As a seasoned crypto investor with a battle-scarred portfolio and a knack for spotting trends that even the most astute analysts might miss, today’s sudden surge of activity from long-dormant Ethereum wallets has me raising an eyebrow or two. The echoes of the infamous PlusToken ponzi scheme seem to be reverberating once more, and I can’t help but feel a twinge of déjà vu.

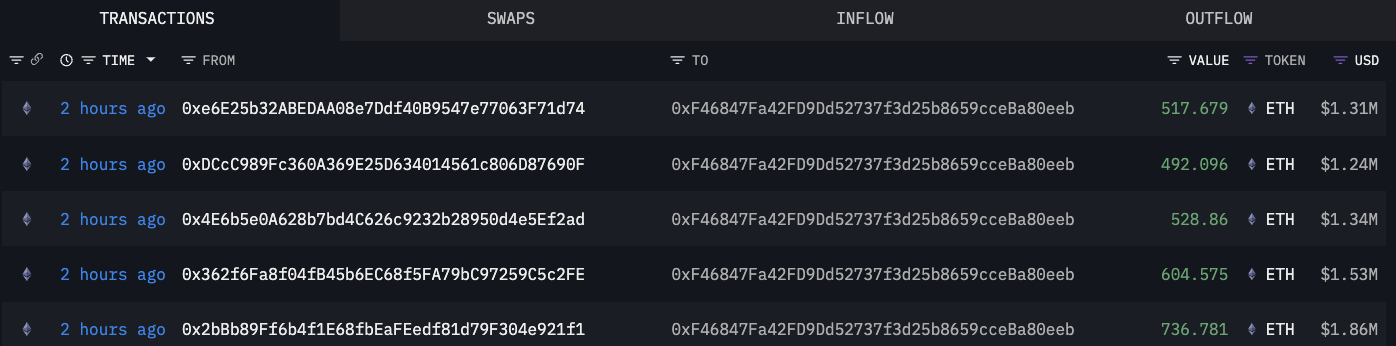

Today saw a significant surge in Ethereum (ETH) activity as dormant wallets, last active 3.3 years ago according to Lookonchain, began transferring substantial amounts of the popular altcoin. These long-dormant accounts were previously inactive.

As someone who has been closely following the world of cryptocurrency for several years now, I have seen many ups and downs, but the recent movement of over 789,000 ETH (worth almost $2 billion) from a wallet linked to the PlusToken Ponzi scheme is particularly noteworthy. This story seemed to have faded into obscurity in 2021, but it appears that it has resurfaced once again. It’s always fascinating to see how these events unfold, and I can only imagine the excitement and anticipation that those involved must be feeling. However, as someone who has witnessed the collapse of numerous cryptocurrency projects over the years, I can’t help but feel a sense of unease about what might happen next. Only time will tell if this is just a one-time movement or the beginning of something larger.

In simple terms, starting from May 2018, the PlusToken Ponzi scheme lured people with promises of high returns through a fabricated cryptocurrency arbitrage trading platform. To participate, individuals were required to invest at least $500 in digital assets, leading to an amassment of billions worth of crypto before the scam was eventually exposed and closed down.

In 2020, Chinese authorities uncovered one of the largest cryptocurrency scams ever. During their investigation, they confiscated a significant amount of various cryptocurrencies such as 194,775 Bitcoins and 833,083 Ethereum. This event has raised concerns reminiscent of Mt. Gox’s Bitcoin transactions, which had a significant impact on the market’s stability in the past.

Reflecting on the recent development, I’ve observed a minor dip in Ethereum‘s price, approximately 2%, bringing it down to roughly $2,480. Although this instant response is noteworthy, it remains uncertain how this unforeseen incident, or “black swan” event, will shape its long-term trajectory.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD PHP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- ENJ PREDICTION. ENJ cryptocurrency

2024-08-07 16:03