As a seasoned crypto investor with a decade of experience under my belt, I must say that the recent market downturn has been a rollercoaster ride, but it’s nothing new to us veterans. The massive Bitcoin outflow from exchanges this week, as indicated by the Netflows metric, is indeed intriguing and could potentially signal a shift in investor sentiment towards accumulation or a long-term belief in Bitcoin’s potential.

As a crypto investor, I found myself starting the week of 2024 with one of the steepest declines in Bitcoin‘s price and the overall market this year. The market turmoil understandably triggered fear and panic among fellow enthusiasts. However, it seemed that numerous investors saw this downturn as a chance to accumulate more digital assets at reduced costs.

Based on recent transaction records, a large volume of Bitcoins has been withdrawn from digital exchange platforms. Let’s explore the implications: This movement could indicate investors are taking their Bitcoin holdings off exchanges, potentially for safekeeping or to use in over-the-counter trades. As for price impact, it’s challenging to predict precisely since factors influencing BTC price are complex and interrelated. However, reduced liquidity on exchanges may lead to increased volatility as the market adjusts, which could influence short-term price movements.

Are Investors Backing The Bull Run To Continue?

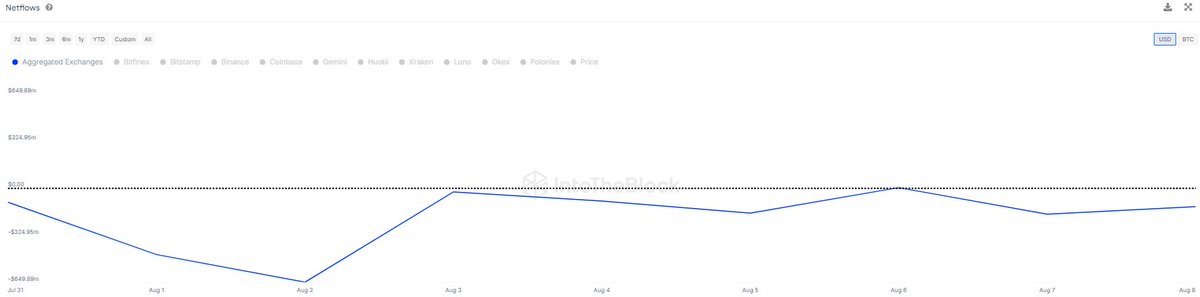

As per the latest figures from IntoTheBlock, approximately 28,000 Bitcoin (valued at over $1.7 Billion) have moved off crypto exchanges within the last week. This significant shift, observed through changes in the Netflows metric, signifies a tracking of the incoming and outgoing quantities of a specific cryptocurrency to and from centralized platforms.

A higher Netflow value, or a positive one, indicates that there’s more money moving into cryptocurrency exchanges than out. Conversely, a decrease in Netflow, meaning it’s less than zero, suggests that more crypto assets are being withdrawn from trading platforms than deposited.

Based on the graph and reports from IntoTheBlock, it appears that the Netflows metric for Bitcoin has been decreasing lately, suggesting a trend of big investors moving their Bitcoin holdings away from centralized exchanges. The most significant withdrawal of approximately $1.7 billion in Bitcoin over the last week is the largest seen within this timeframe in the year 2024 to date.

Despite it being challenging to pinpoint the specific reasons for such a significant migration, massive crypto transfers like this often reflect a change in investor attitudes. This shift could be due to adjustments in investment strategies or new accumulations by major investors, demonstrating their confidence in Bitcoin’s long-term potential.

Additionally, less BTC being available for trade on exchanges might lead to a shortage. Consequently, this decrease in circulating BTC could cause an increase in the price of Bitcoin.

Bitcoin Price At A Glance

After dropping from over $64,000 to $48,000 on August 5, Bitcoin has displayed remarkable strength in the last week, managing to rise again above the $62,000 mark.

Currently, the leading cryptocurrency is approximately valued at $60,400. This represents a 1% decrease in value within the past day. On the other hand, information from CoinGecko indicates that Bitcoin has experienced a more substantial drop of over 3% throughout this week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- USD COP PREDICTION

- EUR CLP PREDICTION

2024-08-10 18:11