Bitcoin’s momentum is stalling like my attempts to stay in shape. Major investors are reducing exposure like I reduce my sugar intake (i.e., barely). Institutional inflows are shrinking, and the asset’s facing a critical test at $110K-because nothing says “confidence” like a market that looks like it’s waiting for a raise it doesn’t trust.

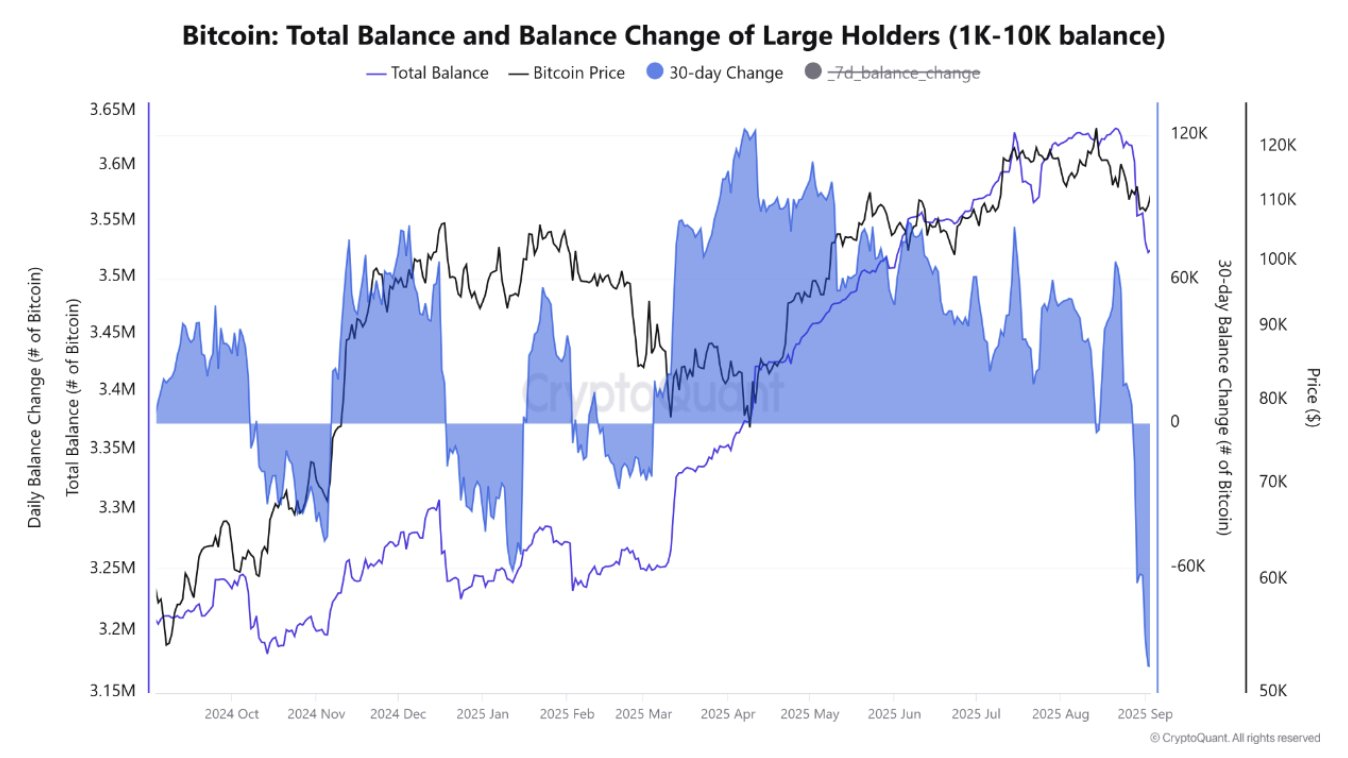

- Whales have dumped over 100,000 BTC lately-the largest selloff since 2022. They’re basically Bitcoin’s version of a toxic ex: “I’ll just offload $11.1B and watch you crumble.”

- Institutional BTC purchases? Slowed to a crawl. Strategy’s monthly buys dropped from 134,000 in November 2024 to 3,700 in August. That’s like going from a steak dinner to a cracker and water.

- Bitcoin’s consolidating between $110K-$115K with low volume. It’s the crypto equivalent of a slow jam at a funeral-no one wants it, but everyone’s forced to listen.

Bitcoin (BTC) is facing mounting pressure around $110K, with data showing a sharp decline in whale accumulation. Because nothing says “bullish” like whales selling more BTC than my ex’s closet full of designer shoes.

Bitcoin Whale Sell-Off: The Great BTC Exodus of 2025 🐳

Per CryptoQuant’s Caueconomy, the Bitcoin market is experiencing the largest whale selloff since 2022. In 30 days, whale reserves dropped by 100,000 BTC-$11.1B in losses. “This selling pressure has been penalizing the price structure,” Caueconomy said. Translation: Whales are making it rain, and the rain’s falling straight into the bear market bucket.

These whales are reducing exposure like I reduce my Netflix binges when the bill arrives. Caueconomy warned the trend isn’t over-because nothing’s ever over in crypto, except maybe your hope.

Adding to the chaos, Maartun revealed long-term holders offloaded 241,000 BTC. That’s like a “get out while you can” party, and everyone’s RSVP’d “bring cash.”

Institutions: Still Here, Just… Bored 🤐

Institutional activity is cooling, despite record holdings. Strategy, the biggest holder, cut monthly purchases from 134,000 BTC to 3,700. They’re still active, but now they’re buying BTC like it’s a limited-time offer at the grocery store: “Sure, I’ll take one… maybe.”

Other companies? They’re buying BTC in chunks so small, it’s like they’re testing if the price will care. Strategy’s average transaction size dropped to 1,200 BTC-because nothing says “confidence” like buying less than a single billionaire’s daily coffee tab.

Institutions are still playing the long game… if the long game is pretending they’re not scared. They’re buying less per transaction, which is either a masterclass in patience or a cry for help.

Price Action: The Worst Date You’ve Ever Been On 💔

Bitcoin’s currently trading at $111,134, down over 10% from its all-time high. It’s consolidating between $110K-$115K, like it’s stuck in a bad relationship. Technical indicators are giving neutral signals-because nothing’s ever clear until it’s too late.

BTC needs to break $115K to keep the bullish dream alive. If it doesn’t? Buckle up for a $105K nosedive. But hey, at least the volatility’s entertaining, right?

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Sword Slasher Loot Codes for Roblox

- Best JRPGs With Great Replay Value

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- Japan’s 10 Best Manga Series of 2025, Ranked

- Non-RPG Open-World Games That Feel Like RPGs

2025-09-08 12:06