Oh, ho, ho! Gather ’round, folks, and let Mel Brooks-I mean, your humble narrator-tell you a tale of Bitcoin, gold, and the mighty (or not-so-mighty) US dollar! 🤑 According to the wizards at NYDIG, Bitcoin’s price isn’t just a dance partner with inflation-it’s more of a tango with the dollar’s strength and liquidity! Who knew? 🤷♂️

Greg Cipolaro, NYDIG’s global head of research (fancy title, eh?), says the data shows Bitcoin and inflation are like a bad blind date-weak and inconsistent. 💔 So much for that “inflation hedge” story we’ve all been spoon-fed! Time to rewrite the script, folks! 🎬

Inflation? More Like Deflation of Expectations! 😴

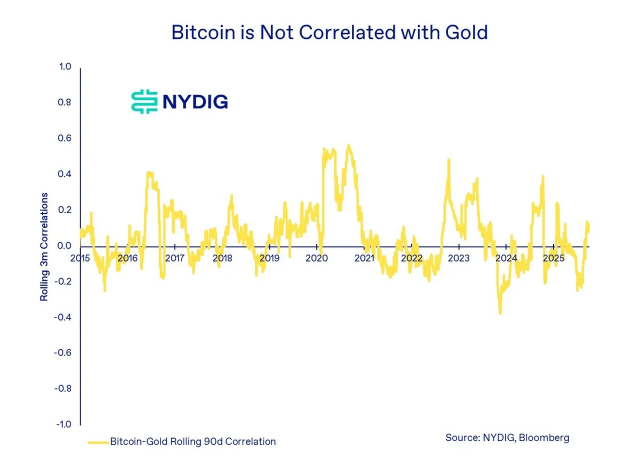

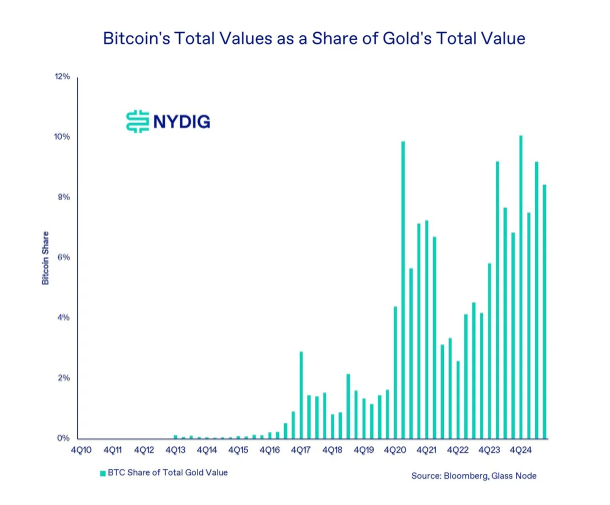

Cipolaro quips that inflation expectations are like a slightly better weather forecast-still not great at predicting Bitcoin’s mood swings. 🌦️ Meanwhile, Bitcoin and gold are like two peas in a pod, gaining weight when the dollar goes on a diet. 🥜💸

Gold’s been doing this dance for ages, but Bitcoin? It’s the new kid on the block, still learning the steps. But hey, it’s catching on! 🕺✨

Gold and Bitcoin: The Odd Couple Against the Dollar! 🦸♂️🦸♀️

Reports say gold’s been climbing as the dollar falls-like a mountain goat on Wall Street. Bitcoin’s following suit, though it’s more of a rollercoaster than a steady climb. 🎢 NYDIG predicts this inverse relationship will only get stronger as Bitcoin goes mainstream. Watch out, dollar! 💪

Traders, always looking for a deal, are swapping dollars for Bitcoin when the greenback’s buying power takes a nosedive. Smart? Maybe. Funny? Absolutely! 🤓💰

Interest Rates and Money Supply: The Real Stars of the Show! 🎭

Cipolaro spills the tea: interest rates and money supply are the puppet masters pulling Bitcoin and gold’s strings. Lower rates and loose policy? Cha-ching! 🤑 But don’t confuse them-gold’s a real-rate hedge, while Bitcoin’s more of a liquidity meter. Subtle? Yes. Important? You bet! 🧐

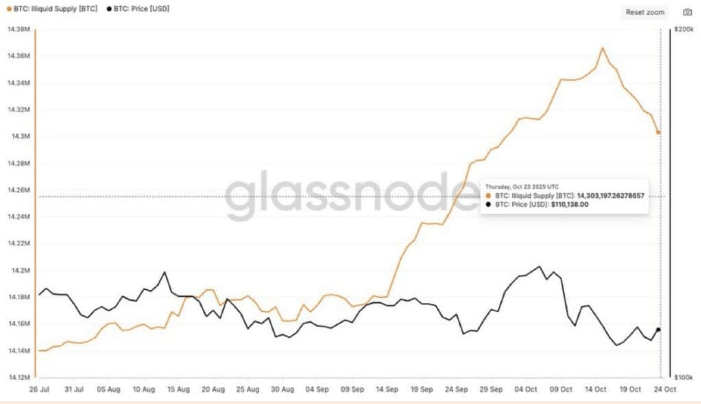

On-chain data? It’s like a soap opera! Illiquid Bitcoin (the dormant coins) took a nosedive from 14.38 million to 14.300 million in October. That’s 62,000 BTC, or $6.8 billion, back in circulation! Last time this happened? Prices softened like butter on a hot pancake. 🥞💸

Glassnode says wallets holding 0.1 to 100 BTC are selling like hotcakes, and first-time buyer supply’s down to 213,000 BTC. Macro perspective? Not great. On-chain metrics? Also not great. New buyers? MIA. Momentum traders? Sitting this one out. More coins available? Yep. Rallies? Blunt. Pullbacks? Deep. Unless the dollar weakens or liquidity improves, it’s a waiting game! ⏳🤦♂️

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- How to Unlock & Upgrade Hobbies in Heartopia

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- God Of War: Sons Of Sparta – Interactive Map

2025-10-27 11:30