Okay, so Bitcoin is bumbling around below a whopping $125,000 after that little dip to $120,000. Hang on, let me remind you that $120,000 is a big deal because it’s what the numbers got all excited about. Hey, us bulls are the strong, silent type, holding up price levels like I hold my grudges. But honestly, everyone’s tiptoeing around like it’s a TikTok dance-off. Tomas-a guy I just made up-says we’re all just waiting for the next big tumble to roll up.

But hey, here’s the kicker. That onchain stuff-and I don’t get half of that yet-seems to be saying something with a smile. Apparently, Bitcoin miners aren’t rushing to dump their Bitcoin. What does that mean? Oh sure, keep up Bitcoin, hold onto it like I hold my later episodes of “Curb Your Enthusiasm.” This might mean, who knows, the miners are actually betting on Bitcoin’s long game (unlike me with my vacations).

So, while we’re all watching the market like it’s a Christian Bale flick for consolidation, these miners are acting like they’ve rock stars backstage (let’s pretend that makes sense). Casual mover’s like traders are trying to figure out if Bitcoin can do the cha-cha back to $125K. And right now, the stage is set, no signs of exhaustion-just think I’m ignoring that treadmill.

Bitcoin Miners: Are They Okay, or is It Just a Front?

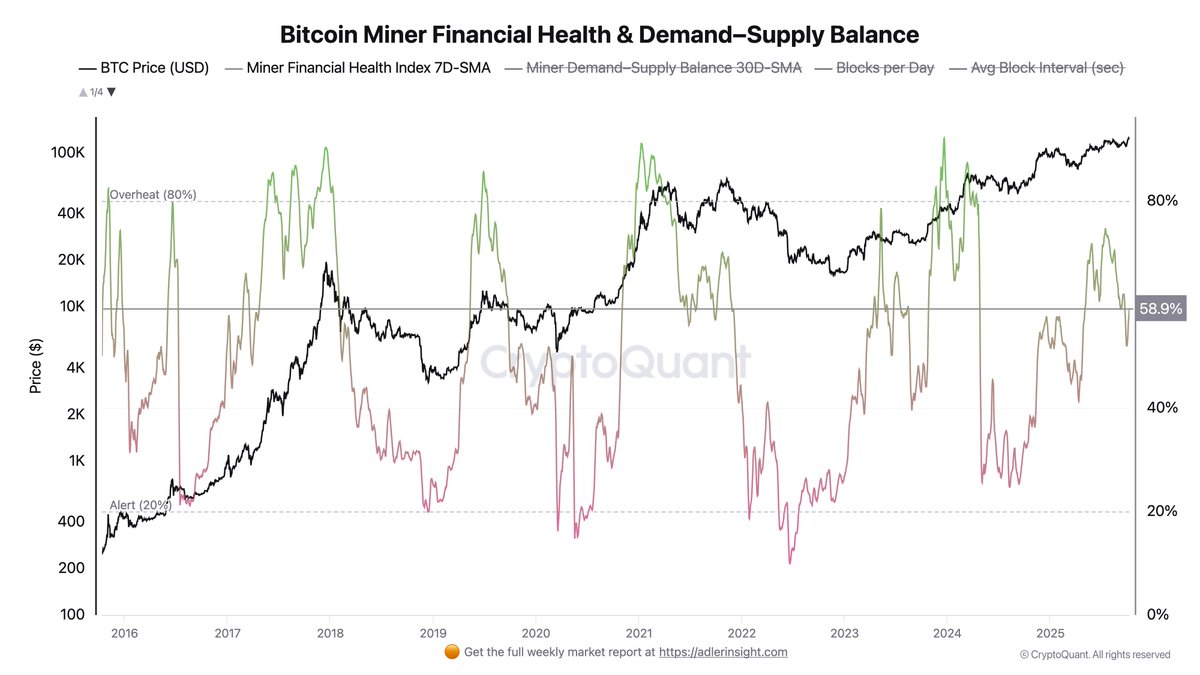

Guess what? Some guy named Axel Adler-probably got a kick out of inventing his own name-has got some fresh insights into what these Bitcoin miners are up to. He’s got this Miner Financial Health Index. Who reads that at a party anyway? It’s like checking your “financial vibe.” Right now, it’s at 59%, which, to put it in my terms, is neither hot or cold but somewhere in the ‘meh’ zone.

What does this all mean? Miners are chill-no wallet-wringing drama, just shrugging and keeping it balanced. No one panics for no reason (until Larry David runs into you and says, “Good night, sleep tight, don’t let the monkey bite”). So, everything’s groovy as long as the index is playing in the 50-65% sandbox.

Nerd alert: when the index hits over 80%, that’s when they go party-selling their hearts out. But we’re not there yet, and that tickles my intellectual curiosity more than my paycheck will. Seems they’re pretty happy unless they’re getting too snug-the classic Goldilocks problem (medium, not too…).

Fine, let’s sprinkle in some more nerdy network activity and strong miner confidence to say there’s nothing fundamentally wrong with Bitcoin except maybe short attention spans. As long as buyers and sellers chill out, Bitcoin’s foundation stays as patient and sturdy as my long-time friends.

Price Gimmicks and Bitcoin’s Bullish Bull-ness

Here’s Bitcoin: hanging out at $121,400. It’s sort of like my moods-either it can’t decide what song it likes, or it’s cool with the choices it made. Chanelling the DJ vibes, Bitcoin played the “pull back from $126,000” like it was too hot for the dance floor. Oh, and those moving averages-50-day in blue, 100-day in green-they’re rising like my blood pressure at a noisy restaurant.

The $120,000-$121,000 zone is like a safe haven-a place where Bitcoin buys its favorite snack bar (also bought by every other guy). If it crosses the magical $123,500, it gets VIP passes to try $125,000 again. But dip below $120,000-boom-busting into a spin toward $117,500, which served as resistance in September like the person who doesn’t get my WiFi password.

Those momentum indicators are cooling things down. Think winter in New York, trading season except it’s with your investments rather than your go-to socks. This brief chill lets people hoard Bitcoin like I hoard my free course offers.

All things considered, Bitcoin’s still giving off the vibes of a conquering hero so long as it stays above $117,500. If it steams past $125,000, we might just see fireworks-oh and some tweeting about it. Fingers crossed!

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Gears of War: E-Day Returning Weapon Wish List

- The Saddest Deaths In Demon Slayer

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- FromSoftware’s Duskbloods: The Bloodborne Sequel We Never Knew We Needed

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

2025-10-11 08:14