Hold onto your stethoscopes! 🏥 Sharps Technology, the medical device company that usually makes needles, just pricked Wall Street with a 96% stock surge Monday. Why? Because they announced a $400 million plan to build a Solana-based digital asset treasury. That’s right, folks, needles meet blockchain! 🚀

The rally came after Sharps revealed a private placement deal and a partnership with the Solana Foundation to acquire SOL, the blockchain’s native token. 📈 Sharps closed the day at $12.01, which is still way better than Friday’s $7.40. Talk about a shot in the arm! 💉

Solana Treasury Strategy Announced

Sharps confirmed Monday they’ve signed a letter of intent with the Solana Foundation to purchase $50 million of SOL tokens through a private investment in public equity (PIPE) transaction. 🧐 Accredited investors will buy company stock and stapled warrants at $6.50 per unit, with warrants exercisable at $9.75 over three years. So, they’re linking Sharps’ equity directly to Solana’s price performance. What could possibly go wrong? 🤣

The company appointed Alice Zhang, co-founder of Web3 startup Jambo, as its chief investment officer to lead the treasury pivot. 🕴️ Another prominent Solana figure, James Zhang, will serve as a strategic adviser.🎯

“Global adoption of Solana’s ecosystem is accelerating,” Alice Zhang said in the company’s press release. “We believe now is the right time to establish a digital asset treasury strategy with SOL, which will set Sharps up for long-term success.”

The offering, expected to close on or around August 28, allows investors to fund allocations using either locked or unlocked SOL and receive pre-funded and stapled warrants in return. 💰

Several US-listed healthcare and biotech companies have already adopted cryptocurrencies as treasury assets. Hoth Therapeutics allocated $1 million in Bitcoin in November 2024, while Atai Life Sciences followed in March with a $5 million purchase. 180 Life Sciences rebranded as ETHZilla in July and announced a $425 million Ether treasury after a 99% stock plunge. 🦖

Wall Street Warns of Risks

Investor enthusiasm surged following Sharps’ announcement. On Stocktwits, a social media platform aggregating retail market sentiment, the outlook on STSS shifted from “bullish” to “extremely bullish” within 24 hours, while message volume hit record highs. 🐂

Not all analysts agree. In a recent investor education video, Charles Schwab warned that companies moving large reserves into volatile digital assets outside their core business “have raised a red flag or two.” 🚩

Sharps, however, insists the crypto pivot will strengthen its long-term outlook. With seasoned executives and growing institutional backing, the company is betting a Solana treasury will deliver more substantial returns than traditional reserves. 🎰

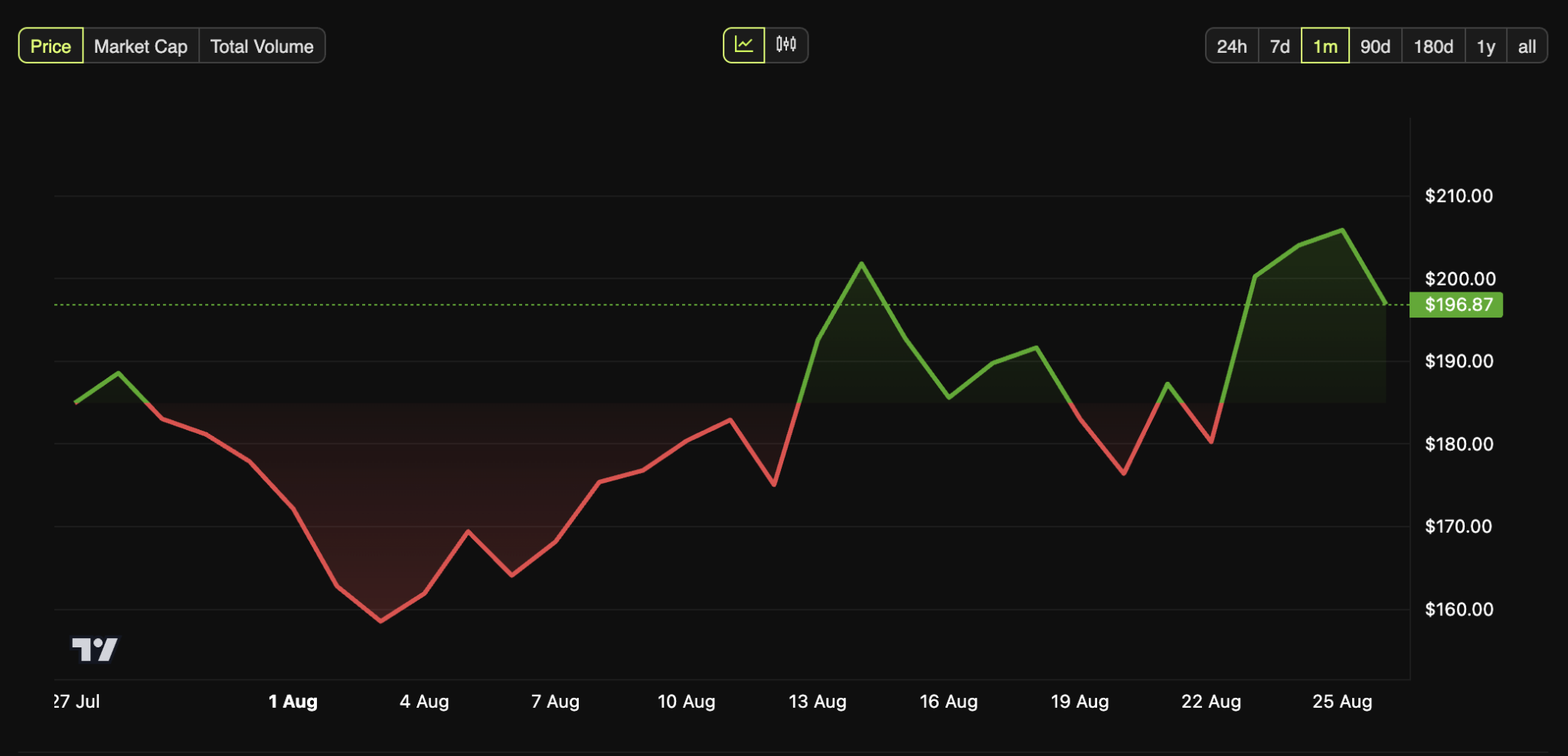

Solana’s native token traded at $187-189 on Tuesday, down 10-11% in 24 hours after briefly topping $212 over the weekend. Despite the dip, SOL remains one of the most institutionally supported assets, with Visa testing its blockchain to speed global credit card settlements. 💳 The token’s all-time high of $293 was reached in January. 🏆

Read More

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- How to Unlock & Upgrade Hobbies in Heartopia

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

2025-08-26 05:42