O my, what a capricious creature is this Bitcoin! 🎭 Between 9 to 10 a.m. Eastern time on Tuesday, Oct. 21, 2025, it flirts with $110K, a mere 12.6% from its lofty peak-though one might call it a “modest retreat” for a digital asset. 🚀

Futures Market Overview

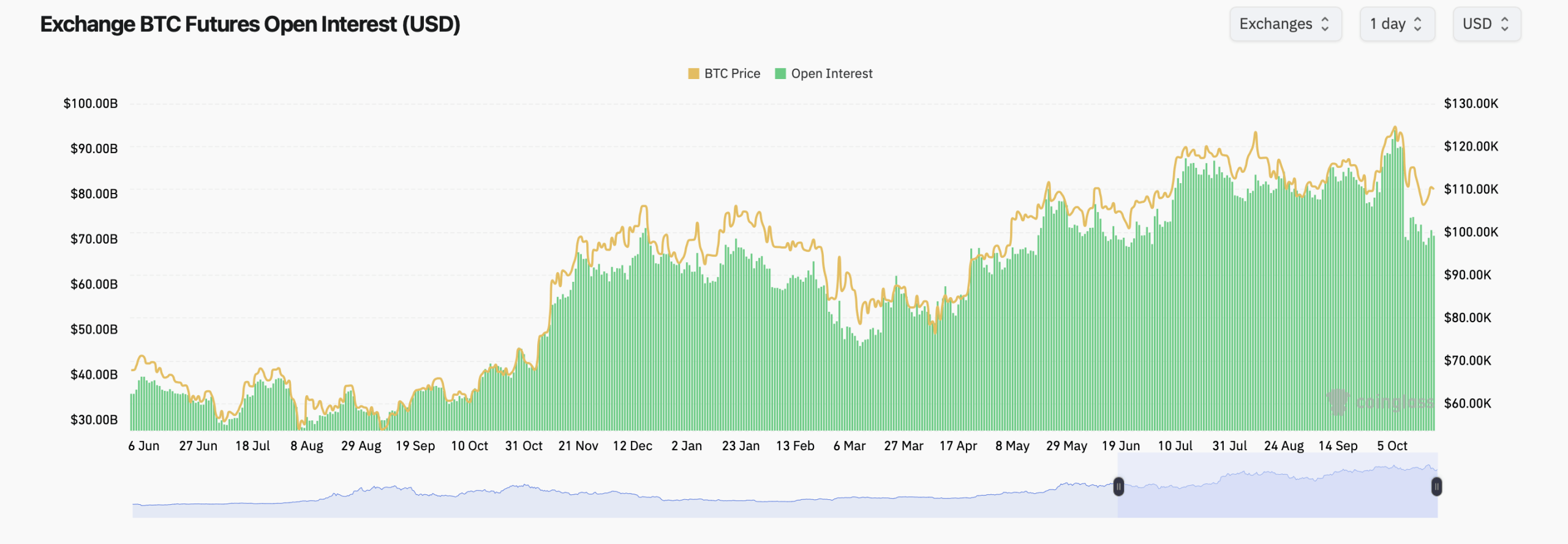

Total bitcoin futures open interest (OI) stands at $70.75 billion, a sum so vast it could fund a small kingdom. 🏰 CME, that paragon of stability, holds the lead with $16.42 billion-23.2% of the market. Binance, ever the rival, follows closely with $12.79 billion. 🏦

While CME and Binance both posted modest gains, the overall daily OI slid 2.19%, hinting at traders unwinding positions like a weary actor exiting the stage. 🎭

Kucoin, that fiery spirit, surged 2.86%, while MEXC, in a fit of despair, plummeted 18.06%. Gate’s OI dipped -6.30%, as if saying, “I’ve had enough of this chaos!” 📉

Futures Open Interest Trends

Coinglass futures statistics reveal OI has climbed since June, mirroring Bitcoin’s climb from $60K to $110K. Despite shakeouts, OI remains elevated-proof that speculation thrives even in the face of uncertainty. 🤷♂️

Options Market: Calls Take Control

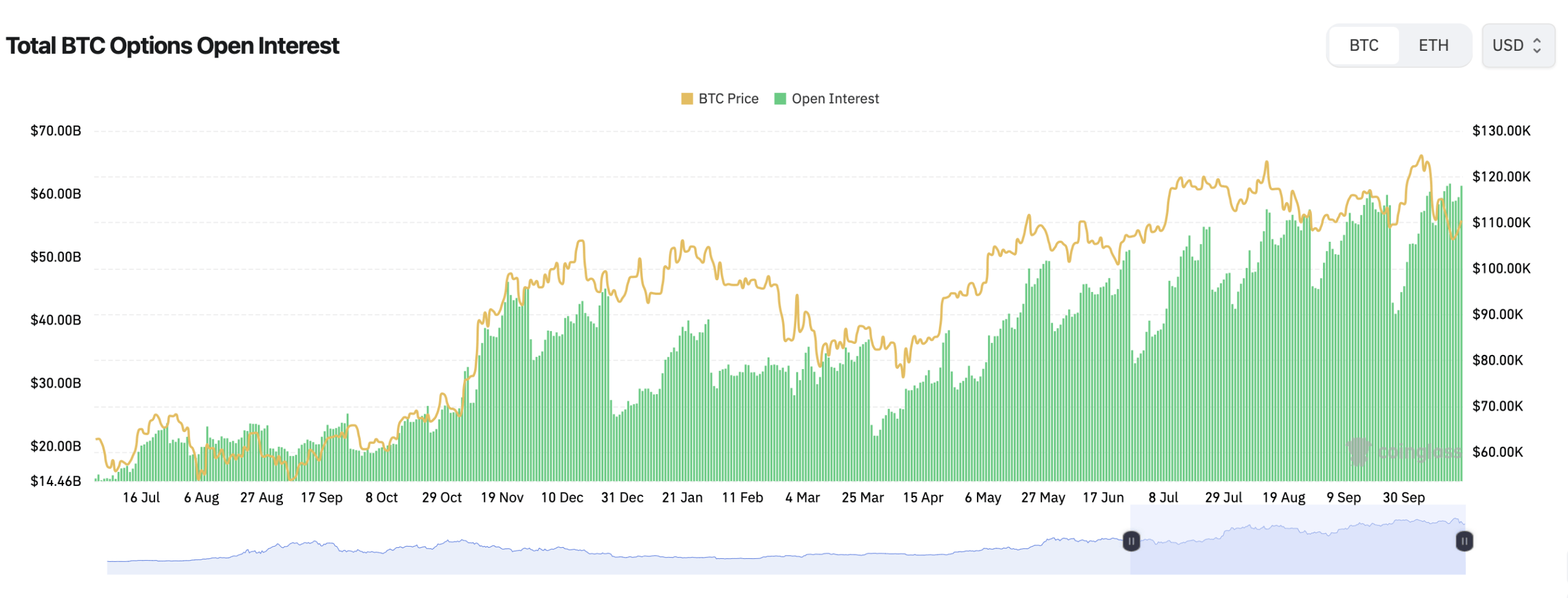

Over in the options arena, bullish sentiment reigns supreme. Calls make up 59.3% of total open interest, while puts play the role of the reluctant skeptic. 🧐

The largest open interest contracts on Deribit are stacked in December 2025, with $140K and $200K calls leading the charge. A comedy of errors, indeed! 🎭

Volume Leaders and Short-Term Positioning

The $150K call leads in 24-hour volume, while near-term puts hedge against dips. A tug-of-war between optimism and caution-how very human! 🧘♂️

Max Pain and Price Gravity

According to Coinglass, the max pain point sits near $114K, where most options expire worthless. A precarious balance, as Bitcoin hovers just beneath it. 🧍♀️

FAQ 🧭

- What is bitcoin’s total derivatives open interest today?

A sum so vast, it could fund a small kingdom, yet here we are, trading it like mere coins! 🏰 - Which exchange leads in bitcoin futures open interest?

CME, that paragon of stability, leads with $16.42 billion. A true titan of the market! 🏛️ - What’s the call vs. put ratio in bitcoin options?

Calls dominate, showing a bullish bias-though one might call it a “romantic delusion.” 💕 - Where is bitcoin’s current max pain level?

The max pain point is around $114K, suggesting traders face neutralized profit potential. A tragicomedy! 🎭

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Who Is the Information Broker in The Sims 4?

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-10-21 19:03