It is a truth universally acknowledged, that a market in possession of a large sum of money, must be in want of a stable investment. Yet, dear reader, behold the lamentable state of Bitcoin ETFs, which have seen a most alarming outflow of $363 million, while Ether funds have lost a further $76 million. A most distressing spectacle, indeed! 🤡

Crypto ETFs Start the Week in Red With Heavy Outflows for Bitcoin and Ether

One cannot help but observe that the week began with a most unflattering dip for both bitcoin and ether exchange-traded funds, as investors, ever the fickle suitors, chose to trim their exposure following a period of volatile flows. Monday’s numbers reveal a most disheartening trend, with no ETF spared from the crimson hue of losses. 📉

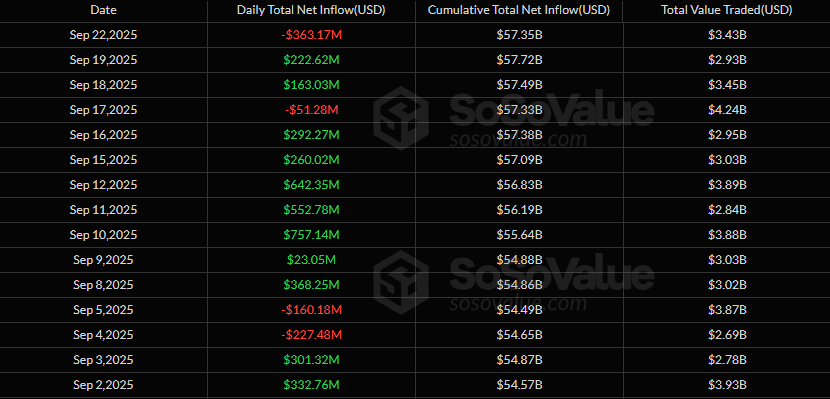

Bitcoin ETFs recorded a collective outflow of $363.17 million, their heaviest daily exit since early September. Fidelity’s FBTC bore the brunt with a $276.68 million withdrawal, while Ark 21Shares’ ARKB followed with $52.30 million in redemptions. One might say they are as ungracious as a guest who departs before the tea has cooled. 🍵

Grayscale’s GBTC lost $24.65 million, and Vaneck’s HODL closed out with $9.54 million in exits. Not a single fund saw fresh inflows. Trading activity remained strong at $3.43 billion, but net assets dipped to $148.09 billion. A most curious paradox, akin to a dance where all participants step on each other’s toes. 🕺

Ether ETFs also turned lower, registering $75.95 million in total outflows. Fidelity’s FETH saw the steepest losses at $33.12 million, with Bitwise’s ETHW close behind at $22.30 million. Blackrock’s ETHA logged a $15.07 million exit, while Grayscale’s Ether Mini Trust slipped by $5.45 million. A most theatrical performance, if one enjoys the drama of financial despair. 🎭

The synchronized pullback suggests that crypto ETF investors are moving cautiously, pulling capital after last week’s inflow-heavy rebound. With both bitcoin and ether ETFs starting the week in the red, all eyes will be on whether Tuesday brings a reversal or deepens the outflow streak. One can only hope for a turnabout, lest the markets continue their most unseemly behavior. 🙃

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Jujutsu Kaisen Modulo Chapter 18 Preview: Rika And Tsurugi’s Full Power

- ALGS Championship 2026—Teams, Schedule, and Where to Watch

- Assassin’s Creed Black Flag Remake: What Happens in Mary Read’s Cut Content

- Upload Labs: Beginner Tips & Tricks

- Mario’s Voice Actor Debunks ‘Weird Online Narrative’ About Nintendo Directs

- Jujutsu: Zero Codes (December 2025)

- The Winter Floating Festival Event Puzzles In DDV

- Top 8 UFC 5 Perks Every Fighter Should Use

- Gold Rate Forecast

2025-09-23 18:38