As a seasoned researcher with a deep understanding of the crypto market, I’ve witnessed numerous ups and downs in Bitcoin’s price action over the years. The current bearish trend is no exception, as prices have retreated from last week’s gains and approached critical support levels.

At present, Bitcoin is showing signs of bearishness, reversing some of the significant progress made in the previous week. Despite optimistic predictions from buyers that prices will rebound and surpass $69,000, sellers have remained persistent, even breaching the upper boundary of the current price range.

Bitcoins current price at the spot market has dropped approximately 6% from its weekly peak and is around 12% below its all-time high. The shrinking contract prices indicate a bearish trend, suggesting potential future lows that may be even lower than the present one in relation to the all-time highs.

Bitcoin Whales Ramping Up Purchase

Despite the convergence of bearish indicators, I’ve noticed some signs of buying activity at current market rates. Specifically, as prices dip below $66,000 – a significant support level – on-chain data from Ki Young Ju on X suggests that large investors, or “whales,” are accumulating Bitcoin. This behavior implies a certain level of confidence in the cryptocurrency’s future price movement.

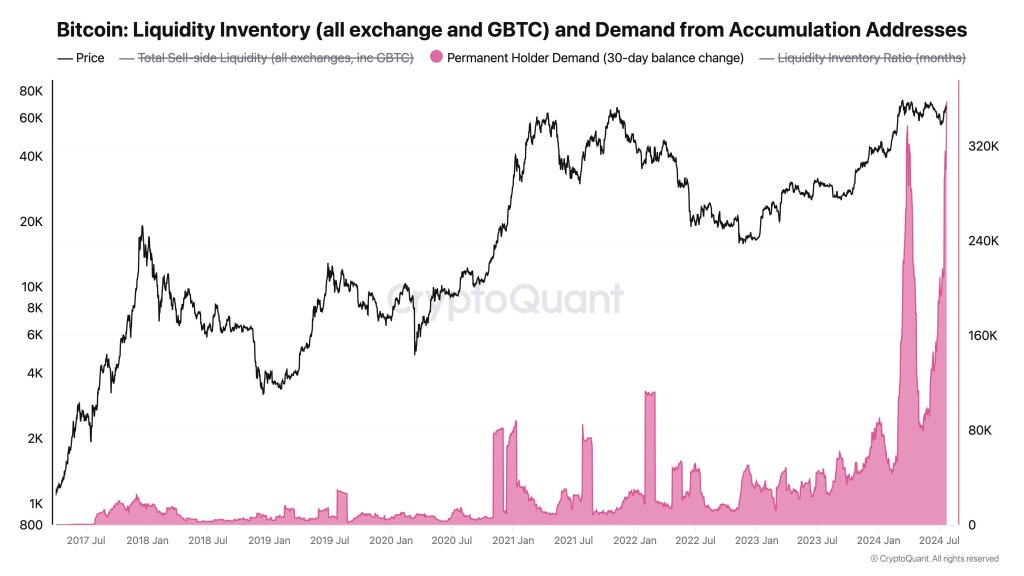

Despite a potential downward trend in prices, Ju, the CEO of CryptoQuant, observes that large investors, or “whales,” have been actively purchasing large amounts of Bitcoin over the last few weeks. Specifically, approximately 358,000 BTC have been transferred to long-term storage wallets during the past month. These particular wallets typically hold onto their Bitcoin for extended periods and remain unaffected by price fluctuations, similar to how retail investors may react when prices decline.

above all, these addresses haven’t been linked to Bitcoin ETF providers or miners; as of July, BlackRock, Fidelity, and other spot ETF providers such as Bitwise have collectively purchased approximately 53,000 BTC for their clients.

The movement of coins into these wallets implies that large investors, referred to as “whales,” have strong convictions about the future and are reluctant to sell their bitcoin hoard. This occurs concurrently with Bitcoin ETF providers increasing their holdings from the market supply.

Mt. Gox Distribution Soaked Impressively Well By The BTC Market

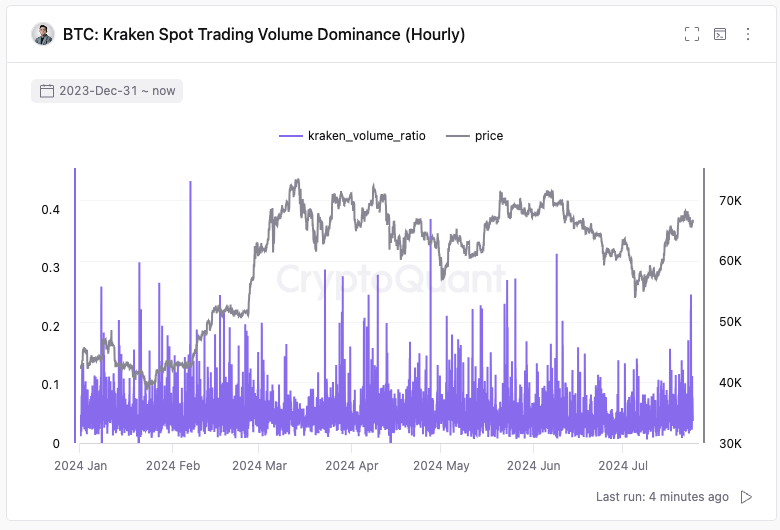

It’s intriguing that whales have been buying more Bitcoin (BTC) and holding it, while Kraken finished the process of repaying Mt. Gox creditors in late June. The crypto market had anticipated a potential price crash due to the distribution of funds from Mt. Gox between June and July.

Based on recent developments, the market appears to have effectively managed any selling pressure, resulting in minimal market turbulence. According to a post on X by Ju, trading activity and exchange traffic on Kraken have remained ordinary.

Amidst the recent advancements, there’s been a resurgence of users returning to the crypto market. Notably, the Mt. Gox refund process through Kraken occurs concurrently with an uptick in USDT and stablecoin liquidity. Previously, significant inflows of USDT into exchanges have typically signaled substantial price growth for Bitcoin.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- MDT PREDICTION. MDT cryptocurrency

- UFO PREDICTION. UFO cryptocurrency

- WELSH PREDICTION. WELSH cryptocurrency

2024-07-26 11:41