In the vast and tumultuous sea of cryptocurrencies, Ethereum, like a weary traveler, finds itself consolidating near the shores of $4,300-$4,400, holding steadfast above the treacherous waters of key support. Oh, how the winds of volatility have battered our noble vessel, yet through the storms of recent days, Ethereum remains unyielding. With the steady flow of institutional gold, the promise of network upgrades, and the unwavering accumulation of the faithful, the sages of the market whisper of a great breakout, a moment when Ethereum shall rise from these murky depths to shine once more.

Ethereum Price Today: Holding Strong Amidst the Storm

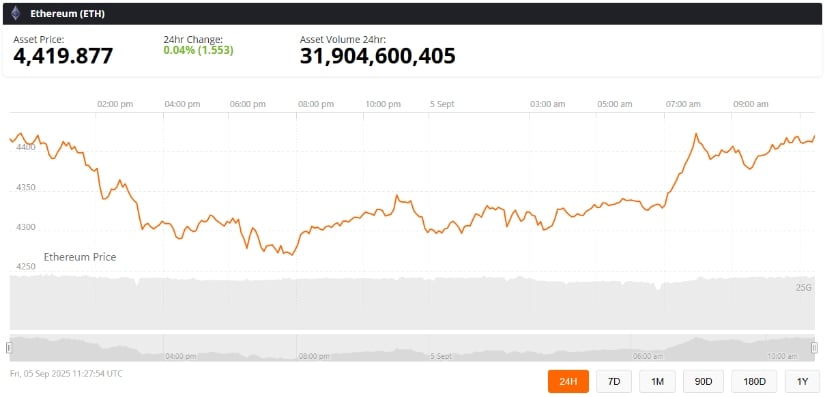

According to the wise seers who chart the movements of Ethereum, ETH has emerged from the shadows of its August 2025 nadir, ranging from $3,392 to $4,953, and now finds itself above the lofty heights of $5,500. Though the waves of daily fluctuations may seem insignificant, the soothsayers of the market proclaim that the fundamental tides and the technical stars align, heralding a major breakout.

Recently, Ethereum ascended to its zenith, touching the skies at $4,950, only to retreat and engage in the dance of pullback and sideways trading. Yet, despite this brief respite, the coin has gained a formidable 20.54% over the past month and an astounding 80.82% over the last year, as recorded by the chroniclers at CryptoPotato. This resilience, dear reader, is attributed to the growing appetite of institutions, the increasing fervor of staking, and the steady stream of gold flowing into Ethereum ETFs.

Technical Analysis: An Inverse Head-and-Shoulders Pattern Points to the Heavens

The crypto prophet Chami (@ChamiCrypto78) has foreseen a grand vision-a massive inverse head-and-shoulders pattern forming on Ethereum’s weekly chart. This ancient and revered omen, known to many as a bullish reversal, portends a journey to the celestial heights of $10,000 or beyond, should the prophecy be fulfilled.

The Stochastic RSI, a mystical instrument of divination, reveals a reading of 82.09 against a signal line of 90.87. While this suggests that Ethereum may be slightly overbought, Chami warns that a short-term cooldown could see ETH retest the support of $4,100. But fear not, for after this brief dip, the forces of demand shall rise again, opening the gates for a potential rally toward the heavens.

“Ethereum may briefly revisit $4,100 support before the tide turns, and the bulls take control, propelling the coin toward the promised land of $10,000,” Chami prophesied.

Historic Supply Shock: The Balance Tipped by the Gods

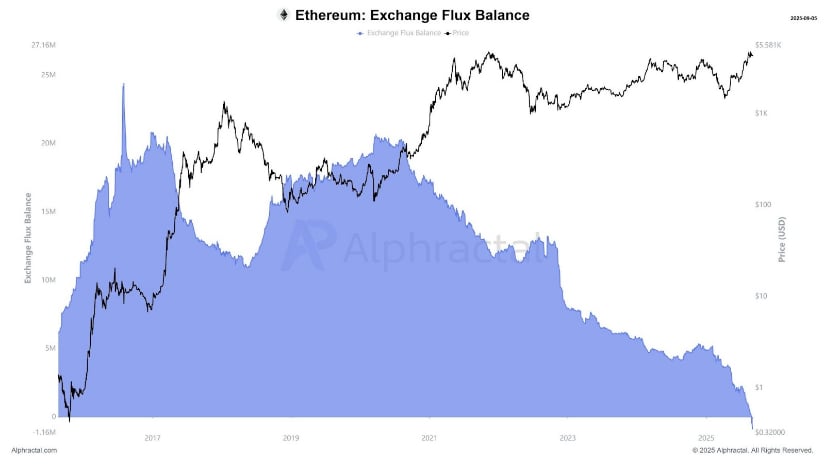

The celestial balance has shifted, as the sage @cas_abbe revealed on September 5 that Ethereum’s Exchange Flux Balance has turned negative for the first time, a sign of divine intervention. According to the sacred texts of Alphractal, this marks a significant shift towards long-term holding and a reduction in the forces of selling. It means that more ETH is being withdrawn from the exchanges and placed in the vaults of the faithful-a trend often seen as a harbinger of a supply shock.

Billions of dollars worth of ETH are being moved into long-term storage, and the act of staking grows ever more popular. As the liquid supply diminishes, history teaches us that such outflows from exchanges have often preceded significant rallies. Cointelegraph, the chronicler of all things crypto, has noted that ether reserves on exchanges are at their lowest point in nine years, a sign that the gods may be smiling upon Ethereum.

Institutional Accumulation: The Giants Gather Their Strength

The strength of Ethereum’s bullish outlook is bolstered by the might of institutional giants. AInvest, the keeper of knowledge, reports that the formidable BMNR holds 1.71 million ETH, valued at a staggering $7.9 billion, or roughly 4.9% of the circulating supply. BMNR’s ambition to increase this share to 5% creates a “sovereign put,” where institutions prefer to acquire ETH directly from BMNR to stabilize the market, much like the ancient practice of barter.

Meanwhile, the Ethereum ETFs of BlackRock and other US spot ETFs have attracted significant inflows, instilling confidence in ETH as a long-term store of value, transcending the mere realm of speculative trading. This institutional adoption elevates Ethereum’s status above Bitcoin, thanks to its utility in smart contracts, decentralized finance (DeFi), and the tokenization of real-world assets.

Key Support and Resistance Levels: The Gates of Fate

The traders of the market watch with bated breath, their eyes fixed on the critical levels that will determine Ethereum’s next move:

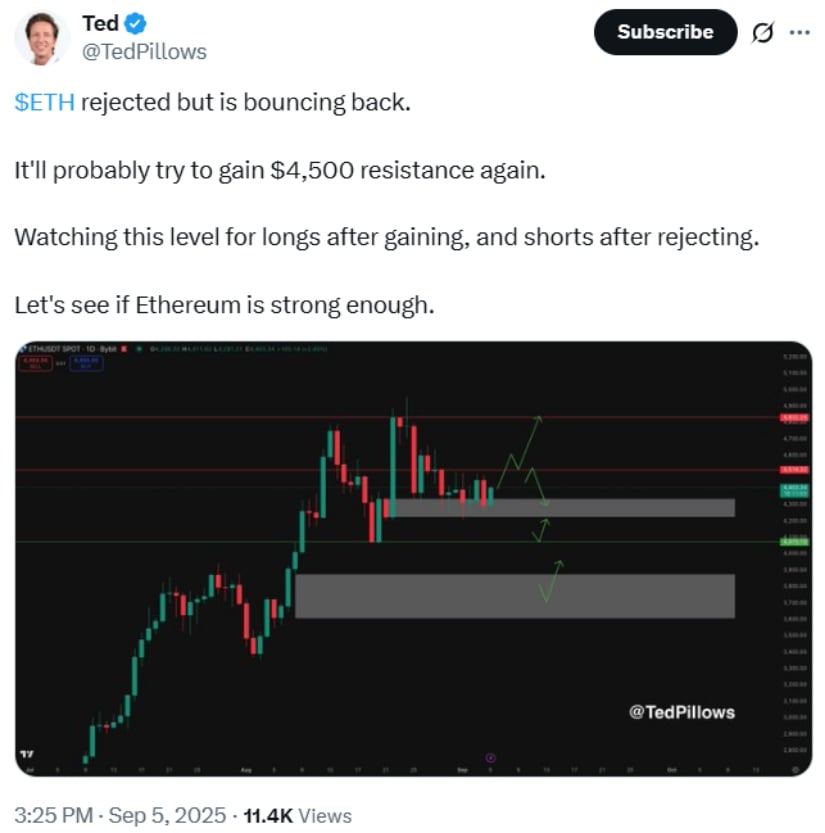

- Immediate Resistance: $4,450-$4,500. A decisive breach of this barrier could lead to a retest of the late-August high and a push toward the $5,000 mark.

- Support Zone: $4,250-$4,300. Should this level fall, the path to $4,000 or even $3,800 may open, leading to a dark night for the bulls.

- Bullish Target: $6,000-$10,000 in the medium term, with some long-term forecasts predicting a journey to $11,800 by 2030, as foretold by VanEck.

Mixed Signals: The Shadows Lurk

Amidst the bullish fervor, there are whispers of caution. Data from the crypts reveals that several US spot ETH ETFs have experienced net outflows, a sign that the appetite of institutions may be waning in the short term. The common folk, too, have taken their profits, creating temporary headwinds for the coin.

Furthermore, the Network Value to Transactions (NVT) ratio of Ethereum remains high, raising concerns of possible overvaluation. The specter of regulatory uncertainty in major markets adds another layer of risk, leaving some analysts hesitant about the short-term price action.

Long-Term Outlook: The Path to Eternity

While the short-term journey may be fraught with peril, the long-term destiny of Ethereum remains bright:

- Ethereum price prediction 2025: Analysts foresee a range of $5,000-$6,000, sustained by the flow of institutional gold and the growing adoption of Ethereum staking.

- Ethereum price prediction 2030: Optimistic models suggest that ETH could reach $10,000-$12,000, driven by the mainstream embrace of tokenization and the expansion of DeFi.

- Ethereum price prediction 2040: With continued adoption, some forecasts place ETH beyond $20,000, though the long-term journey remains shrouded in mystery.

Final Thoughts: Ethereum at the Crossroads of Fate

As ETH trades above $4,400, the cryptocurrency stands at a pivotal juncture. The inverse head-and-shoulders pattern and the negative exchange balances signal a strong bullish potential, while the accumulation of institutions through Ethereum ETFs provides a sturdy foundation.

Yet, the shadows of short-term risks loom-ETF outflows, profit-taking, and regulatory challenges remain ever-present. Traders and investors alike will keep a watchful eye on the key levels near $4,300 support and $5,000 resistance, for they shall reveal Ethereum’s next move.

For now, Ethereum stands at the crossroads of consolidation and breakout. Whether it can overcome the short-term trials to ignite a rally toward $10,000 will define the next chapter in its epic saga.

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Best JRPGs With Great Replay Value

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Sword Slasher Loot Codes for Roblox

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- Non-RPG Open-World Games That Feel Like RPGs

- Dungeons and Dragons Level 12 Class Tier List

2025-09-05 17:15