So, despite the token making a tiny, almost apologetic hop forward, all the fancy squiggly lines and market mumbo-jumbo shout, “Hold your horses-something bearish might be lurking behind that cozy curtain of cautious optimism.” 🎭

Optimism itself, which sounds like it should be shouting from rooftops, is instead pacing nervously between $0.67 and $0.78, as if uncertain whether it really wants to leave its comfort zone or not. Investors? Oh, they’re twiddling their thumbs, hoping the cosmic market gods will send a clearer memo before they do something reckless.

Price Consolidation: The Market’s Version of a Cliffhanger

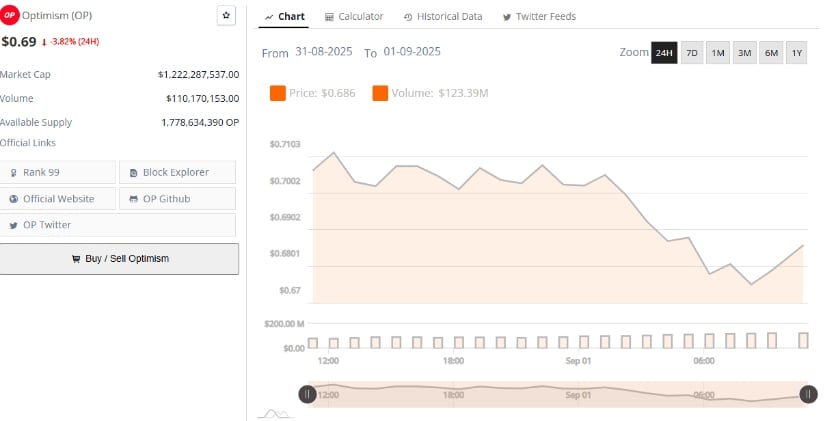

Look at the 1-hour chart from Coinalyze if you dare. OP’s price is basically stuck in a doghouse-sized trading range: $0.67 to $0.78. It’s currently hovering around $0.694-a modest 1.58% pep-up from its earlier lows-yet it’s still politely refusing to challenge the mighty $0.78 fortress. It’s like watching a hedgehog try to join a marathon but just ends up rolling around confused.

This sideways shuffle is the market’s way of saying, “I have no idea who’s going to win-buyers, sellers, your Aunt Edna maybe.” Everyone’s debating whether to jump in or just watch with popcorn. 🍿

Without that elusive breakout above $0.78, expect the token to continue this teeter-totter game-fluctuating “maybe here, maybe there” without any real drama. And the open interest data, which you can think of as traders’ collective enthusiasm meter, just confirms the lull. No one’s really leaning in hard-it’s the financial equivalent of waiting for a bus that may or may not arrive.

Open Interest: The Market’s Gentle Tug of War

Glancing at BraveNewCoin’s data, the Optimism price is hanging around $0.686, while open interest hovers like a diligent but unflappable cat around 195.7 million contracts. This means there’s a delicate standoff between buyers and sellers-think of it as a polite tea party rather than a street brawl. ☕

There were some minor spikes near August 26, which is just trader-speak for “Someone got excited for a minute.” But then, as if remembering they left the oven on, everyone quickly relaxed back to normal levels. The market remains on its middle-of-the-road saga, reluctant to break into either a confident sprint or a dramatic nosedive.

Until open interest decides to take a clear side-up or down-the market is in consolidation mode, also known as “Let’s just hang out here and see what Netflix suggests next.”

Technical Indicators: The Token’s Moody Horoscope

The ever-reliable TradingView daily data is waving a tiny red flag: MACD, which is basically the token’s mood ring, is sulking below the signal line and flashing a gloomy histogram. This means bullish enthusiasm is about as lively as a damp sock, and selling pressure might just rain on optimism’s parade. ☁️

The Chaikin Money Flow (CMF), the token’s financial bloodstream, is currently at -0.10, suggesting a modest trickle rather than a flood of cash flowing out. It’s as if investors looked at OP, shrugged, and said, “Eh, we’ll see.”

Overall, the technical signs are the financial equivalent of that awkward party guest who’s neither here nor there, mildly bearish but not ready to storm off just yet. The market remains cramped between $0.67’s basement and $0.78’s penthouse, waiting for a breakout or a breakdown-preferably with popcorn and a good soundtrack.

One piece of advice: keep your eyes peeled for any sudden moves above $0.78 or below $0.67, because until then, this slow shuffle just keeps chugging along, with all the enthusiasm of a committee meeting about committee meetings.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-09-01 20:35