In a spectacle as predictable as a vicar’s sermon, the erstwhile President Trump has once again taken to his digital pulpit to declare economic warfare, this time with China in his crosshairs. The cause? A trifling matter of rare earth minerals, those arcane elements that, one supposes, are as essential to modern life as a cocktail shaker to a Waugh protagonist.

Bitcoin Plummets as Trump’s Tariff Tirade Triggers Market Mayhem

Ah, Trump, that indefatigable maestro of market mayhem, has struck again. On a Friday morning, no less, when the world is still clutching its coffee cups and wondering if the week will ever end. With a flourish worthy of a third-rate tragedian, he warned China of “a massive increase of tariffs”-a phrase so laden with hyperbole one expects it to be followed by a drumroll and a cymbal crash. The result? Bitcoin, that darling of the digital age, took a nosedive, plummeting 2.53% as if it had tripped over its own ledger. Stocks, too, joined the lament, sliding into the red like a debutante at a particularly dreary ball.

“They want to impose Export Controls on each and every element of production having to do with Rare Earths,” Trump proclaimed, his prose as florid as a Victorian novel. One can almost picture him, quill in hand, penning this missive with the gravity of a man composing his last will and testament. “One of the Policies that we are calculating at this moment is a massive increase of Tariffs on Chinese products coming into the United States of America.” Calculating, indeed. One wonders if he’s using an abacus or merely throwing darts at a board.

China, ever the silent strategist, quietly announced its expansion of rare earths export controls on Thursday, a move as subtle as a brick through a window. This, mere weeks before Xi Jinping is due to meet Trump in South Korea for the APEC summit-a meeting now as likely as a snowstorm in the Sahara. Many suspect this is a strategic play, a game of chess where China holds the queen and Trump is left flailing with a pawn. 🧲♟️

The Middle Kingdom, with its 90% stranglehold on global rare earth production, has effectively cornered the market. These minerals, essential for everything from electric vehicles to smartphones, are now subject to export controls, requiring companies to grovel for government permission before selling them abroad. Thursday’s announcement added five more minerals to the list, a move as generous as a miser’s tip. 💎🔒

But Trump, ever the drama queen, is having none of it. “I never thought it would come to this,” he lamented, “but perhaps, as with all things, the time has come.” One can almost hear the violins swelling in the background. “Ultimately, though potentially painful, it will be a very good thing, in the end, for the U.S.A.” Painful, indeed, like a root canal without anesthesia. 🦷🇺🇸

A Glimpse into the Market’s Melancholy Metrics

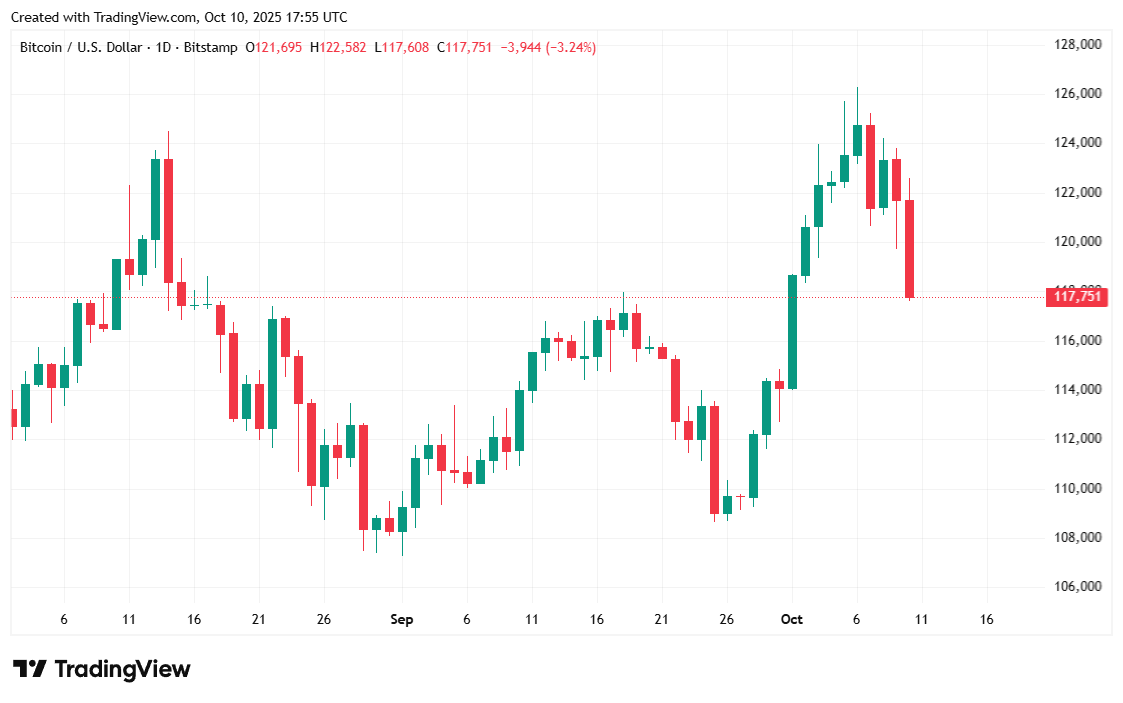

Bitcoin, that fickle creature, was down 2.53% at $117,655.04 at the time of writing, according to Coinmarketcap. Over seven days, it has shed 3.61%, fluctuating between $117,624.44 and $122,509.66 since Thursday-a performance as erratic as a Waugh character’s love life. 💔📉

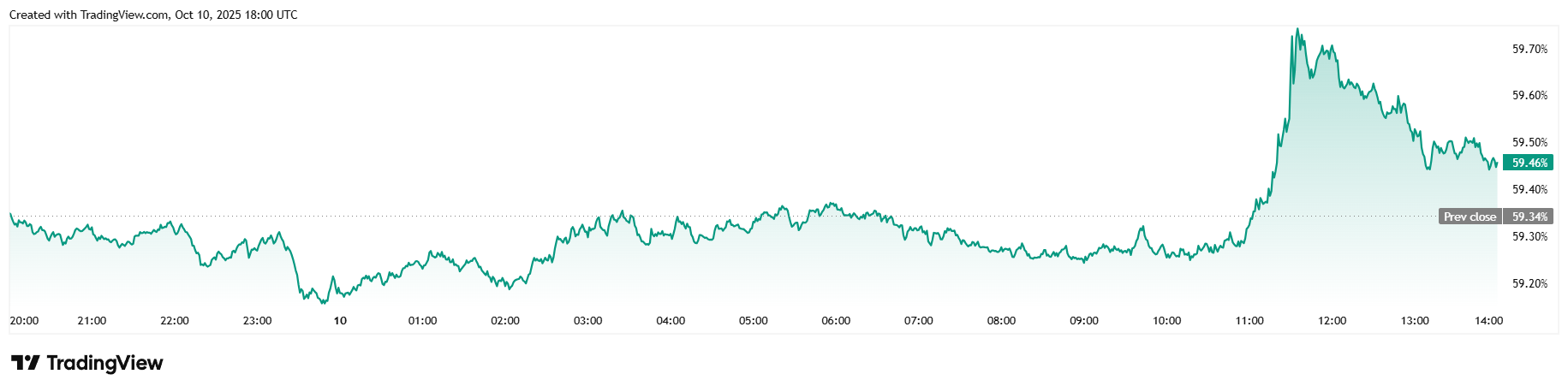

Twenty-four-hour trading volume rose 6.48% to $77.09 billion, while market capitalization fell 2% to $2.35 trillion. Bitcoin dominance, however, climbed 0.17% to 59.46%, a small victory in a sea of losses. 🏆📊

Total bitcoin futures open interest dropped 2.76% to $87.02 billion, according to Coinglass. Liquidations reached a staggering $180.98 million, with longs taking a $140.20 million hit-a massacre worthy of a Shakespearean tragedy. Short sellers, not to be outdone, lost $40.78 million, a mere consolation prize in this financial bloodbath. ⚔️💸

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Gold Rate Forecast

- How To Upgrade Control Nexus & Unlock Growth Chamber In Arknights Endfield

- Jujutsu: Zero Codes (December 2025)

- Top 8 UFC 5 Perks Every Fighter Should Use

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Deltarune Chapter 1 100% Walkthrough: Complete Guide to Secrets and Bosses

- Solo Leveling: From Human to Shadow: The Untold Tale of Igris

- Where to Find Prescription in Where Winds Meet (Raw Leaf Porridge Quest)

- Byler Confirmed? Mike and Will’s Relationship in Stranger Things Season 5

2025-10-10 22:18