In the vast and tumultuous realm of cryptocurrency, Bitcoin, that most capricious of digital sovereigns, has once again attempted to reclaim its throne, rising from the shadowed depths of $106K-a realm where institutional demand lurks like a dragon hoarding gold. Yet, dear reader, let us not delude ourselves: this recovery, though valiant, is but a flicker in the grand candle of fate. To confirm a true bull run, BTC must conquer the lofty peak of $114K-$116K, a trial as arduous as Ivanhoe’s quest for honor.

Technical Analysis

By Shayan, the modern-day Nostradamus of blockchain.

The Daily Chart

Behold, the daily chart! Here, Bitcoin’s rebound from the $102K-$104K zone-a sacred ground where the 200-day MA and ascending channel converge-reveals a drama as old as time. The 100-day MA, that sly fox at $115K, now bars the path, its tail flicking doubt into the hearts of hopeful bulls. One might call it a “critical test,” though history whispers that such tests often end in tears and margin calls.

If BTC ascends above $116K, the gates to $120K-$122K will creak open, though the ghosts of $125K loom like judgmental ancestors. Should it falter? The $102K-$104K zone awaits, a Siren’s song for those who dare to accumulate… or liquidate. The market, ever the paradox, balances on a needle between hope and despair.

The 4-Hour Chart

The 4-hour chart, that fleeting snapshot of mortal struggle, shows Bitcoin clawing back higher lows-a Hail Mary pass from the $102K-$104K abyss. Now, it consolidates beneath the Fibonacci’s cryptic riddle ($114K-$117K), a crossroads where traders ponder whether to bet their futures or flee to safety. Ah, the decision point (DP)! A phrase as ominous as a Kremlin decree.

Should BTC breach this zone, it may yet rewrite its destiny toward $120K. But failure? A descent into chaos, where lower highs beckon like a tavern’s last shot of vodka. Momentum, that fickle lover, wavers between passion and indifference, hinting at volatility’s next dance-a tango with ruin or glory.

On-chain Analysis

By ShayanMarkets, the bard of blockchain’s soul.

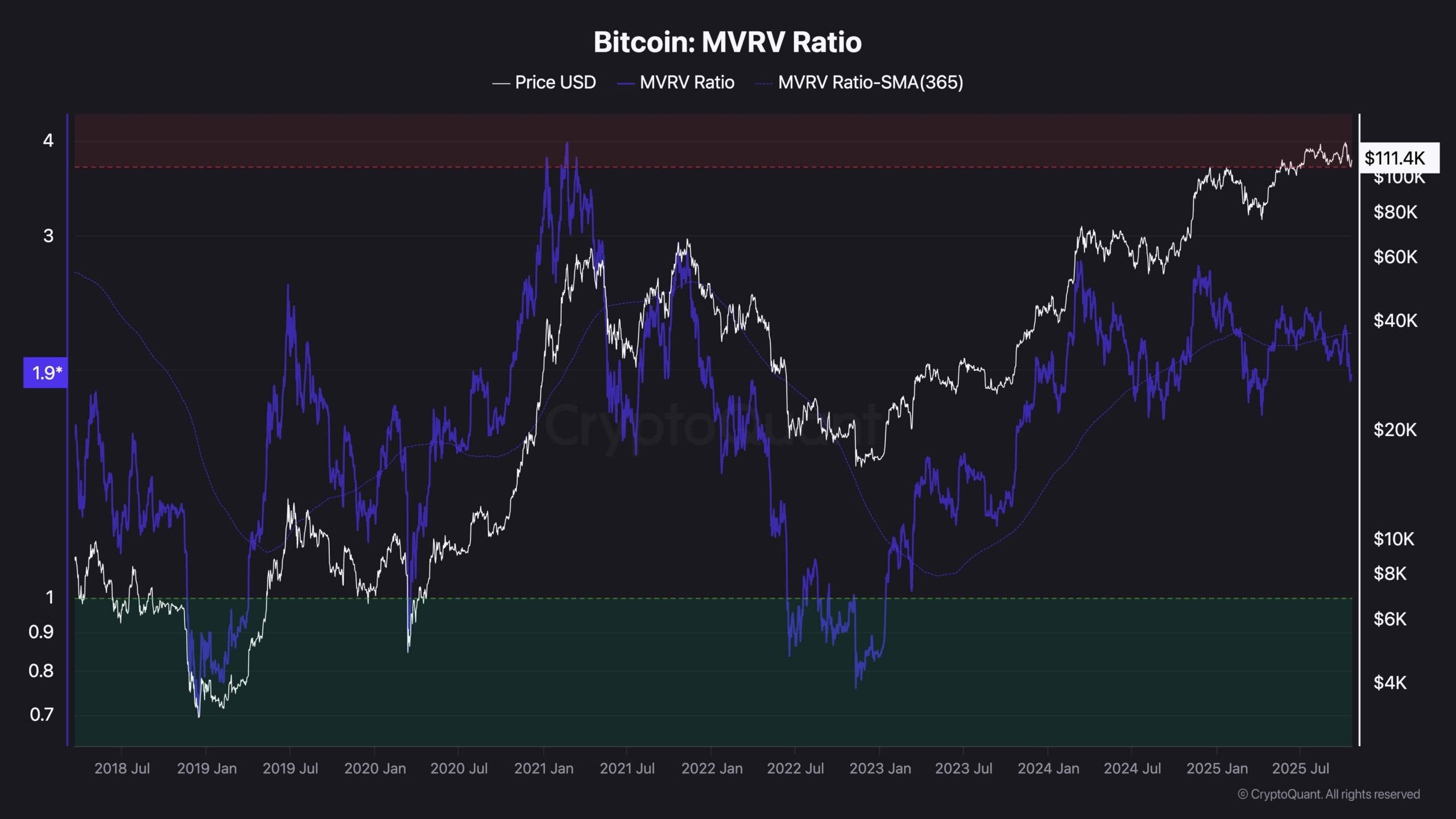

The MVRV Ratio, that fickle barometer of market sentiment, now hovers near 1.9-a number that whispers of undervaluation, yet screams of pending madness. History, that old fool, reminds us that every dip below its 365-day SMA has birthed false dawns and broken dreams. Mid-2021, June 2022, early 2024… were those victories or mere preludes to disaster?

Yet here we stand, clutching the hope that long-term holders, those mythical creatures, will ride in on a white steed to save us from our own greed. The MVRV’s descent below its SMA? A sign of reduced speculation, or just the calm before the storm? Only time, that unrelenting tyrant, will tell.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Who Is the Information Broker in The Sims 4?

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-10-20 17:33