KEY POINTS:

Luxembourg is the first Eurozone nation to invest in Bitcoin.

FSIL allocates 1% of its $730M fund into BTC ETFs.

Move aligns with MiCA and broader crypto adoption.

Growing demand drives need for Bitcoin L2s like $HYPER.

Well, well, well, look who’s leading the charge! Luxembourg-yes, the tiny, charming country with more wealth per capita than a dragon hoarding gold-has officially decided to throw its hat into the Bitcoin ring. And not just as a casual observer. No, no. Luxembourg is going all-in, becoming the first Eurozone nation to make Bitcoin a part of its national treasure chest. Talk about a statement.

As one of the world’s richest countries, Luxembourg’s Intergenerational Sovereign Wealth Fund (FSIL) is putting 1% of its $730 million portfolio into Bitcoin ETFs. That’s right-BTC ETFs, not your usual government bonds or vintage wine collection. Finance Minister Gilles Roth spilled the beans on this dazzling move during the 2026 national budget presentation. Hold on to your wallets, folks, this is just the beginning!

Let’s not forget about compliance. Luxembourg’s decision to dip its toes into the crypto pool is, of course, wrapped in EU-approved, MiCA-compliant, shiny legal packaging. Because, naturally, you don’t want to make an ‘Oops, didn’t read the fine print’ kind of mistake when you’re handling millions.

According to Jonathan Westhead, the head of communications at the Luxembourg Finance Agency, this move is all about believing that “Bitcoin represents the future of finance.” Well, duh. If that’s not a glowing endorsement of crypto, I don’t know what is. Maybe Bitcoin should get a thank-you card.

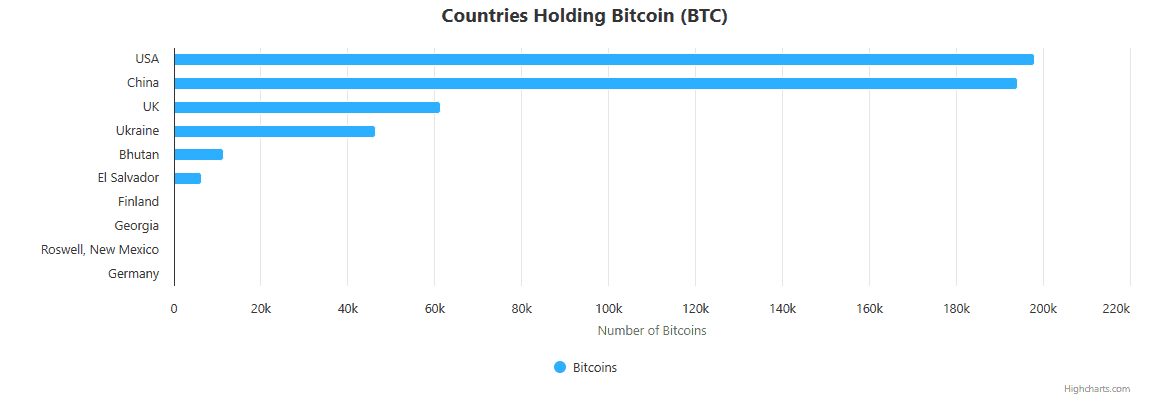

While other countries like the US, El Salvador, and Finland have been dabbling with Bitcoin, Luxembourg is the first to step up with an actual policy-driven investment strategy, as opposed to just confiscating Bitcoin from random villains or illicit activities. Now that’s progress.

https://bitbo.io/treasuries/countries/

Now, let’s address the elephant in the room. As more nations cozy up to Bitcoin, there’s one thing becoming increasingly apparent: Bitcoin’s infrastructure needs a serious upgrade. A bit of a digital spring cleaning, if you will.

Enter Bitcoin Hyper ($HYPER). This nifty little Layer-2 chain is like the power-up Mario gets when he eats a super mushroom. It’s designed to scale Bitcoin to meet the insatiable demand from sovereign and institutional investors. Because, let’s face it, Bitcoin’s original setup just isn’t going to cut it for governments or corporations trying to move some serious coin.

Why Bitcoin’s Sovereign Era Demands New Infrastructure

Let’s put it bluntly: Bitcoin’s current network can’t handle the traffic. Sure, it’s a lovely system, but if you’re trying to use Bitcoin for things like, oh I don’t know, national economies, you might run into a problem. Right now, Bitcoin handles a whopping 8 transactions per second (TPS)-the equivalent of a toddler trying to play the piano while wearing mittens.

https://www.blockchain.com/explorer/charts/transactions-per-second

Analysts are waving their red flags, warning that Bitcoin could hit a major bottleneck if it doesn’t scale up soon. We’ve seen this happen before with Ethereum. It couldn’t handle the pressure until it got a few upgrades (looking at you, Arbitrum, Base, and Optimism). Bitcoin is just a few steps behind, but fear not, $HYPER is here to save the day.

With the US Strategic Bitcoin Reserve and sovereign funds joining the Bitcoin party, there’s a need for faster, greener, and more compliance-friendly infrastructure. And guess who’s answering that call? You got it-Bitcoin Hyper ($HYPER). It promises to combine Bitcoin’s rock-solid security with transaction speeds that would make even Solana’s developers break into a proud sweat.

Bitcoin Hyper ($HYPER): The Scalable Future of Institutional $BTC

Bitcoin Hyper ($HYPER) is the new kid on the block, and it’s making waves. Built with ZK-rollups, sidechains, and Lightning Network integration, it’s the best of both worlds-maximizing throughput without sacrificing Bitcoin’s beloved principles of security and decentralization.

The presale for $HYPER is already seeing massive momentum. Over $23 million has been raised, and tokens are priced at just $0.013095 each. Early buyers can even score staking rewards of up to 51%. Get in early, folks, before it’s too late!

For perspective, Arbitrum-the Ethereum L2 heavyweight-once hit an all-time high valuation of $5 billion. And considering Bitcoin is roughly five times the size of Ethereum, if $HYPER achieves even a fraction of that success, we’re looking at some serious upside potential.

As institutional inflows reshape Bitcoin’s role in global finance, $HYPER’s Layer-2 framework is poised to become the backbone of a new trillion-dollar liquidity era. So, are you ready to ride the Bitcoin wave into the future?

Visit the Bitcoin Hyper presale now and join the Layer-2 revolution that’s powering Bitcoin’s next cycle.

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Best JRPGs With Great Replay Value

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Sword Slasher Loot Codes for Roblox

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- Non-RPG Open-World Games That Feel Like RPGs

- Dungeons and Dragons Level 12 Class Tier List

2025-10-10 19:22