency without having to understand what a blockchain is! This filing marks the end of a two-step regulatory tango that began when Nasdaq submitted its initial application back in the ancient times of March 2025.

Second Major AVAX ETF Application

But wait! There’s more! Grayscale is not alone in this wild adventure. It faces stiff competition from VanEck, which also decided to throw its hat into the Avalanche ETF ring in March 2025. The SEC, in its infinite wisdom, acknowledged VanEck’s filing in April but has since decided to play the waiting game, delaying its decision until July 15, 2025. Because who doesn’t love a good cliffhanger? 📅

Both applications are like two peas in a pod, with funds holding AVAX tokens directly and tracking the cryptocurrency’s price performance. VanEck’s proposed ETF will use the MarketVector Avalanche Benchmark Rate, which is just a fancy way of saying it combines pricing data from the five largest AVAX trading platforms. Because, of course, we need more acronyms in our lives! 📈

As of now, the SEC has yet to approve any spot cryptocurrency ETFs for assets other than Bitcoin and Ethereum. So, these Avalanche applications are like the first brave explorers setting sail into uncharted waters, hoping not to be eaten by the regulatory Kraken lurking beneath the surface.

Fund Structure and Operations

Grayscale’s proposed AVAX ETF builds on its existing Avalanche Trust, which launched in August 2024 and currently manages a whopping $15 million in assets. The trust operates with a net asset value per share of 12.20%, which has sadly declined from a high of 27% in December 2024. It’s like watching your favorite ice cream melt on a hot day. 🍦

Coinbase Custody will be the fund’s custodian, handling the storage and security of AVAX tokens. Meanwhile, BNY Mellon has been chosen as the administrator and transfer agent, responsible for daily operations and shareholder services. Because who doesn’t want a middleman in their financial transactions? 🙄

The ETF will operate through a creation and redemption system using “baskets” of 10,000 shares. Authorized participants can purchase or redeem these baskets directly with the trust using cash, while a separate liquidity provider will handle the actual AVAX token transactions. It’s like a game of Monopoly, but with real money and slightly less chance of being sent to jail.

And here’s the kicker: Grayscale’s proposal includes potential staking rewards! The fund may stake up to 85% of its AVAX holdings to earn additional tokens, which would be reflected in the ETF’s value if certain conditions are met. Because who doesn’t love a little extra on the side? 🍽️

Avalanche Network Sees Record Growth

Interestingly enough, the timing of these ETF applications coincides with a significant growth spurt in Avalanche’s network activity. The blockchain now processes over 20 million transactions daily, which is a 20-fold increase compared to its 2021 figures. It’s like watching a toddler discover sugar for the first time! 🍭

Monthly active addresses across the Avalanche ecosystem have reached 7.3 million as of July 2025, maintaining levels above 6 million since May. This sustained user activity indicates growing real-world adoption rather than just a passing fancy. It’s like finding out your favorite band is still together after all these years! 🎸

Despite these strong network fundamentals, AVAX has been struggling with price performance. The token currently trades around $24.25, down 9% over the past year and a staggering 55% below its all-time high of $54.11 reached in December 2024. It’s like watching your favorite stock plummet while you hold on for dear life. 📉

Growing Institutional Interest

In a twist that could only be described as “unexpected,” several major financial institutions have begun incorporating Avalanche into their operations. Anthony Scaramucci’s SkyBridge Capital announced a $300 million tokenization project on Avalanche, while the network ranks second in BlackRock’s BUIDL Fund with over $53.8 million in tokenized assets. It’s like watching the cool kids finally invite you to their party! 🎉

Visa has also integrated Avalanche into its stablecoin settlement system, and the launch of the Avalanche Visa Card allows users to spend AVAX and stablecoins like USDC directly for purchases. Because who wouldn’t want to buy a cup of coffee with cryptocurrency? ☕

These institutional developments provide additional context for the ETF applications, as they demonstrate growing enterprise adoption of the Avalanche platform beyond speculative trading. It’s like watching the grown-ups finally take cryptocurrency seriously. Who knew? 🤷♂️

Regulatory Timeline and Market Impact

The approval process for both Grayscale and VanEck’s AVAX ETFs remains as uncertain as a cat in a room full of rocking chairs. The SEC has shown caution with altcoin ETF approvals, citing concerns about market manipulation and investor protection for smaller digital assets. Because, of course, they care about us little guys! 🙏

Grayscale’s filing is part of a broader expansion strategy that includes applications for XRP, Dogecoin, Solana, and Litecoin ETFs. The company currently manages $25 billion across its ETF portfolio, including its flagship Bitcoin Trust ETF (GBTC) with approximately $20 billion in assets and its Ethereum funds totaling around $8.5 billion. It’s like a financial buffet, and they’re just getting started! 🍽️

If approved, an AVAX ETF would represent a significant milestone for both Avalanche and the broader cryptocurrency ETF market. It would provide traditional investors with regulated exposure to a major smart contract platform without requiring direct cryptocurrency ownership or storage. It’s like having your cake and eating it too, without the calories! 🎂

Market Outlook and Next Steps

The potential approval of spot Avalanche ETFs could increase institutional adoption and provide more accessible investment vehicles for retail investors. However, approval remains uncertain given the SEC’s cautious stance on altcoin ETFs. It’s like waiting for a bus that may or may not show up. 🚌

Technical analysts suggest AVAX faces key resistance levels between $22-$26, with potential targets reaching toward $54 if the cryptocurrency can break above current resistance zones and maintain momentum. It’s like trying to climb a mountain while carrying a backpack full of rocks. 🏔️

The outcome of these ETF applications may set precedents for future altcoin ETF approvals and indicate how regulators plan to address the growing number of cryptocurrency fund applications in 2025 and beyond. So, stay tuned, folks! The adventure is just beginning! 🎢

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Gold Rate Forecast

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- The Saddest Deaths In Demon Slayer

- Jujutsu: Zero Codes (December 2025)

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

- Nami’s Ultimate Showdown: How She’ll Outsmart Elbaf’s Deadly New Threat in One Piece!

2025-08-26 01:07