As an experienced financial analyst, I believe that the recent surge in Bitcoin’s Daily Active Addresses is a positive sign for the cryptocurrency’s price trend. The increase in unique addresses making transactions on the network implies more interest and traffic in Bitcoin, which could potentially lead to sustained bullish momentum.

Recent on-chain data indicates a turnaround in the number of active Bitcoin addresses, potentially signaling good news for the digital currency’s value.

Bitcoin Daily Active Addresses Have Been Climbing Up Recently

Based on data from the market intelligence platform IntoTheBlock, I’ve observed an uptick in the number of daily active addresses for Bitcoin. In simpler terms, this means that more unique Bitcoin addresses have been involved in transactions on the blockchain recently.

As a researcher studying blockchain data, I utilize the Daily Active Addresses (DAA) metric to monitor the unique count of addresses that engage in transactions on a day-to-day basis. This measurement considers both the sender and receiver addresses in its calculation.

An increase in this metric’s value signifies that a greater number of distinct addresses are being active on the network. Given that each unique address represents an individual user on the blockchain, this pattern suggests that the cryptocurrency is experiencing heavier usage.

As a crypto investor, I’ve noticed that the declining indicator points to decreasing activity on the blockchain. This could be an indication that investor enthusiasm for the asset may be waning.

Here’s a chart illustrating the recent development in the number of daily active Bitcoin addresses:

From my analysis of the graph before you, I’ve noticed an impressive surge in the number of daily active Bitcoin addresses. This figure has broken through the threshold of 900,000 for the first time, reaching a new peak.

Approximately 900,000-plus addresses engaged in transactions within a day’s timeframe. This surge is indicative of a larger pattern, as there has been a gradual rise in activity since early June, according to the analytics company’s observations.

As a researcher studying the trends of a particular cryptocurrency’s usage, I have observed that the Daily Active Addresses (DAA) metric had been on a downward trend earlier due to decreased user engagement with the coin. However, I have noticed an uptick in this trend lately, bringing the DAA back up to levels last seen in mid-April.

Historically, Bitcoin rallies have been more robust with a consistent influx of fuel in the form of active users. Consequently, a rise in Daily Active Addresses could serve as a catalyst for price upticks in Bitcoin.

It is yet to be determined if this recent surge in activity will serve as a base for the cryptocurrency to initiate new bullish trends.

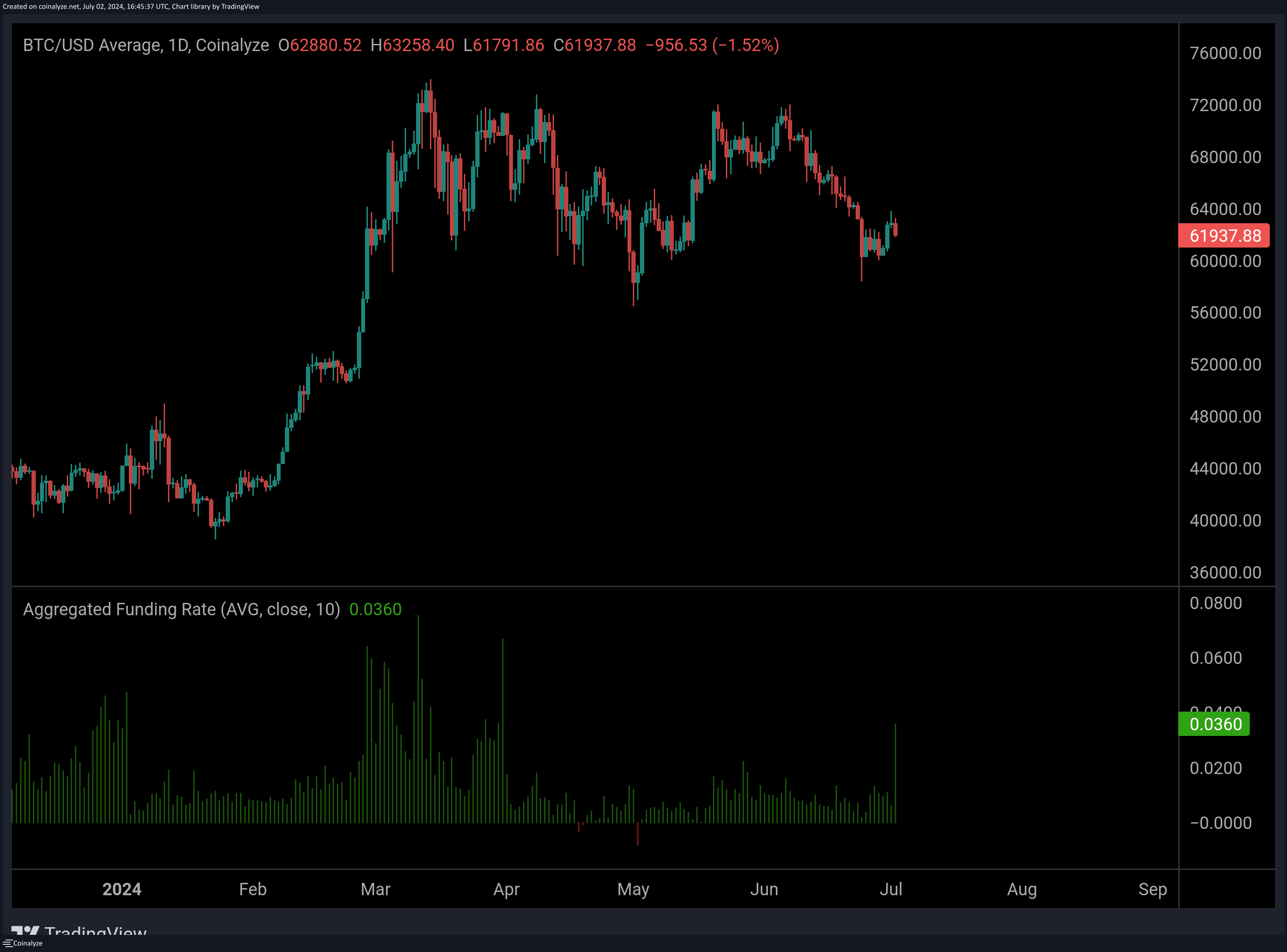

In various news articles, there seems to be a surge in optimistic wagers in the Bitcoin derivatives market, according to Maartunn, the community manager at CryptoQuant, who brought this up in a recent post.

According to the chart, the Bitcoin funding rate has experienced a notable increase, indicating that long contracts significantly outnumber short ones at present. Previously, this imbalance in favor of bullish sentiment hasn’t boded well for Bitcoin’s pricing trend.

BTC Price

Currently, Bitcoin is hovering near the $61,900 mark with a decrease of over 2% in value during the previous 24-hour period.

Read More

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BCH PREDICTION. BCH cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- Best Goomba Characters In Mario Games, Ranked

- USD RUB PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- ZETA PREDICTION. ZETA cryptocurrency

- USD PHP PREDICTION

2024-07-03 12:57