Ah, the tempestuous dance of the crypto markets! How they mirror the human soul-restless, capricious, and ever so slightly absurd. Yesterday’s liquidation wave, a veritable tsunami of $824,470,000, swept away the overleveraged bulls, leaving the market sentiment rattled but, like a stubborn peasant, unbroken. Bitcoin, that enigmatic tsar of the digital realm, remains ensconced at $110,258, while the altcoin capitalization, excluding its august brethren BTC and ETH, clings to a round trillion, despite a 5.48% monthly tumble. 🌾💨

The Fed, in its infinite wisdom, has decreed a 25 bps rate cut, with QT set to conclude in December, a slow drip of liquidity returning to the parched fields of finance. Yet, the traders, those fickle creatures, are more concerned with the immediate flow: SpaceX wallets stirring once more, XRP donning its Nasdaq finery, and U.S.-China headlines whipping up a froth of volatility across all markets-crypto, of course, being the most dramatic of the lot. 🎭

TL;DR

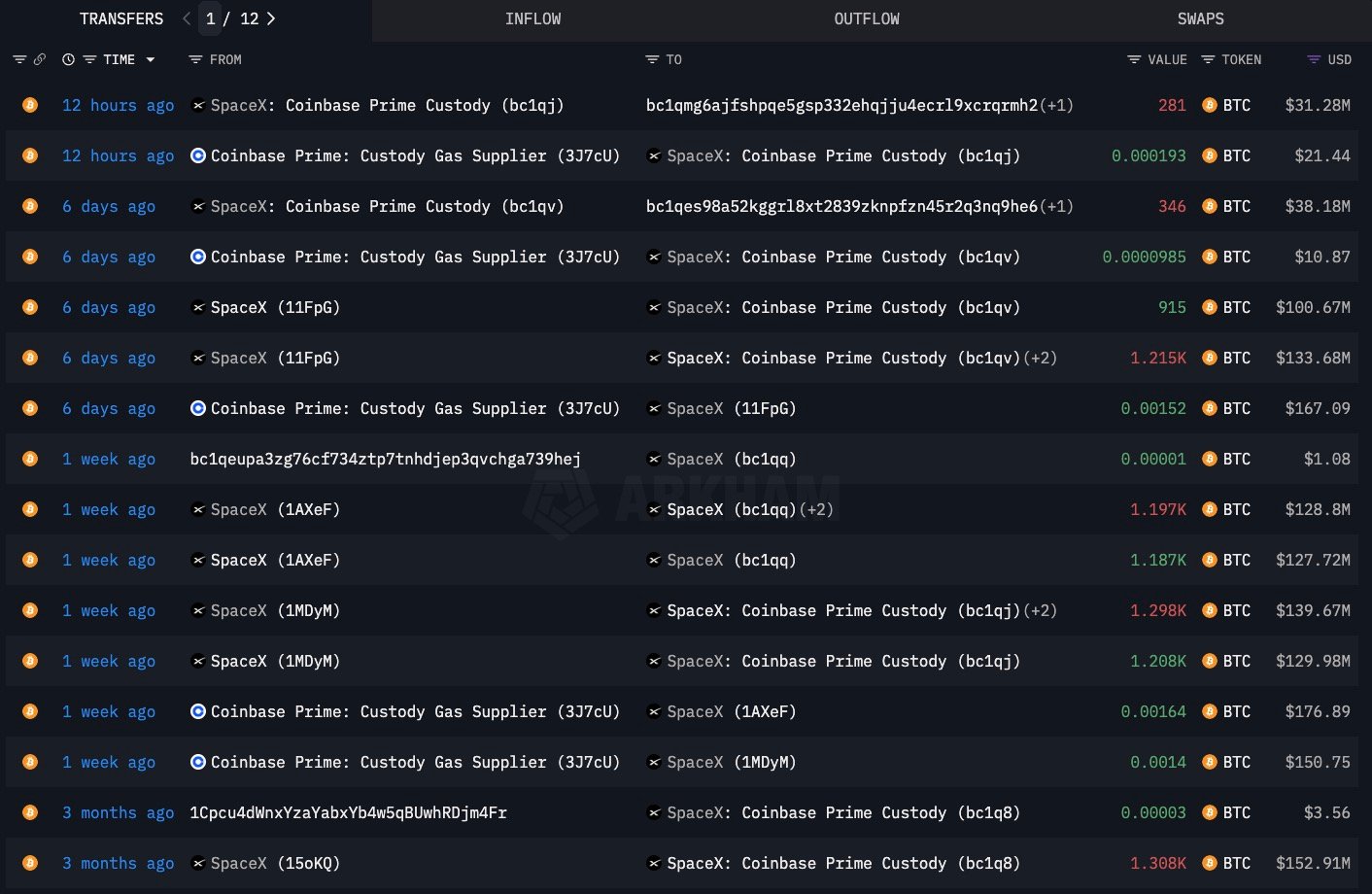

- SpaceX shuffles 281 BTC, a cool $31,280,000, to a new address-because why not? 🚀💼

- XRP, now trading as XRPN on Nasdaq, flaunts $1,000,000,000 in fresh capital-a new suit for the ball. 🎩

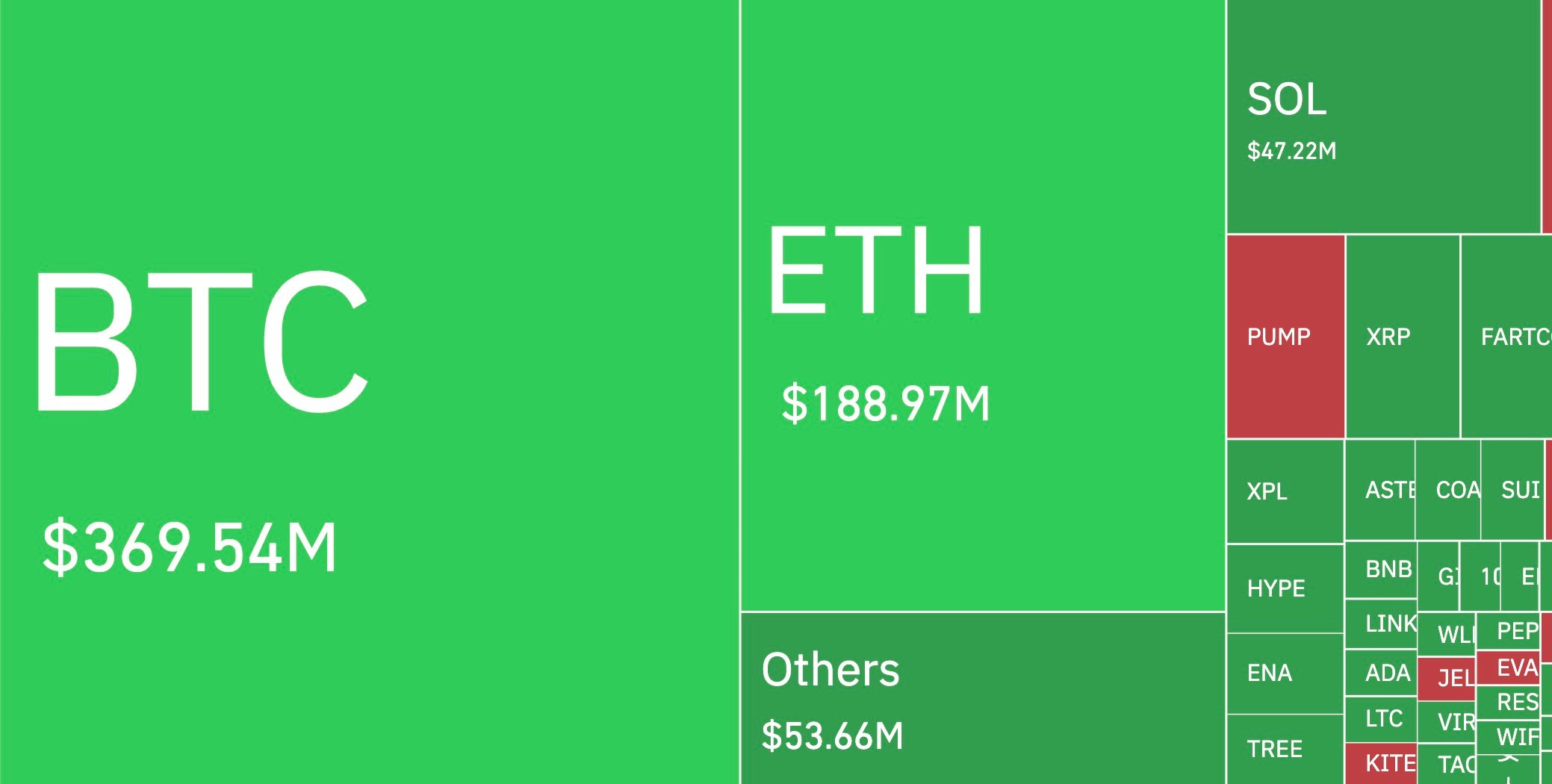

- U.S.-China pact sparks $824,470,000 in liquidations, a massacre of the overleveraged. ⚔️

- Bitcoin lingers at $110,000, caught between $100,000 and $120,000-a financial Hamlet. 🧐

Bitcoin news: Elon Musk’s SpaceX wallets on the radar again as $31,280,000 BTC move

Ah, Elon Musk, the modern-day Prometheus, forever toying with the flames of crypto. Data from Arkham reveals that SpaceX has transferred 281 BTC, worth $31,280,000, to a fresh address, continuing a peculiar streak of moves. Earlier this month, 2,130 BTC and 2,495 BTC were shuffled, and July marked the first transfer in three years-1,308 BTC, a princely $153,000,000. Is it a change in strategy, a test of liquidity, or merely Musk’s whimsy? The world, like a curious peasant, watches and wonders. 🤔

On the charts, Bitcoin sits at $110,258, its monthly range a drama of highs and lows-$126,195 and $102,329. The $100,000 mark, a psychological fortress, and the $81,697 breakout level offer support. But should it breach $120,000, the path to $130,000 opens like a novel’s final chapter. 📈

Liquidation data confirms Bitcoin’s dominance, erasing $369,540,000 in 24 hours. Longs bore the brunt, deflating the overheated bullish leverage-a necessary pruning for the market’s next ascent. 🌱

XRP news: Nasdaq debut gives XRP ticker new identity

Arrington XRP Capital’s Armada Acquisition Corp. II has donned a new Nasdaq identity, its Class A shares now trading as XRPN, units as XRPNU, and warrants as XRPNW. A merger with Evernorth Holdings raised over $1 billion to purchase XRP, an institutional treasury model unprecedented in crypto. Michael Arrington, ever the optimist, hails it as a testament to XRP’s potential, citing integrations with Hidden Road, GTreasury, and Standard Custody. A listed equity vehicle tied to XRP flows-a bold move, indeed. 🎉

Why XRP did not get 21 million like Bitcoin: Ripple CTO breaks it down $xrp

– U.Today (@Utoday_en) October 30, 2025

Price action, however, remains subdued. XRP trades at $2.55, down 3.28% for the week. Resistance at $2.71, support at $2.40-$2.45. Only a break above $3 will unleash its true potential; failure to hold $2.40 could spell a steeper decline. A fragile dance, this. 💃

$824,470,000 liquidations: U.S.-China tariff deal shocks leveraged traders

The markets, ever the drama queens, were caught off guard by a U.S.-China trade pact on rare earths and minerals. Tariffs slashed from 57% to 47%, and China’s openness to chip and agricultural discussions sent ripples through risk assets, triggering liquidations across crypto. Bitcoin led the charge with $369.54 million, followed by Ethereum’s $188.97 million and Solana’s $47.22 million. Altcoins, as a group, lost $53.66 million. Longs absorbed $656.09 million, shorts $168.16 million-a testament to the crowded long positions. Once again, crypto proved its macro dependency, reacting not to native catalysts but global trade flows. 🌍

Evening outlook

As the U.S. evening session unfolds, four pivots dominate the stage:

- Bitcoin: Must hold $110,000 or risk a plunge to $100,000-a 10% drop. 🪂

- XRP: Nasdaq debut narrative vs. the fragile $2.40-$2.70 technical corridor. 🎭

- Altcoin market cap: Defending $1,020,000,000,000 or slipping to $900,000,000,000. 🛡️

- Macro backdrop: Commodity clauses and Fed December rate cut probabilities. 📉

With $824,470,000 in leverage flushed, the market enters the evening lighter, leaving spot flows and headlines to dictate the next act. What a spectacle! 🎪

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Best JRPGs With Great Replay Value

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Sword Slasher Loot Codes for Roblox

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- Non-RPG Open-World Games That Feel Like RPGs

- Dungeons and Dragons Level 12 Class Tier List

2025-10-30 14:54