World Liberty Financial’s WLFI, a token linked to the ever-charming Donald J. Trump, has taken a nosedive of nearly 10% over the last 24 hours, leaving many to wonder if it’s about to take a holiday in the bargain basement. 😂

On-chain indicators, those pesky little things that always seem to know what’s going on before we do, suggest that the altcoin might be in for more rough weather unless it can muster up some enthusiasm from buyers. It’s a bit like trying to get a crowd excited about a mime act at a children’s party-challenging, to say the least.

WLFI Under Pressure as Traders Exit Like Rats from a Sinking Ship 🐀

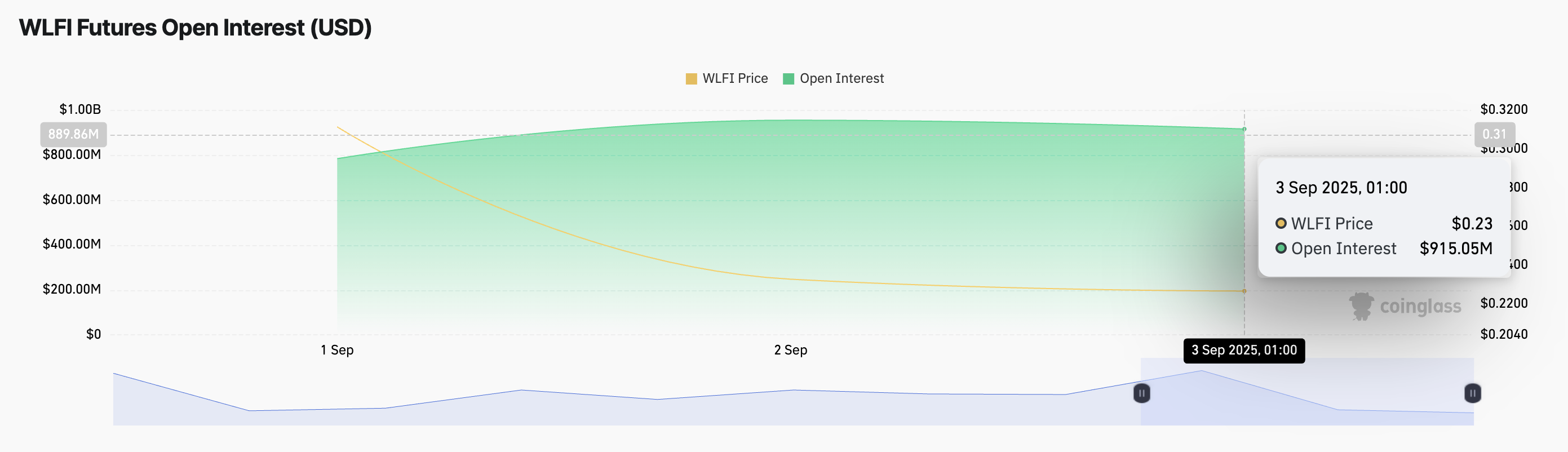

WLFI’s price dip has been accompanied by a decline in its futures open interest, which is the financial equivalent of people realizing they’ve had too much punch at a wedding and starting to sneak out the back door. According to Coinglass data, this has plummeted by 4% in the past 24 hours, sitting at a modest $915.05 million. Quite the party pooper, wouldn’t you say?

For token TA and market updates: Fancy more insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. It’s like getting a daily dose of financial caffeine, only without the jitters.

Open interest, for those who haven’t had the pleasure of delving into such arcane matters, refers to the total number of outstanding futures or options contracts that haven’t been settled yet. It’s a handy way to gauge how many people are still willing to dance to the tune of a particular asset.

When an asset’s price takes a tumble and its futures open interest follows suit, it usually means that traders are closing their positions faster than a cat runs from a bath. This trend suggests that confidence in WLFI is waning faster than a politician’s promise during an election campaign.

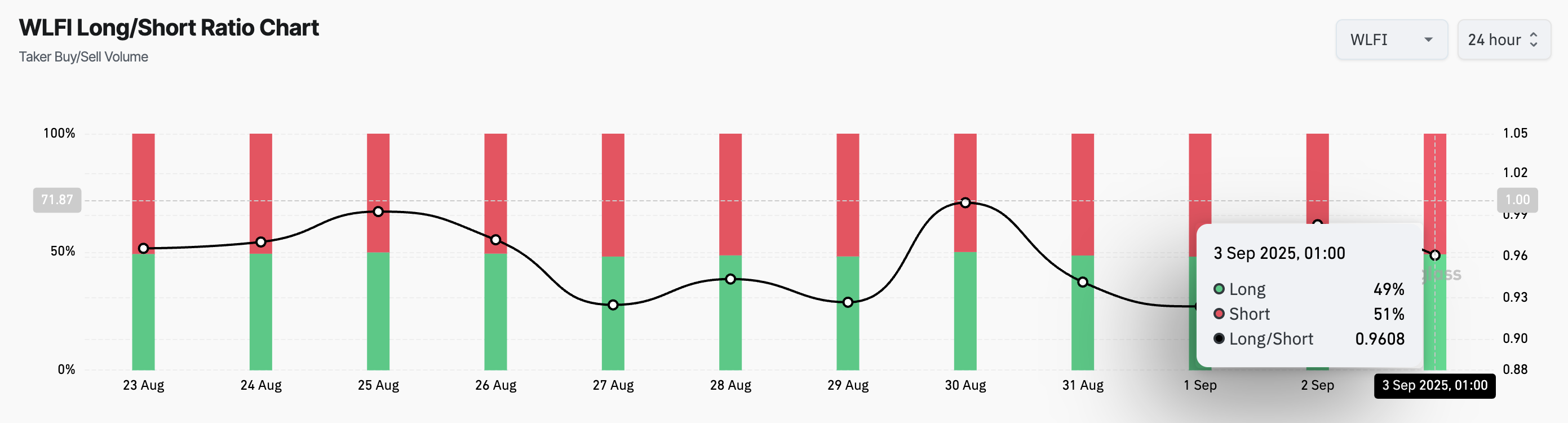

Moreover, on-chain data reveals that WLFI’s long/short ratio is leaning heavily toward shorts, a bit like a seesaw with a particularly heavy elephant on one end. As of this writing, the ratio stands at 0.96, indicating that more traders are betting against the token than are rooting for it. It’s a bit like cheering for the underdog in a boxing match where the underdog forgot to show up.

The long/short ratio measures the proportion of long bets (those hoping the asset will rise) to short bets (those betting it will fall). A ratio above one means more people are bullish, while a ratio below one, as with WLFI, means the bears are having a field day. 🐻

WLFI’s Next Target: A Penny for Your Thoughts? 🤔

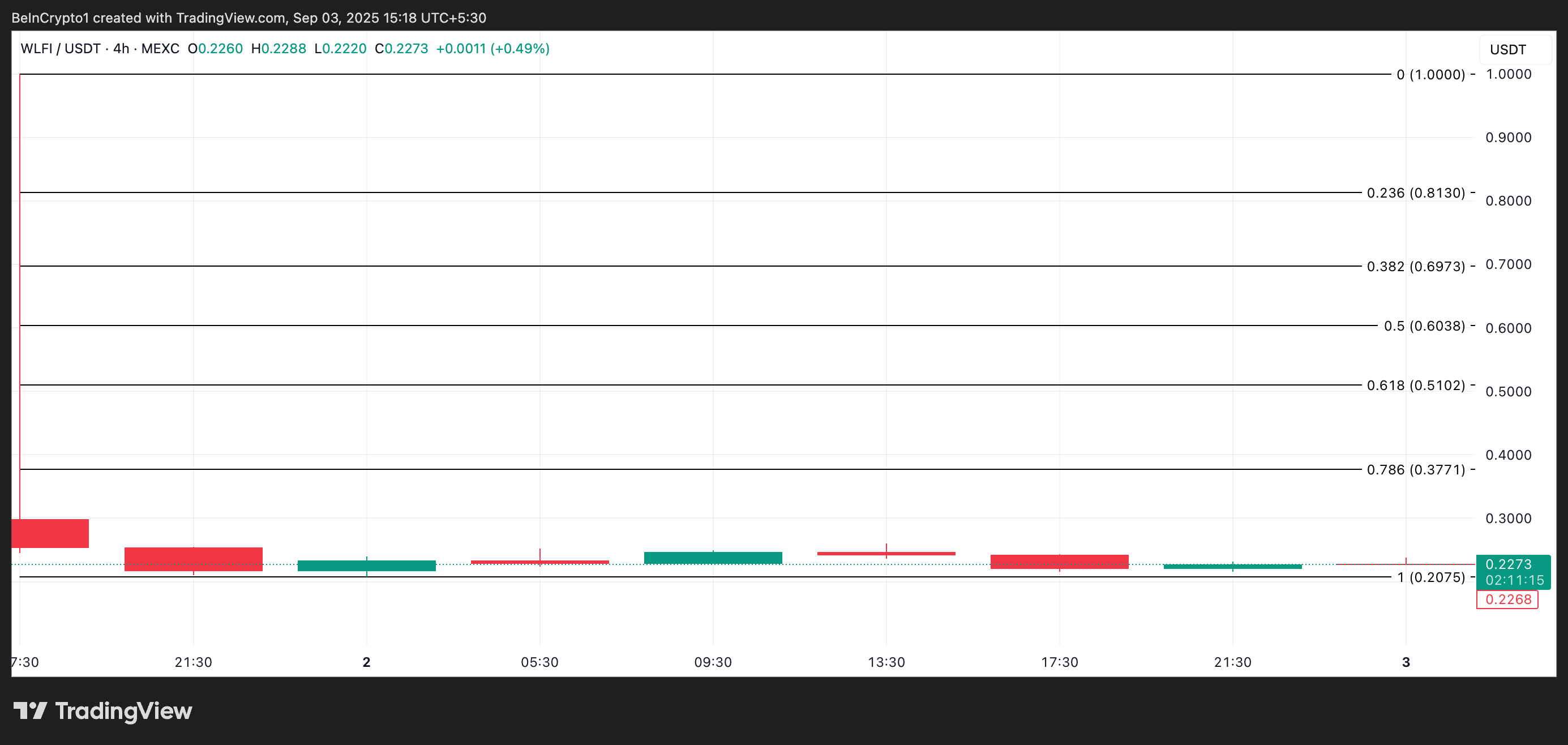

Without a sudden surge of buyer interest, WLFI risks sliding further. If demand continues to wane, its price could plummet to $0.2075. That’s about the price of a cup of coffee at a fancy café, minus the tip. 😅

On the other hand, if new buyers decide to throw a lifeline to WLFI, it could spark a rebound toward $0.3771. It’s a bit like hoping for a sunny day after weeks of rain-possible, but don’t hold your breath. ☔️

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Sony Shuts Down PlayStation Stars Loyalty Program

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- God Of War: Sons Of Sparta – Interactive Map

2025-09-03 21:50