As a researcher with a background in blockchain technology and financial markets, I find Franklin Templeton’s perspective on Ethereum (ETH) particularly intriguing. The report emphasizes Ethereum’s role as the backbone of the decentralized economy and the foundation for Web3 innovation.

Expert: Franklin Templeton, a seasoned wealth management firm with an assets under management (AUM) of $1.65 trillion, expresses optimism towards Ethereum (ETH). Ethereum continues to be the foundation for the decentralized economy, fueling technological advancements and presenting new possibilities for its user base. Despite fierce rivalry, Ethereum’s significance as a tech innovation and economic tool endures.

“Forefront of Web3 innovation”: Franklin Templeton praises Ethereum

Expert: Franklin Templeton, a prominent player in global asset management, has published a report titled “The Value of Ethereum Network Explored: A Look at Its Tech Impact as the Second Largest Cryptocurrency.” This document highlights the key attributes of Ethereum (ETH), its strengths and weaknesses.

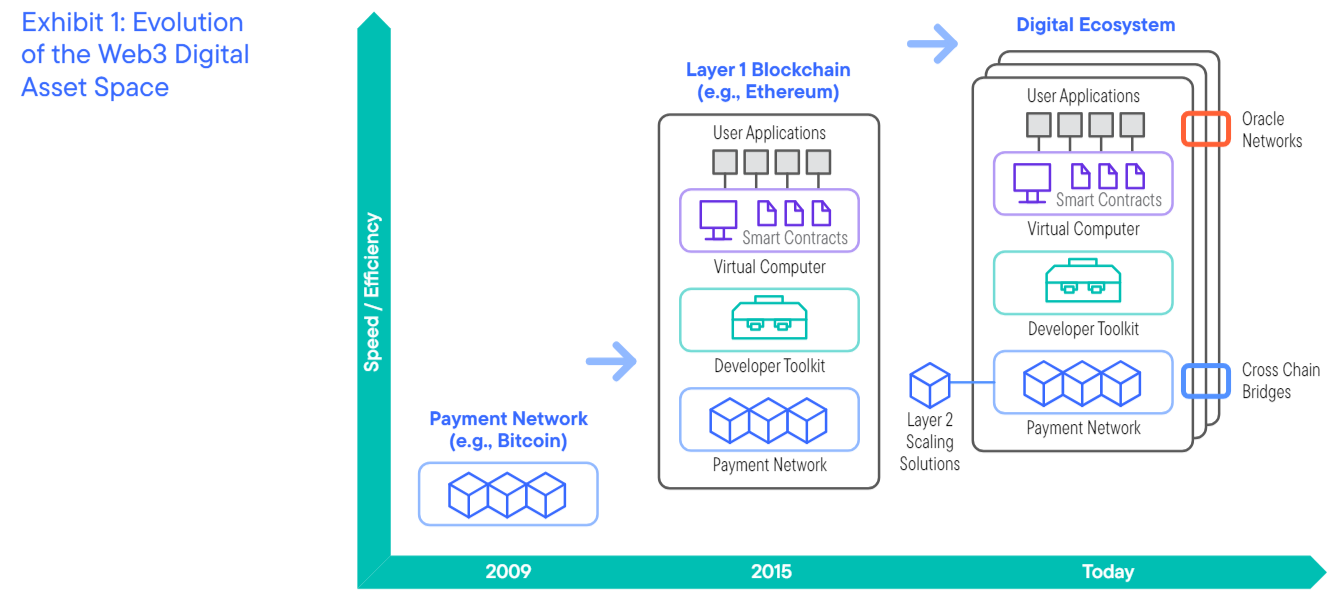

Investment experts at the firm highlighted how Ethereum built upon Bitcoin‘s achievements, developing a strong and user-friendly technology foundation for distributed ledger apps. This advancement paved the way for a more complete decentralized economic system.

From a researcher’s perspective, the introduction of the Ethereum Virtual Machine (EVM) and its Solidity smart contracts has revolutionized application development, positioning Ethereum as the base for an expansive array of decentralized solutions catering to both business-to-business (B2B) and business-to-consumer (B2C) markets.

The report underscores the crucial part played by Layer 2 networks in enhancing Ethereum’s (ETH) capabilities in terms of performance and decentralization.

As a researcher studying the blockchain landscape, I can tell you that Ethereum and other L1 (Layer 1) blockchains, along with L2 (Layer 2) solutions, serve as the base infrastructure for “Web3” – the next evolution of the World Wide Web. With Web3, users gain ownership over the web, and innovative business models that have emerged in this space are pioneering a new network economy and transaction approach. This economy is characterized by protocols that promote decentralized ownership and incentivize active participation.

I’ve analyzed the Ethereum (ETH) blockchain, and the results are quite impressive. It has successfully fostered a dynamic and multifaceted protocol economy, teeming with innovative applications in decentralized finance (DeFi), gaming (GameFi), non-fungible tokens (NFTs), metaverses, and other emerging sectors.

Ethereum ETFs: Final call?

The researchers found that Ethereum (ETH) distinguishes itself as a remarkable blend of a decentralized payment system, an accessible software development kit, and a machine for running smart contracts, which has raised the bar for blockchain innovation.

Franklin Templeton has joined the competition for an Ethereum spot ETF in the United States. They submitted an application for SEC approval in February 2024.

I’ve kept a close eye on Ethereum news, and as reported by U.Today before, there’s growing confidence among analysts and the community that Ethereum-based spot Exchange Traded Funds (ETFs) could receive approval this month.

The president of The ETF Store, Nate Geraci, indicated that the approval process for S-1 forms is predicted to be completed by July 12. This could signify that trading for the related ETFs may commence as early as July 15.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- FISH PREDICTION. FISH cryptocurrency

- BOX PREDICTION. BOX cryptocurrency

- OPUL PREDICTION. OPUL cryptocurrency

2024-07-06 22:27