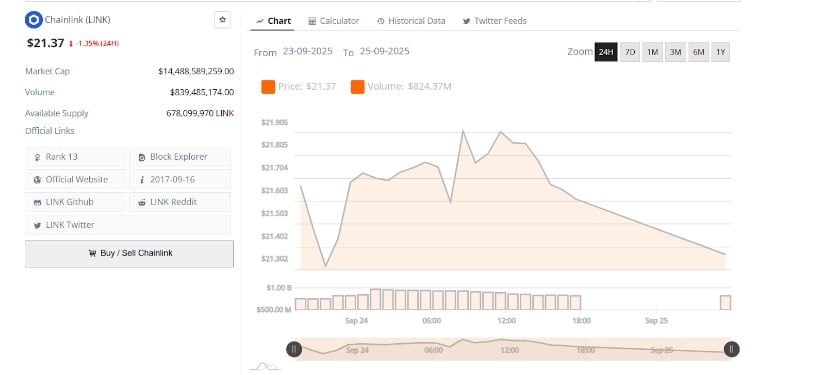

Ah, the market, that capricious mistress, whispers tales of Chainlink’s struggle against the fateful diagonal resistance. With a trading volume of $839 million-a sum that would make even the most frugal bureaucrat blush-the stage is set for a drama of epic proportions. The bulls, those stubborn creatures, must cling to the $21.30-$21.40 range like a cat to a curtain, lest they be cast into the abyss of despair. 🦬💨

The Crucible of $22.00

Behold, Chainlink teeters at $21.77, with $22.00 looming like a gatekeeper to the heavens. Analyst Crypto Monkey, that sage of the charts, observes the price testing this threshold after a series of humiliations. Will it break through, or shall it be repelled like a poorly timed joke at a funeral? The market holds its breath, and the outcome shall dictate its next whimsical move. 🤡📉

Should $22.00 prove too formidable, a short trade opportunity may arise, targeting the $20.00 demand zone-a sanctuary for the weary. Yet, a breakout above $22.00 could unleash a torrent of buying, paving the way to $26.00. Ah, the duality of fate! ⚖️✨

The Red Diagonal: A Barrier of Legend

MarketMaestro, that oracle of the charts, laments LINK‘s failure to breach the long-term red diagonal resistance-a barrier as stubborn as a Moscow landlord. Since the 2021 peak, this trendline has rebuffed every attempt at ascent, a technical fortress guarding against hubris. The recent rejection proves that sellers remain vigilant, their knives sharpened for the next assault. 🗡️🔒

Support levels at $14, $17, $21, and $25 stand as potential bastions against the onslaught of selling. To falter here would be to invite a deeper pullback, a descent into the abyss. Momentum indicators demand consistent buying pressure-a Herculean task in these uncertain times. 🛡️💪

The Elusive $31: A Siren’s Call

Yet, hope persists! The $31 zone remains the siren’s call, beckoning Chainlink toward its long-term destiny. A monthly close above the red diagonal could shift the winds of sentiment, setting the stage for a triumphant march to higher Fibonacci extensions. But for now, the market watches, waits, and wonders. 🧜♀️🌊

Will Chainlink consolidate above its key supports, building a foundation for another rally? Or shall it crumble under the weight of its own ambition? A recovery, buoyed by volume and a break above resistance, could see it resume its bullish trajectory. But the path is fraught with peril, and the market is no friend to the faint of heart. 🏰🗡️

The Daily Chart: A Tale of Woe

The 24-hour chart reveals a day of drama: opening at $21.60, peaking at $21.80, and closing at $21.37-a 1.35% loss. Sellers, those relentless foes, dominated the session, their presence as unmistakable as a bear in a china shop. Yet, volume remained robust, a testament to the market’s unyielding interest. 📉📊

The $21.30-$21.40 range now stands as immediate support, a last line of defense. A break below could spell disaster, a retracement into the depths. With a market cap of $14.48 billion and a circulating supply of 678 million, Chainlink holds its ground at 13th place-a position both enviable and precarious. Reclaiming $21.80 is the short-term goal, while the red diagonal resistance remains the ultimate challenge. 🏆🎭

Read More

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Build Muscle in Half Sword

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- Violence District Killer and Survivor Tier List

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

- Sega Declares $200 Million Write-Off

- How to Unlock the Mines in Cookie Run: Kingdom

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

2025-09-26 02:53