As a seasoned crypto investor with several years of experience under my belt, I’ve learned to pay close attention to on-chain data when making investment decisions. The recent decline in retail investor demand for Bitcoin, as evidenced by the plummeting transfer volume, is a red flag that can’t be ignored.

Recent on-chain figures indicate a significant drop in retail investor interest in Bitcoin, reaching levels not seen since early 2018. This potential decrease in demand could be a warning sign for the cryptocurrency market.

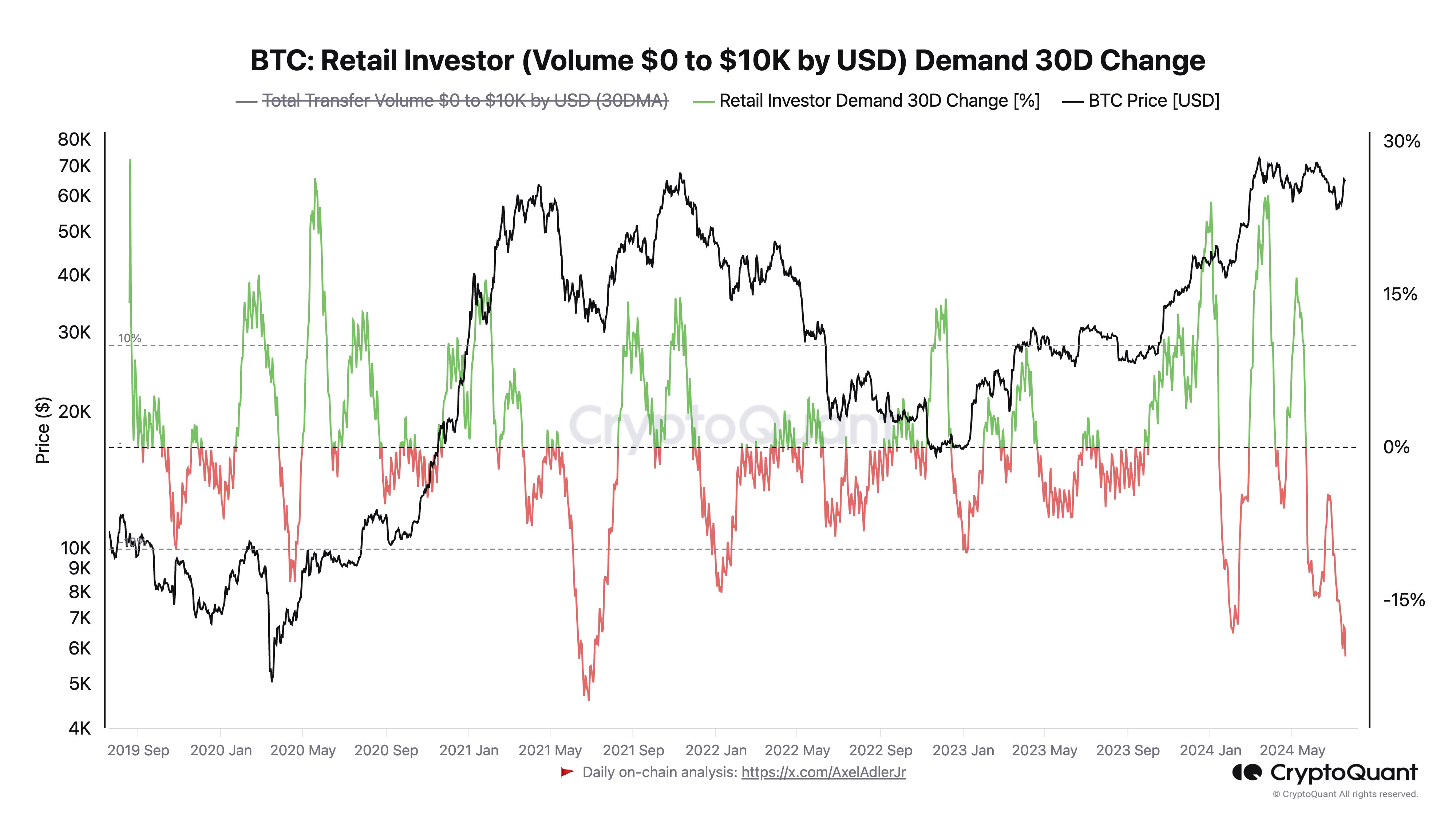

Bitcoin Retail Investor Transfer Volume Has Plummeted Recently

According to a recent post by Ki Young Ju, the founder and CEO of CryptoQuant, there has been a noticeable drop-off in demand from smaller Bitcoin investors in the market.

As a researcher studying the crypto market, I often use the term “transfer volume associated with them” to gauge the level of demand for cryptocurrency usage within specific groups, such as retail investors. Since most retail transactions are comparatively small, typically under $10,000 in value, this data helps me understand their trading patterns and overall market dynamics.

Young Ju’s analysis reveals that the total transfer volume for these transaction sizes has shifted by approximately 30 days to give an indication of current retail investor interest.

Based on my extensive experience in the cryptocurrency market and having closely followed the insights shared by industry experts, I find the chart presented by CryptoQuant’s founder particularly intriguing. Over the past few years, this metric has displayed some notable trends that could potentially provide valuable context to current market dynamics. It’s fascinating to observe these patterns unfold and consider their implications for the broader crypto landscape.

The graph shows that the number of Bitcoin transfers made by retail investors over the past 30 days has significantly decreased, indicating a decline in their trading activity.

The decrease in this metric’s value is rather significant, as it now stands at its lowest point in approximately three years. Such a decline could be indicative of waning enthusiasm among retail investors towards cryptocurrencies due to recent market downturns.

Over the last week, Bitcoin’s price has rebounded, but it hasn’t significantly boosted demand from this specific group yet. We’ll have to wait and see if increased transaction volumes emerge among these investors in the near future if the price trend persists.

Despite a decreased interest from retail investors in utilizing blockchain technology lately, they have continue to make purchases, according to analyst James Van Straten’s explanation in a recent post.

An analyst has noted that these investors have recently adopted the tactics of savvy investors, as evidenced by the graph showing they’ve purchased more Bitcoin when its price decreases and sold when it reaches peaks.

During the depths of the bear market after the cryptocurrency exchange FTX’s collapse, this particular group engaged in a notable shopping frenzy.

BTC Price

When writing, Bitcoin is trading around $64,100, up over 11% in the last seven days.

Read More

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- Ethereum (ETH) Crashes Dramatically, What’s Next? Solana (SOL) Can Still Reach $200, XRP Struggling Before $0.63 Test

- Profit from the Dip: Hong Kong To Debut Asia’s First Inverse Bitcoin ETF — Here’s When

- US Govt Dumps $4M In Bitcoin Again, Another BTC Selloff Ahead?

- Bitwise Ether ETF Reveals 10% Profit Donation To Ethereum Developers

- USD PHP PREDICTION

- Breaking: Spot Ethereum ETF Trading Affirmed by US SEC

2024-07-20 13:11