Ah, the fickle dance of the Binance token, a creature of whims and wallets, has entered a phase of consolidation, as if pausing to catch its breath before another mad dash toward the heavens. Whales, those leviathans of the crypto sea, circle with intent, their eyes gleaming like rubles in the moonlight, fixated on the $900 mark. Will they breach the surface, or will the waters remain calm? Only the depths of the market know for sure. 🌊🐳

The token, having rebounded from its earlier misfortunes with the resilience of a Gogol protagonist, now teeters on the edge of destiny. Should it surpass this critical threshold, it may ascend to the lofty heights of $950, or even $1,000, a sum that would make even Chichikov blush with envy. But beware, for the path is fraught with sellers, those cunning harbingers of resistance, who have thrice thwarted its ambitions. 🛡️⚔️

Bulls and Bears: A Ballet of Greed and Fear

In the grand theater of technical analysis, the chart of BNB reveals a drama worthy of a Gogol novella. The $896-$900 range stands as the impenetrable fortress, where sellers have repeatedly repelled the advances of the bulls. Yet, undeterred, the bulls prepare for another assault, their horns gleaming with determination. A daily close above this zone would be a triumph, a declaration of renewed dominance, and a spectacle to behold. 🎭🐂🐻

The broader trend, much like the meandering plot of “Dead Souls,” shows the asset rallying from $820, establishing higher supports with the tenacity of a bureaucrat chasing a bribe. Retracements, those fleeting moments of doubt, have been absorbed near $850 and $800, reinforcing a bullish structure built on the unshakable faith of demand zones. This resilience suggests that buyers are as stubborn as a Gogol character, determined to maintain upward pressure despite the intermittent whims of the market. 🏰💪

Yet, should the token fail to clear the resistance, it may enter a phase of short-term consolidation, a period of introspection and quiet contemplation. But fear not, for the pattern of higher lows indicates that buyers are positioning themselves with the aggression of a land-grabbing nobleman, ready for another attempt. As long as key supports remain intact, sentiment leans toward the possibility of a breakout, a moment of triumph that would make even Akaky Akakievich proud. 🧘♂️🚀

Market Data: A Symphony of Stability

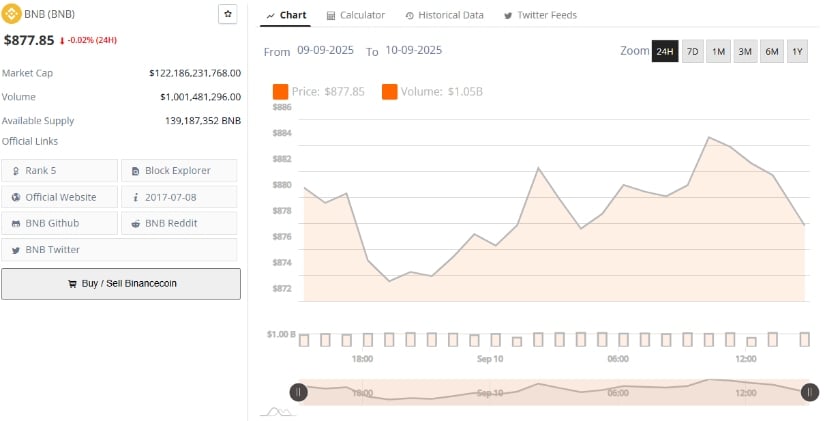

The latest figures, as dry and unyielding as a government report, show the coin trading at $877.85, a marginal daily decline of 0.02%, according to Brave New Coin. Despite this minor slip, the asset maintains a formidable market capitalization of $122.18 billion, securing its position as the fifth-largest cryptocurrency by value. This underscores the asset’s stability, even in phases of market hesitation, much like a Gogol character enduring the absurdities of life with stoic resilience. 📊💎

Trading activity remains solid, with $1.00 billion in 24-hour volume, a testament to the persistent interest from both institutional and retail participants. Such liquidity provides a stable environment for smoother price movements, allowing the token to consolidate comfortably below resistance without significant volatility. It is as if the market itself has adopted the slow, deliberate pace of a Gogol narrative, where every movement is deliberate and meaningful. 💧💹

With a circulating supply of 139.18 million tokens, the asset remains central to the Binance ecosystem and the broader crypto market. Its consistent ranking and demand profile reflect the confidence of long-term holders, while offering shorter-term opportunities as price action hovers near a pivotal zone. It is a tale of patience and perseverance, a story that Gogol himself might have penned, had he lived in the age of blockchain. 📜🔗

Indicators: Whispers of Momentum

At the time of writing, BNB was trading at $883.69, marking a modest daily gain of 0.42% and holding near its recent peak of $900.71. Buyers are actively defending the $870 support zone, which has served as a reliable floor throughout recent retracements, sustaining positive sentiment. It is as if the bulls have taken a page from Gogol’s playbook, refusing to yield to the absurdities of the market. 🛡️🐂

Technical indicators, those mysterious oracles of the market, lend support to the bullish thesis. The Chaikin Money Flow (CMF) currently reads 0.09, highlighting mild yet steady capital inflows into the asset. This suggests accumulation is underway, even as broader conviction remains as cautious as a Gogol character approaching a new venture. Sustained readings above zero would reinforce the case for a continuation of upward momentum, a narrative that would delight even the most skeptical of investors. 📈💸

Momentum strength is further echoed by the BBPower indicator, which stands at 30.27. This uptick signals a recovery in bullish energy following a period of consolidation, much like a Gogol character finding renewed purpose after a moment of despair. If momentum continues to build, the crypto could not only retest the $900 level but also position itself for a move toward $950. Should it fail to sustain strength, $870 remains the next area to monitor, a safety net in this grand ballet of greed and fear. 🎢🚀

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- How To Upgrade Control Nexus & Unlock Growth Chamber In Arknights Endfield

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Byler Confirmed? Mike and Will’s Relationship in Stranger Things Season 5

- Top 8 UFC 5 Perks Every Fighter Should Use

- Gears of War: E-Day Returning Weapon Wish List

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- USD RUB PREDICTION

- All Pistols in Battlefield 6

2025-09-10 20:44