Hunting for Hidden Errors in GPU Code

A new approach to fuzzing CUDA programs aims to bolster the security of heterogeneous systems by proactively identifying memory safety bugs.

A new approach to fuzzing CUDA programs aims to bolster the security of heterogeneous systems by proactively identifying memory safety bugs.

They’ll dip their toes in first with an initial deposit of 2,016 ETH-because starting small is a charming human thing to do-before unleashing the rest over time.

Yet, as if the market weren’t chaotic enough, the final days saw a sudden exodus, like a drunken crowd fleeing a fire. The volatility, they say, was tied to rising oil prices-a metaphor for the unpredictable nature of human folly.

Consider the meme coin’s plight, trading just above nine cents, clinging to its critical support level like a drowning man to a raft. After a protracted correction since the autumn of 2025, its volatility has waned, leaving it as inert as a Chekhovian protagonist in the third act. Yet, the withdrawal of such a fortune to an unknown wallet suggests that some grandees find this price level irresistible-or perhaps they are merely amused by the spectacle.

Zoom out, and it’s even uglier. Since August’s $5K fantasy, ETH’s shed 60% of its value. Feels like buying a designer wallet only to realize it’s made of discount-store velcro. And get this-on-chain signals? They’re screaming like a car alarm in a thunderstorm.

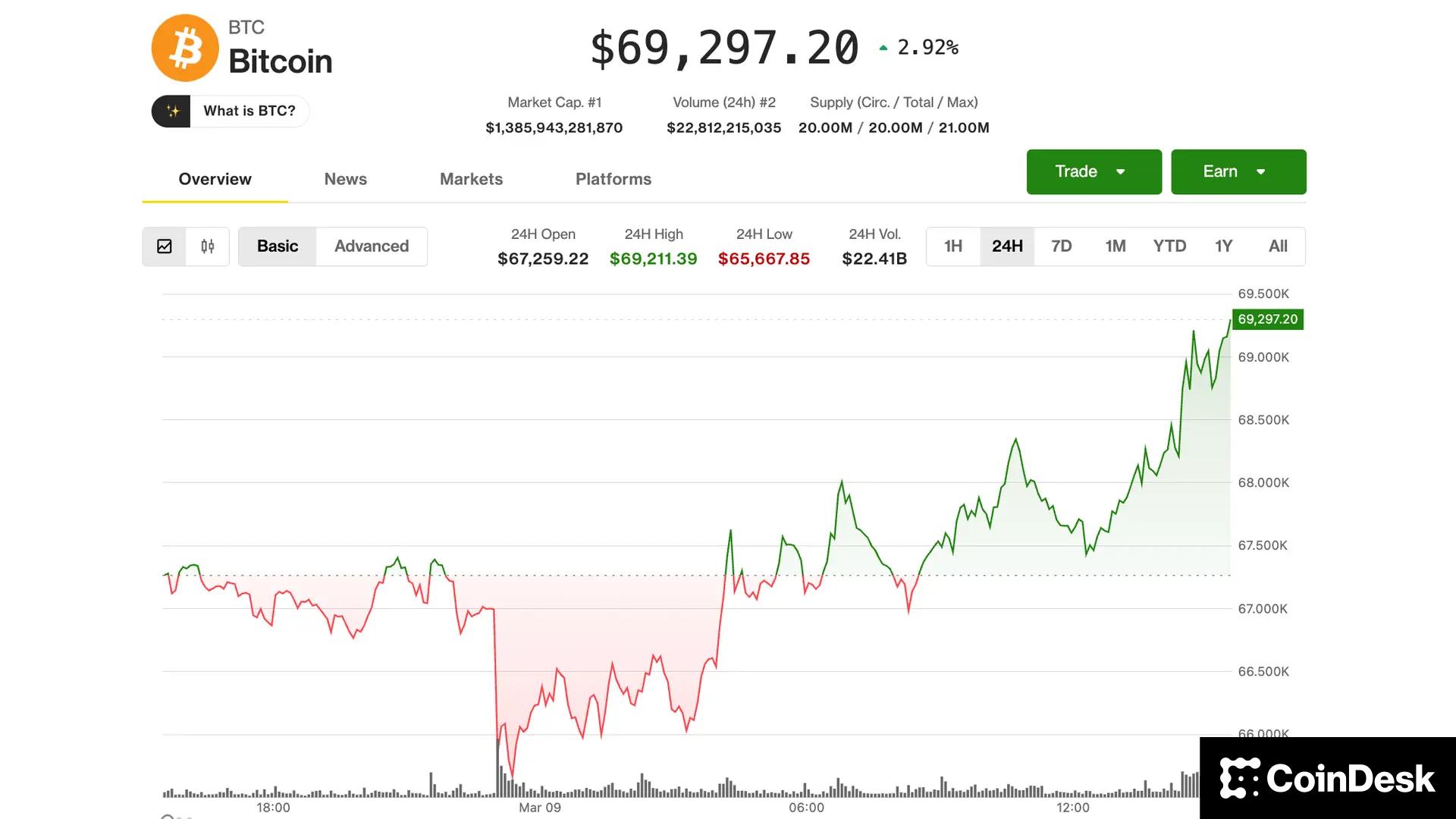

Bitcoin, that enigmatic scribe of digital gold, hovered near $69,000 by midday, a 2.5% ascent over 24 hours, while ether (ETH), the silver fox of cryptos, reclaimed the $2,000 threshold, advancing 4% with the grace of a ballerina on a trapeze.

Here’s the kicker: the market’s in a full-on sulk, but prices aren’t budging. It’s like showing up to a party where everyone’s frowning, but the punch bowl’s still full. Are the sellers just tired? Have they run out of steam, or are they secretly hoarding their coins like squirrels with acorns? The plot thickens, my friends.

![The comparison of Monte Carlo (MC@NLO) predictions with next-to-leading order (NLO) fixed-order calculations and leading-order approximations-both with and without parton shower effects-demonstrates the process [latex]e^{+}e^{-}\to Z \to e^{+}e^{-} [/latex] at a center-of-mass energy of 365 GeV, highlighting the importance of higher-order corrections and parton shower modeling for accurate theoretical predictions.](https://arxiv.org/html/2603.05585v1/x45.png)

New calculations refine the modeling of particle interactions at high energies, crucial for maximizing the discovery potential of next-generation lepton colliders.

Some anonymous villain, who clearly took “sharing is caring” to a criminal extreme, nicked $24 million from Sillytuna-an NFT and gaming aficionado-and decided that Monero was the cryptocurrency equivalent of a trench coat and sunglasses.

Yet lo! A specter from the past doth return-a historical chart formation, long thought vanquished, now reappearing like a ghost in the machine. This time, it is accompanied by a collapse in coin distribution, as if the market itself hath grown weary of selling. Could this herald a reversal, or merely a fleeting hope?