As a seasoned crypto investor with years of experience under my belt, I’ve seen my fair share of market volatility and unexpected events. The recent surge in transactional activity on Shiba Inu (SHIB) was a stark reminder of the wild nature of this asset class.

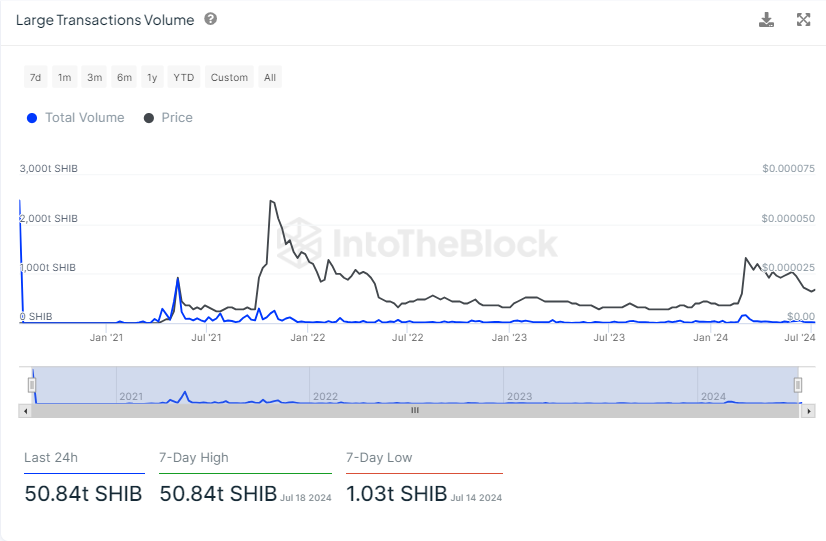

The number of Shiba Inu transactions suddenly spiked dramatically, with approximately 50 trillion coins being exchanged unexpectedly. This surge in activity put significant strain on the network. It’s believed that this sudden influx may be linked to the recent WazirX exchange hack, causing the loss and subsequent release of large quantities of SHIB tokens into circulation.

The latest figure shows that WazirX holds approximately $230 million worth of assets as of the last update. These assets consist of 5.43 trillion SHIB, 15,298 ETH, 20.5 million MATIC, 640. billion PEPE, 5.79 million USDT, and 135 million GALA.

A hacker sold an astonishing 5.43 trillion SHIB tokens for approximately $92 million worth of Ether (26,535 ETH). Notably, market makers like Wintermute intervened and purchased SHIB from decentralized exchanges (DEX), later transferring it to centralized platforms to capitalize on price differences, thereby helping to ease the token’s price instability. This action created an illusion that the absorption of liquidity was progressing in a typical manner.

Despite the significant sale of SHIB, the market price showed resilience and effectively absorbed the liquidity. This stability in the face of sales is an optimistic sign as it indicates the market did not experience a major downturn.

Due to the backing of market makers and the overall market conditions, Shibaswap (SHIB) managed to hold its ground during this period. A significant surge in trading activity, as evidenced by the chart analysis, is apparent from the substantial volume spike – a clear sign of numerous transactions taking place.

Before the selling pressure could be fully absorbed, some large investors may have begun transferring their funds in anticipation of a significant price decrease. However, following the announcement about the hackers’ funds being liquidated, it appeared that there was no cause for alarm and a mass sell-off could be avoided.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- PLI PREDICTION. PLI cryptocurrency

2024-07-19 16:10