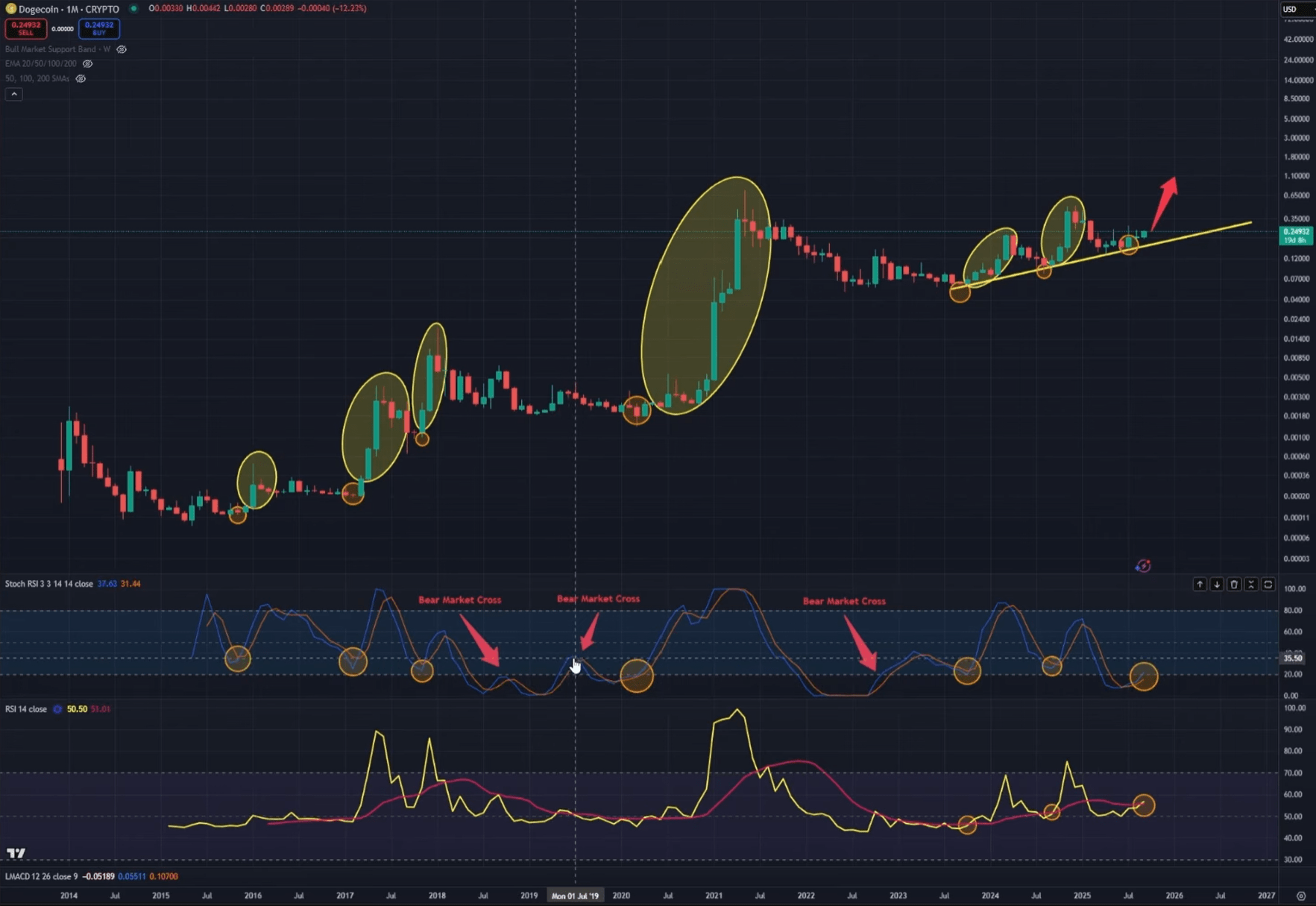

One cannot help but observe that Dogecoin, that most whimsical of digital curiosities, appears to stand once more upon the very precipice of a certain monthly chart inflection-a circumstance which, in days gone by, hath preceded its most extraordinary adventures. Such is the assertion of Master Kevin, a gentleman of notable analytical perspicacity, whose recent discourse upon the subject, dated the eleventh of September, hath suggested a fresh stochastic RSI (or, if you prefer, stoch RSI) prospect to the upside. Though it has not yet attained the dignified height of twenty, this indicator’s stirrings tease a resemblance to previous epochs wherein Dogecoin’s fortunes did wax exceedingly radiant.

Is Dogecoin About to Explode or Just Sputter?

“In the distant February of 2017,” Kevin declaims with great conviction, “our dear Dogecoin enjoyed a V-shaped stock RSI cross above the 20 mark and then, like a gentleman suddenly possessed by an unseasonable enthusiasm, embarked on a rally of no less than 1,852%.” He further confides that a subsequent monthly cross was not content with mere civility, but produced a “very nice 1,751% gain” – before, alas, the inevitable market ceiling was reached. And now, he professes, the stage is once again set for Q4, where such spirited exploits might be renewed.

His method, cunningly simple, involves pairing the monthly stoch RSI with its more staid cousin, the monthly RSI, alongside a cautiously anchored trend structure. During the 2015-2017 chapter, crosses of the stoch RSI above twenty proved decisive: they divided the pretenders from the true bear-market feints; the genuine bulls from mere hopefuls. By contrast, the 2019 gambit petered out, for the stock RSI shied from a durable ascent, caught still beneath the yoke of bearish rule. Yet in 2020-2021, a renewed stoch RSI bull cross beyond twenty heralded the grandest rally of this canine crusade.

According to Kevin’s diligent observation, the present cycle is a model of decorum and clarity. Following a confirmed monthly stoch RSI bull cross, Dogecoin first made an advance of “roughly 280%,” then, after a corrective pause-a genteel rest-another monthly cross propelled a November-December rally of “497%,” before the scene reset itself once more.

Presently, he notes with a spark of hope, “A monthly stock RSI cross is emerging once again. Yet, the 20 level remains unconquered. Ergo, we find ourselves at the tender beginnings of what might blossom into a rally most promising.” To temper our enthusiasm, he reminds us that the grandest price ascensions are reserved for those moments when the stock RSI sashays above the esteemed 80 threshold-a moment he wittily dubs the “first or second inning,” as if Dogecoin were a particularly rambunctious cricket match.

Beyond the caprice of momentum, Kevin highlights a tripartite convergence upon the monthly chart: first, the RSI repeatedly crosses its moving average at notable inflection points; second, each such recapture joyfully accompanies a stock RSI cross to the upside; third, price dutifully defends a long-endured trend line by ascending higher lows with admirable steadfastness.

Though a minor deviation below the trend line occurred-a most scandalous faux pas-Dogecoin is now “breaking back above the trend line and the RSI moving average simultaneously after firmly holding the 50 level.” He dubs this a textbook double-bottom reaction, the sort of technical formality that must delight any faithful chart student. Yet, as with all things market, confirmation demands patience: “We still have… more than half a month to go… this is not guaranteed,” he cautions, before signing off with the confident assurance that “we’re speaking of an alliance of indicators and technicals that have not once failed before,” provided the wider world remains agreeable.

The Almighty Macro Conditions: Friend or Fiend?

Ah, but macroeconomics is ever the soothsayer’s caveat and potential saboteur. Kevin, ever the astute economist, frames United States monetary policy as the veritable “earnings report” for this digital menagerie. Inflation, he observes, has pirouetted within a range for a year, while labour’s vigour gently softens-a combination that nurtures expectations of forthcoming rate cuts in September, November, and December alike.

Should this well-laid plot unfold as anticipated-with a dovish Federal Reserve casting a benign eye upon the FOMC-the dominance of Bitcoin may wane, allowing the merry “alt season” to bloom once again, and Dogecoin, our merry canine protagonist, to outshine its elder in Bitcoin’s shadow. Woe betide us, however, if hawkish winds blow or inflation revives its mischief; in such a case, a “major hiccup” would surely jar this delicate scheme.

Seasonality adds yet another layer of intrigue to this dance. September, alas, remains “seasonally weak,” and with the FOMC meeting barely a week hence, choppy and indecisive price movements are expected, as the market community bids bated breath while awaiting Chairman Powell’s tone-whatever form it may take.

Yet through it all, the higher-timeframe storyboard remains our lodestar: the monthly uptrend structure, RSI reclaiming its moving average, the stoch RSI at an incipient turn, and the historical propensity for grandeur only once momentum gauges surge into extravagance. “These charts,” Kevin assures us, “are shouting quite plainly that Dogecoin is preparing for a move most splendid… the path forward is well and truly laid.”

At the moment of this report, DOGE exchanged hands at a modest $0.261-a price point perhaps modest enough to encourage one’s hapless hope.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Who Is the Information Broker in The Sims 4?

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- All Kamurocho Locker Keys in Yakuza Kiwami 3

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-09-12 13:20